Updated 7 Jan 2023

Do you have money sitting in your business account? Would you like to invest your company’s leftover cash?

I have many friends who own small limited companies or are self-employed. The pattern usually goes like this: The business is profitable and starts generating some cash. The business owner takes income plus dividends up to a point that is tax-efficient, usually around £50,000.

People cannot use the business cash remains without paying a huge tax bill and cannot expense it either because business expenses is a sensitive area only used for business purposes. As a result, the company profits stack up and a large amount of cash is sitting “locked in” in the business account.

I was in the same boat and I knew I was missing out. If you have a look at the UK inflation data (2.9% at the point of writing), cash is losing its purchasing power. In plain English, your cash can buy less stuff than today in a few years time.

My £10,000 will be worth £7,500 in 10 years time. So doing nothing was really not an option! Similarly, £100,000 will be worth £75,000. A £25,000 loss!

Having asked around in the community, it looks like people either do nothing or just take a big tax hit by withdrawing their profits. After researching all the options, it looks like there is a better way. In other words, investing through a limited company and not taking the money out until really needed. But, what’s better?

Take the money out and then invest or invest through a limited company?

In both cases, taking the first £50k or so almost tax-free makes sense. But what about the cash surplus?

Obviously, if you need the money for personal reasons (e.g. buy a house) there is no question. You just need to take everything out and take the tax hit upfront.

But for those (including myself) who want to put the money to work for them let’s dive into the math and decide.

To take the money out we would have to pay 32.5% dividend tax upfront. That’s a lot, but our money would then grow tax-free thanks to ISAs and other allowances. This is not always the case but let’s assume you and your partner have a £50k tax-free allowance.

Copy my online Excel document (File -> Make a copy) and play with the numbers. As you can see, not paying the tax upfront gives us a nice £252,000 advantage compared to tax-free personal investments, even after paying the corporation tax on the profits.

At the end of the 10 year period, we can either take everything out of the company or we can simply withdraw as much as we need and pay much lower taxes.

You wouldn’t want to pay £289,900 (32.5%) dividend tax to take £892,000 out, so why do it incrementally over 10 years? The numbers stack up.

It looks like keeping the money in the company and accessing it only when needed is a much more profitable strategy. Even more importantly, if you stop working at some point and achieve financial independence. Isn’t this everyone’s goal…?

How to Invest your Company Money

There are two ways that you can invest via a limited company. Let’s say you are an IT consultant operating via your limited company: “Tech Guru Ltd”.

There are two ways that you can invest via a limited company. Let’s say you are an IT consultant operating via your limited company: “Tech Guru Ltd”.

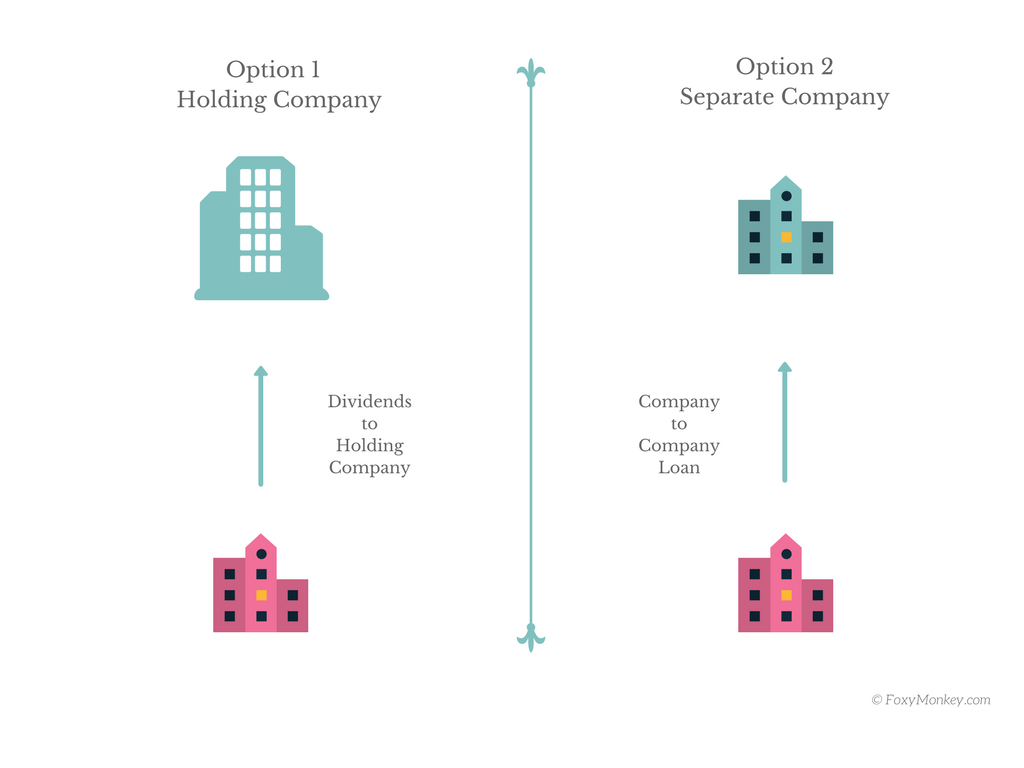

- Option 1: A holding company (ie “Tech Guru Holdings”) owns your “Tech Guru Ltd” trading company and receives the cash surplus as dividends.

- Option 2: You open a totally separate company and receive the money as a loan from “Tech Guru Ltd”.

The option depends on your time horizon and your goals. Generally speaking, having 2 companies as separate entities is a quicker, more short-term structure and easier to set up.

I, therefore, chose option 2 and decided I’m going for a commercial-rate loan in a timescale to be agreed. I documented the loan agreement in a signed letter from the trading to the investment company and I make regular bank transfers while keeping track of the money flow. There is no obligation to pay back the loan and I’m the sole director of both companies.

You may want to make it more formal by having the borrower pay a small interest to the lender.

If you invest via another limited company the trading company has better chances of qualifying for Entrepreneur’s Relief as long as the loan is repaid in full.

Entrepreneur’s relief means that in case you want to close down or sell your business you’ll only pay 10% capital gains tax on the gains. See also – Can I claim Entrepreneur’s Relief if my Company Invests?

Why not invest the money from your trading company directly?

Three reasons.

- The trading company should not get caught up in ‘non-core’ activities. There is a risk of your trading company being classified as a close investment holding company which has tax implications. Your trading company should trade only in its relevant sector. In our case, “Tech Guru Ltd” can build websites, provide hosting, etc but should not start buying buy-to-let flats.

- Legal separation: If there’s trouble in one company, your other company will not be affected in legal terms.

- Easier for tax purposes: The investment company will not have any payroll, VAT obligations etc.

In both cases, you need to open a new company. That’s actually quite easy and the Gov.uk website does a great job at explaining the process.

I opened mine online which costs £13 and only spent 30 minutes because I wanted to be super careful. You need to appoint a director (yourself), have a registered UK address and allocate one £1 share to yourself.

Note that you will need to provide a list of SIC codes, which technically defines the nature of your business. There are no fixed rules for what your SIC codes should be. Just focus on finding the SIC code(s) that best describes your investment activities.

Because I invest in shares and bonds, and I may invest in property too, I selected the following SIC codes:

64991 – Security dealing on own account

68100 – Buying and selling of own real estate

It’s better to set up a special property vehicle (SPV) if you want to invest in property. This is essentially another company that only invests in property. This way it’s easier for the underwriter to give you a buy-to-let company mortgage.

Sign-up to my Company Investing Course

I will teach you how to go from zero to having a limited company that generates passive income if you give me 2 hours per week.

In a series of online videos and live Q&As, you will learn about the right tax structure, how to choose and sign up for an LTD company brokerage account, stocks, property investing, crypto, choosing the right accountant, pension vs LTD investment company and other useful topics.

You will also be part of an online community of likeminded individuals who successfully invest their business profits.

Can you invest business profits to avoid taxes?

People think that by investing the business profits you can save on taxes. Well, not so fast. The trading company must still pay the corporation tax each tax year. In other words, investing does not reduce the corporation tax bill from trading activities.

However, the main benefit is that the directors make a big saving on the income tax. That’s because the money does not yet leave the company which would otherwise trigger extra income tax.

Let’s not also forget that investing might bring profits and these are taxable as well. However, that’s only if those gains are realised. In other words, in the stocks & shares world, if you “buy and hold” a fund but never sell, you don’t have to pay anything even if the fund price keeps increasing every year. You only make a gain when you sell at a profit.

Dividends received at the company level are exempt from corporation tax (HMRC link). That’s as long as the location of the fund/shares is in the UK or in one of this long country list. This is great and an added benefit! The reason behind this is that dividends have already been taxed at the company which distributes them.

Non-dividend income, rent from property, for example, is subject to corporation tax the year it’s received.

Disclaimer: This is not tax advice. Ask for tax advice before you proceed!

What should I do with business profits?

The answer is simple: Invest in income-producing assets like stocks, property and bonds. Consider re-investing some profits into your business too if possible.

That’s a complicated topic because different people have different tolerance to risk, different goals and taste.

Have a look at my investing category for inspiration. A great book on the subject is called Smarter Investing by Tim Hale. It’s probably the only book you need to read to start investing wisely.

My personal preference is broad low-cost index funds. By owning the whole market you avoid sudden shocks of one or two stocks dropping in value and wiping out our profits. Not to mention I don’t have the skills to research a company better than the quant experts employed at the Wall St.

So by owning everything, I capture the whole market return and spread my risks across different companies and countries.

Stock market Index funds

My favourite investment provider is Vanguard who set the foundation of the passive investment industry. They have products that allow you to own a small percentage of every company in the world, thus owning the whole market.

Vanguard Lifestrategy 60% equities, 40% bonds is a global balanced portfolio with a very low fee of 0.22%. You can invest with Vanguard directly but the minimum investment is £100,000.

My investing experience with Vanguard has been very smooth so far and the customer service is excellent. To open an account, you need to fill out a form. Then you can start investing right away.

If you feel more adventurous and want higher returns, just tilt the equity part of the portfolio and go for 80% stocks. If you want a smoother journey instead, go for 60% or even 80% bonds.

The only drawback is that Vanguard don’t offer an online platform to buy, sell and view your investments online. Although in the beginning, it was frustrating, I now find it positive as it keeps me from checking my accounts every day and make bad investment decisions based on what the news said today.

Note: If you want to invest directly with Vanguard, call them on 0800 408 2065. The UK-focused vanguardinvestor.co.uk website doesn’t advertise business accounts just yet.

Alternatively, you can go via a broker and pay a platform fee for using them.

UPDATE 2020: Interactive Brokers offer a corporate account. It costs nothing to open and they recently removed their monthly inactivity fee. Interactive Brokers don’t have the £100,000 minimum requirement Vanguard has.

Read how to open a limited company investment account with Interactive Brokers.

Property

Your company can invest in a buy-to-let property. Bricks and mortar is another classic way to invest here in the UK.

A company can purchase flats and houses for investment purposes and rent them out. Interest rates are usually higher for limited companies compared to personal mortgages and lending criteria are tighter.

But if you can find good opportunities then it’s worth looking into property investment. Check out the Rob & Rob property podcast if you want a good resource.

Although I’m not investing in traditional buy-to-let directly, I am investing in property via Property Partner.

I think Property Partner strikes a nice balance between stock-like REITs and traditional Buy to Let. REITs provide exposure to property but exhibit stock-like behaviour. So when the stock market falls, the correlation is very high.

Buy-to-let, on the other hand, provides some very nice rewards in terms of returns. However, it involves a lot of hassle to find a good deal, requires a high initial capital and it’s highly illiquid. The other disadvantage I see is that you cannot diversify and spread the risk in 5 cities unless you have a very high initial capital.

Property Partner is a platform I’m investing through that allows you to own part of a property, collect the rent and have it professionally managed. I like the idea, it’s been running since 2013 and it’s easy to register as a limited company.

So far, the returns have been 5.2% a year.

And here’s my experiment investing £50,000 over the next 5 years (starting 2018). I also met the team and started building a trust relationship.

A little hack: Since I’m investing in Property Partner as a limited company, the rent I receive in the form of dividends is tax-free! That’s because dividends received in an investment company are not taxed again. They have already been taxed at source.

Peer to Peer Lending

An LTD company can invest in peer-to-peer loans. They offer lucrative returns for lending cash to other people and businesses. I’ve written a Zopa review for investors you may want to read.

TL;DR: Returns of around 5%, hands-off automatic investment, loan length of up to 5 years.

The sign-up process is pretty straightforward as they need your business details, the director details and your money. As always, do your own research.

Have you forgotten the pension?

If you don’t pay yourself a pension then it’s definitely worth considering this option. Your company should pay a pension into a SIPP pot that grows tax-free.

The best part is that the money going into the pension is not taxed by corporation tax. It’s a win-win situation for both the company and yourself and a great way to secure your financial future.

You need to find the right balance between pension contributions and LTD company investments though. That’s in order to maximise tax breaks while ensuring you can access some of your money before the pension age.

How to find a good accountant for Limited Company Investing

I had trouble finding a good accountant that can implement one of these strategies and answer my questions.

The truth is that not many people invest (outside their pensions) and even fewer have their company money working for them. This is why there is less demand for accountants who manage company investments.

If you just want an accountant, please send me an e-mail at “michael at foxymonkey dot com” and I can connect you with one.

In my experience, finding an accountant is only half the battle. It’s why I built the limited company investment course to take care of everything a company director needs to know before investing the company profits (including how to find a decent accountant).

- Which investment platforms are best for company owners based on their experience/needs and sign-up tips

-

How to easily track your ongoing investments and tax obligations

-

Different exit strategies 5-10 years down the line

-

Property + HMO investing through an LTD

-

How different assets are taxed when investing through a limited company (not just what the final tax bill is)

-

How to actually choose a decent accountant for an investment LTD company

-

An online community of like-minded business owners/investors to discuss ideas and strategies

-

Which bank accounts to (not) use

-

Pros and cons of Pensions vs LTD company investing and how to balance between the two to maximise profits as well as tax breaks

-

Bonus resources such as videos, excel spreadsheets and reading material to succeed in investing

You can register your interest for the course here. I respect everyone’s privacy. Your e-mail will not be used for any other purpose.

Final thoughts

I have been investing as a limited company for 5 years now and I’m updating this guide with new findings over time. On one hand, company investment gains are taxed by corporation tax, but at the same time, you invest a larger pot if you don’t take dividends out. It really makes a big difference.

An added benefit of investing via a limited company is that the dividends received from stocks & shares and property partner are exempt from corporation tax. That’s a big plus.

Investing through a limited company requires a bit more upfront work to set it up. That’s because you need to open a new company and a new business account, find an accountant, keep track of the loans etc. Nevertheless, this can be a much more profitable strategy to build your wealth and use it while travelling the world, raising kids, you name it!

Want to read more? Visit The Company Hub, which lists all resources for limited company investing.

What keeps you from investing through a limited company? Or are you not investing at all? Let me know in the comments.

This article was last updated in January 2023.

See also: Can I invest my business cash?

315 thoughts on “How to Invest your Company Profits”

Great article. The reason I haven’t invested through an ‘investment’ Ltd company is the belief that I could only take out a ‘Director’s loan’ from my existing Ltd company which would need to be repaid inside a 9 month period. If this is the case then surely the ‘investment company’ would not be able to invest in any long-term strategy such as stock market index funds. Or am I wrong?

Hi Nick, great question. The Director’s Loan can only be used if you take a loan personally, as a director. But in this case, you’re not a person but a company and can take a loan from another company for longer than 9 months.

Therefore, the same investment strategies that you would normally follow for personal investments can be applied to company investments too.

Hi Michael,

Great website and blog, thank you!

While reading it, it was like you were in my head and since then I have set up a second Ltd with the aim of investing my current Ltd profits as you described. Could I please ask for the above chat to recommence a little?

I have set up the new Ltd with my current company as a corporate shareholder but I am still a little confused on how best to send and document the money. As Nick mentioned, a directors loan needs to be cleared within 9 months but interesting and it make sense that you say, this is not a directors loan but a company to company loan (or maybe in my case, Ltd original sending Ltd New its starting capital?).

Have you gained a new insight into this method of sharing as I am buying and holding stock long term and don’t see how the new Ltd can make regular repayments. Also, do you have any resources to use to read up on the company to company loan pathway, please?

Hope you’re well, Matt

In theory can ‘company A’ loan ‘company B (investment Ltd) a loan over an unlimited period? Are HMRC fine with this?

Technically it’s not an unlimited period, but a loan in a timescale to be agreed. This is what I have been told. However, I’m not an accountant myself and it’s better to seek professional advice if you’re not sure.

Feel free to report your findings back to the blog so everyone can benefit!

Does the trading company lending money to the investment company have to charge interest or can it be 0% loan?

It can be a zero-interest loan but it’s best practice to charge interest to make the transaction arm’s length.

Hi Michael

Some interesting stuff here thanks.

Does anyone have a draft loan agreement that they can share that covers the necessary items for a Co to CO loan?

Are there any tax implications if 0%?

I really don’t want to charge interest or repay capital monthly/yearly as I want the money in the investment company SPV to compound as much as possible.

Will do thanks Michael.. great blog by the way!

Thanks, Nick! Glad you like it :)

Hey Foxy,

I’ve recently set up a limited company for one of my side-hustles, I’ll also be doing the same when I eventually start contracting. One thing I’m unsure/worried about is getting professional advise. From a terrible experience with solicitors, I don’t want to get ripped off when looking for an Accountant/Financial Advisor. Have you got any advice on the price to pay for an Accountant? Do you pay for them to complete your tax returns and handle everything for you, or just provide you with advise? Do you pay a set fee or a percentage fee, is it worth it? If you can recommend a good accountant that would be awesome too!

Thanks,

Slike

I understand your frustration, Silke, and speaking of solicitors I had a terrible and expensive experience in the recent past!

Usually, if you operate as a contractor through an Ltd, or own a small business you expect to pay somewhere between £100-125 per month (incl VAT) for an accountant. That typically includes the annual accounts, a basic planning around salary and dividends and accounting software, such as Xero or FreeAgent so you can take a look at your business finances too.

The accountants may offer a personal tax return as part of the package for the company director. Mine charge a £100 fee so I did it alone via FreeAgent last year. It was actually easy.

Although I’m happy with my accountancy service for the trading company, I still haven’t found a viable solution for my investment company. Simply put, all I need is the annual accounts for a company that doesn’t have any Payroll, VAT or much trading activity. That definitely shouldn’t cost £1500 per year. That’s wiping out a big chunk of my investment gains!

How do you manage your side hustle Ltd?

I’ll send you a message regarding personal accountant recommendations.

Awesome, thank you! It is a little pricier than I hoped it would be, I’m assuming all of the costs are tax free though? As my side-hustle is through Amazon it keeps all of my payments nicely documented so I don’t really need to track it, I also don’t pay myself a salary and am yet to take out any dividends (I’ve only recently incorporated). Thanks for all of your help! :)

Hi Michael

Great article by the way. I’m in exactly the same position in terms of having a trading company and looking to invest surplus cash.

Now given that the article is over 18 months old, did you manage to find an elegant solution for getting the investment company’s accounts done?

Thanks, Tom. Yes, I have been doing it for quite some time now and company accounts follow the standard practice. I need to keep track of your trades I make, the company expenses and annual income. Then my accountant will review them and prepare my annual accounts. It’s manual and not so elegant but it’s not so bad in terms of time/effort plus it’s only once a year.

Thanks for a very thorough article, great idea and the calculations to back it up! I wonder if you really need an accountant for the investment company? You can file corporation tax yourself and since the accounts are simple, then I can’t imagine a tax inspector would have anything to fine you for. I use an accountant for my existing company who charges £600 in VAT for filing corporation tax, but don’t see why i would need to pay the same again. Hope all is going well for you, are you using Vanguard? I looked on their website FAQs and it says they don’t do business accounts.

Hi James, I invest with Vanguard as a business, yes. The UK-focused vanguardinvestor.co.uk website doesn’t advertise business accounts just yet. If you want to invest directly with Vanguard, call them on 0800 408 2065. Thanks for reminding me, I wanted to update the article to reflect this. The process involves a bit of paperwork but saves lots of fees long-term.

Regarding accountants, sure, you can do it yourself, definitely. I just don’t have the knowledge or the resources to learn how to do it.

Thanks Michael and sorry for my delayed reply!

I will definitely contact Vanguard :) perhaps my accountant will file the accounts for the investment company at a discounted rate. VAT returns are easy online but i’ve never completed a corporation tax return. Wishing you all the best

HI, Michael,

Thank you for the nice article.

Could you highlight where do you invest through the second limited company?

Thanks

Glad you liked the article, thanks! I invest in low-cost index funds (Vanguard 80% Lifestrategy) as well as peer-to-peer lending (Zopa, Ratesetter). The setting is very similar to my personal investments. Do you invest through your Ltd as well?

Thank you for your reply Sir.

I am hoping to invest, but major banks refused to take the investment on the company name. They were happy to have it with the personal name.

I liked your idea of opening another company to invest and feed it from the original company.

But Not sure which funds to invest. Ideally, FCA regulated!!

Always FCA regulated :)

You’ll have to go through a fund provider, such as TD Direct Investing. If you provide all the company documents (incorporation certificate, year accounts etc) I’m sure they will let you invest as a company.

Hi Michael,

I am looking to set up a LTD/SPV, so I can invest in my own New Build Property to the side of my existing house.

I will be looking to transfer the land to the SPV from existing Joint names.

Do you know much more about any Tax implications or can recommend an accountant that is familiar with this type of project.

Thanks,

Nazrul

Hey Nazrul, I don’t know your exact situation but yes there will be tax implications given a transaction takes place here. Capital gains tax for the land owners and stamp duty tax for the SPV come to mind. You will have to work with an accountant who has experience with this type of deals but unfortunately I cannot recommend any.

thank you, I will contact them (TD) for more info.

Zopa is not taking any more customers.

Any other fund provider are you aware/dealt. Hargreaves Lansdown etc

thank you so much for your time

I researched TD Direct but ended up going with Vanguard directly. You save on the platform fees as a side benefit, but the minimum investment is £100,000.

Not a problem Ishaikh, happy to help!

I have looked on Vanguard’s website and there is no mention of accounts for limited companies, just personal accounts.

Do you have contact details please

Thanks.

if you invest through the second company, would that be regarded CIC company, I guess if you have taken loan, you would have repay to the parent company.

How long you can take a loan.

Lastly: You would be keeping the investment for long term, so I guess the second company would not have any yearly profit as all money is invested.

Thank you

“There is a risk of your trading company being classified as a close investment holding company which has tax implications.”.

That’s the reason for opening the second company; to engage in pure investment activities. Loan lengths and CIC are also explained in detail in the post!

Of course, there will be profits to declare if your investments go upwards. Because the money is invested this doesn’t mean there are no profits :)

Hi Michael,

You mention in the article that you won’t be charged corp tax on the investments (shares for example) if they go up in value but you don’t realise the gains.

So your reply here “Of course, there will be profits to declare if your investments go upwards. Because the money is invested this doesn’t mean there are no profits 🙂” I assume this just means that regardless whether your investment goes up or down – you need to declare the current state of the investment to HMRC for informational purposes only? As you will only get taxed when you sell out of your holdings at a profit…

Thanks

That’s right, Giten. The balance has to be reported to HMRC every year regardless of whether the investment is realised or not.

Thanks Michael :)!

Good article!

You say it is not a good idea for the trading company to invest the money directly because then the trading company “could be classified as a close investment holding company which has tax implications.” But taking your option 1 as an example, paying dividends up to the holding company and the holding company investing the money, is the holding company not then a “close investment holding company” and would that not have the same tax implications?

Also do you know what those tax implications are?

If it is a “close investment holding company” do the standard exemptions for small companies (turnover, size) still apply? This is an important consideration for small businesses where being allowed to file unaudited micro company accounts makes year end accounting much easier.

Thanks for the great comment Will. Please note, I’m not an accountant and this is not advice, just personal research and interest on the subject!

According to HMRC:

“The main effect of this subsection – Section 34 (2)(c) – is to exclude from being a close investment-holding company the holding company of a trading group or a property investment group, even where the group consists only of the holding company and one trading or property investment subsidiary.”

Therefore, I believe that the holding company would not be classified as CIC. I don’t really know what the exact tax implications for close investment holding companies are, but I know that they cannot claim entrepreneurs relief. I also think CICs are not entitled to small profits corporation tax but they have to pay the standard CT rate.

If you, by any chance, find out any accurate accountant advice, please report back and I will update the post accordingly. Looking at Google traffic, it looks like a lot of people are interested in this post.

Hi there,

Thanks for the blog post, this is an interesting idea.

I’m not quite clear when you say:

“You wouldn’t want to pay £273,000 (32.5%) dividend tax to take £840,000 out, so why do it incrementally over 10 years? The numbers stack up.”

So how do you avoid the higher rate of tax? Do you just slowly draw down on what’s built up in the company account? I don’t understand how you get the 840k out of the company without incurring a lot of tax. Are you proposing that you close down the separate company that you’ve set up with a loan and get entrepreneurs relief on this?

Thanks

Hi Andrew,

Good comment. You don’t avoid the tax by keeping the funds in the second company but this gives you options.

The purpose is two-fold: You invest a bigger sum as you build your wealth, therefore higher sum returns higher amount.

You also get the option of drawing down funds at a lower tax threshold in quiet periods.

For example, I may take a 2-year break during which I won’t have any income. It is more tax efficient to withdraw during these years than taking out the money upfront.

Hope that makes it clearer!

Hi Michael, I had come to the same conclusion as you and came across this blog whilst researching!

Presumably you pay corporation tax on the profit\gain made by the investment – would that tax only be incurred when you sell the shares/funds?

Thanks for your comment, H. I believe you’d only pay corporation tax when you sell the holdings. However, I’m not 100% sure on that as I have not done my annual accounts yet on the investment company.

Dividend income is exempt from corporation tax though, as another reader has pointed out.

Hi Michael,

I ran your numbers but surely in order to have a fair comparison you’d want to look at exiting the funds from the company? At which point the numbers turn favourably to investing personally.

Thanks,

Ramzi

Hey Ramzi,

Investing personally is always less profitable because you pay higher taxes upfront, therefore starting with a smaller amount.

The idea is that by taking the first £40k out and investing the surplus via a limited company gives you more options for the future. After a few years that you’re happy with your company investments you can:

a) Take everything off the company, which will give you the same result had you invested personally in the first place. Big tax hit.

b) Take as much as you need to cover your lifestyle while you stop being a higher rate taxpayer. Maybe you don’t want to work, you can only do part time, retire etc. That will give you a big advantage since you’re paying much lower taxes when you don’t have a big salary.

Plus remember that having a company account is even better overall if you can make expenses. You pay lower corporation tax.

As always, this is not accountancy advice and you should ask a professional :) (and let me know!)

Thanks for your response! Not sure I agree. You do pay taxes upfront when investing personally but when investing as a company you are simply deferring them. When you apply the final tax costing of actually getting your hands on the money (dividend tax) the numbers should be identical. This also does not account for the CGT exemption and utilising the 20k ISA limits. At which point all things being equal it the numbers start favouring personal investment.

Ramzi, I think you’re missing the point. If you invest the money via a company when you are a higher rate tax payer but withdraw the money when you are a lower rate tax payer (when you retire) then it definitely works out better.

Ramzi, it will really depend on what you are trying to achieve. Most small business owners or contractors tend to leave surplus cash in their limited company in order to take advantage of entrepreneurs’ relief when they decide to retire or exit. This means surplus cash cannot be used for investment purpose. By moving the surplus cash to the 2nd company, it will be easier to invest the surplus cash without affecting the trading company’s entrepreneurs’ relief status.

Deferring taxes allow you to make more on your investments in the interim.

Hi Michael,

The company to company loan strategy is very interesting. I’ve pinged this idea by my accountant, and they’re saying that because the companies are connected (you are director and shareholder of both companies) this will cause it to be treated the same as a director’s loan, with the accompanying disadvantages: year end + 9 months duration, potentially benefit in kind and national insurance contributions.

I’m waiting on a reply from them with a source / section of the tax code where this is made clear; if you have evidence as to the contrary, I’d love that.

Otherwise, very solid roundup and article.

Best,

Theodor

Hi Theodor,

It’s an interesting point of view but I hope it doesn’t hold true. I would be surprised since the two companies are totally independent and the loan goes from one legal entity to another (no persons involved). I’ve confirmed this with 2 different accountants before writing this post. Definitely let me know with references to the tax code!

Here’s the part of the Corporate Finance Manual where it details on connected parties: https://www.gov.uk/hmrc-internal-manuals/corporate-finance-manual/cfm35110. You are correct that the companies are separate legal entities, but they are also considered under the control of the same individual, and as such connected.

However, I don’t have an exact reference for how this turns the company to company loan into a director’s loan. I took my accountant at their word at the moment. I’m considering weekend reading https://www.legislation.gov.uk/ukpga/2009/4/part/6 in hopes of finding a solid answer. Even if I find an accountant that thinks otherwise, at this point I’d like to see it spelled out in the tax code before I decide to do anything else. :)

Hi Michael,

Any updates on Thendors comments.

Shall we make a loan from company A to companyB which are two legal individual companies having same director.

Ok, I did a bit more research in the accountancy forums.

To my understanding, a loan to another company in which a director is a participator is not treated as a director’s loan.

A note about related parties must be present on the company accounts.

Ask your accountant how to do this. According to the internet, it’s in a note to the accounts under the heading “related party transactions”.

https://www.ukbusinessforums.co.uk/threads/inter-company-loan.305139/

“This has nothing to do with Directors Loan accounts. All that is necessary is that a note be put in the accounts about connected parties.

As the Director has not taken the money out and spent it on himself. The money has gone to another company (entity) and the other company will be spending the money

on company expenditure (wholly and exclusively for business use).”

Another useful article:

https://www.accountingweb.co.uk/any-answers/can-a-company-lend-money-to-another-company-with-partial-common-shareholders

Shall I charge interest between companies? https://www.accountingweb.co.uk/any-answers/interest-on-loans-between-companies

In short, there is no need for interest to be charged as that will only add paperwork to the process.

According to another article comments:

https://www.accountingweb.co.uk/business/financial-reporting/frs-102-loans-between-related-parties

The loans that are not formalised under an agreement to be paid on a specific date (and are therefore paid ‘on demand’) are not subject to FRS 102.

Warning, there are many comments on this article!

Now if someone is an accountant or if people ask their accountants like I did, please contribute to this thread and let’s make sure we’re doing

everything in a legit way.

Hi Michael, really appreciate that you looked into this further! I read that same UKBusinessForums thread myself too when I was researching this same issue, and one of the accountingweb threads too. Widespread opinion agrees that company to connected company loans are not treated as director’s loans.

For myself I’ve decided to hold off on trying this strategy, as I don’t have that much leftover this financial year anyway, so I won’t have anything to contribute to this discussion for a while. I think you’re right, but to convince myself I need to read it in the tax code rather than on a forum. But that’s just me, I’m also quite interested in it for the sake of it.

Hey Theodor, I appreciate your interest! I would also want to read it in the tax code.

It’s just too hard to find the right one :)

Especially when we’re looking for an absence of a relation. Thanks for stoping by. I’ll continue to update the article with further findings.

I checked with my accountant and he has confirmed what Michael has said. It cannot be treated as directors’ loan.

—————–

In my opinion, a business to business loan will be fine. Both limited companies will be separate entities.

I would recommend drawing up a business loan agreement and pay interest to your limited company. I would also recommend putting a disclosure in your company year end accounts of the transaction in the year it occurs.

—————–

Hi Michael,

any update on Theodors comments?

Hi,

yes I would be interested as well in any update on Theodor’s comment.

Hi Michael,

Any updates on Thendors comments.

Shall we make a loan from company A to companyB which are two legal individual companies having same director.

Hi There,

A friend of mine has a Trading company with some cash surplus.

If I create an investement company I guess Theodore issue (company to company loan considered director load because both company have the same director name) wouldn’t be an issue anymore no?

Thanks !

Hello Michael,

Is there an issue if the Trading company starts an SPV with surplus funds and invests in Shares and property. In such case it acts like a holding company. I was told, the trading company can be closed at a later date while keeping the SPV since it’s a legal company on its own? Your comments pls.

Hey Chaks, I don’t have any experience in SPVs to be honest. But if it’s a company-to-company loan then it shouldn’t be a problem to shut the trading company down, right?

We have a separate ‘property’ company set up to utilise amassed funds within our Ltd company. We then purchase property with said loaned money, and it seems to work very well so far…we did have to declare to HMRC that the directors of the two companies are connected….

So in theory could you set up a separate Ltd company, buy the property to rent out, then pay into a pension to reduce your corporation tax to zero?

I don’t think so, I think you must pay the corporation tax from your profits first then you can put the left over money to pension. Is that right Michael?

Michael,

Great post and great analysis. I’ve been thinking and looking at this for the last 18 months (while my funds have been sitting in the bank earning zip!) Thanks for posting it and sharing your work.

Are you able to message me directly regarding personnel / tax accountant recommendations?

Thanks a lot, Ryan. I’m happy people find value in the post.

I’ll send you an e-mail regarding accountant recommendations.

Hi Michael. Thank you for such a useful article. I’d also be interested in hearing what accountants you would recommend.

Thanks very much Michael, this is what I just have been looking for. I’m an IT contractor and can’t really receive any good information from my accountant. Could you please recommend your one and if possible email me their contact details please. How easy is to move from one accountant to another? Many thanks

Hi all, been following this thread with interest…

I am a professional with c. £80k surplus cash a year and am loathed to withdraw more than £40k personally to mitigate my tax bill!

I already have a couple of properties personally so want to avoid any more, to keep a balanced portfolio.

I have a holding company which I send dividends to from my trading co. (but will not also look at the loan option from this thread).

I had several chats with IFA buddies recently. To minimise my Corp Tax bill I am looking at investment trusts for companies, some of which are allowable for tax relief. For the balance, I have been looking into a SSAS pension for company money and also VCT investments for personal money.

All look very interesting for sheltering investments from tax and the SSAS is quite flexible (moreso than a SIPP).

Oh and just to answer the latest post, pension payments from your company to you pension are paid pre-corp tax.

Just some additional ideas for you all to consider…

Do you own research, and best of luck to everyone.

*edit – I meant I will “now” look at the loan option :-)

Hey guys,

I’m in the process of finding a good accountant for investments and will let you know as soon as I have an update.

There are so many people on this thread, I’m sure some of us can provide accountant recommendations/costs?

Cheers,

Michael

Hey Michael, thanks for all the useful information you provide on this great blog – fantastic job! I’ve been thinking along similar lines which is how I came across this article – however, my research suggests that to invest in property you need to set up a SVP limited company whose only purpose is to sell, buy and let property. BTL mortgages are apparently very limited unless lending to an SVP. So you may actually need two separate companies – one for stocks/shares investments and one for property. I also wonder whether the SIC code for “Security dealing on own account” qualifies us to invest in anything we like including shares, P2P lending, fine wines/alternative investments – what are your thoughts?

Do you have an accountant you can recommend who is clued up re all this stuff? I have found they don’t generally seem to have this knowledge at their finger tips with me having to do hours of my own research and then present it back to them with questions….less than ideal!

Keep up the good work!

Hi Smitha, thanks for all the info, I have updated the post to mention SPVs as well. I have not invested in property yet but may do so in the future. In your experience, how high are the interest-rates compared to the personal ones?

With the recent tax changes it only makes sense to invest via an Ltd as the mortgage expense will not be tax deductible.

“Security dealing on own account” will only allow shares and bonds in my opinion. However, I have invested in peer-to-peer lending as well.

PS. No accountant recommendations yet but getting there and I will update the post to let everyone know. Thanks for commenting!

Could the investing company invest in such things as art, jewlery, gold or watches does anyone know?!

I’ve spoken to my accountant and he’s raised a big issue with the approach of loaning from a trading company to an investment company. According to my accountant, if more than 20% of your trading company’s assets are investments then your trading company is then an investment company and this means much less favourable tax circumstances for it. I can’t speak for your company but in terms of assets I think most contractors operating under an LTD won’t really have any assets at all. If you make a loan from your trading company of £10k to your investment company then that loan is a £10k asset owned by your trading company and a loan counts as an investment. Unless your trading company has at least £40k in other, non investment, assets then it then itself becomes an investment company, adversely effecting it’s tax status. ?

Hi Mark. Can you clarify ‘adversely affecting tax status’ please? Corporation tax rates for small profits and main rate are now the same so I’m not quite sure what you mean.

As I understood it, the main adverse effect is that the expenses incurred as part of the company’s trading activities are no longer tax deductible. This sounded like it included pretty much all of my current expenses, including my salary. I’m an IT contractor doing the standard contracting thing of paying myself through my own LTD, BTW.

I’ve also been looking at using surplus cash in my LTD to purchase BTL property and/or invest in stock & shares.

Has anyone considered the following scenario?

Create a new Holding LTD (that doesn’t own or earn any money in its own right). The holding company owns Tech Guru LTD and a newly created SPV. Money from Tech Guru LTD can be paid to the holding company, the holding company gives this money to the SPV to purchase a property. The SPV ‘owes’ money back to the holding company, but it isn’t a loan, its owner invested funds which can be transferred back at a later date.

This seems superior to the holding company owning just Tech Guru LTD as in this scenario if Tech Guru LTD were to become insolvent, administrators could demand the loan be repaid from the holding company/SPV (potentially forcing a property sale). In the scenario where the holding company (which owns the SPV and Tech Guru LTD) the money moves as Franked Investment Income i.e. Tech Guru LTD => Holding company. Maybe this adversely affects ER though for the trading company (Guru Tech LTD)?

Any thoughts?

What you are suggesting would work but there are few disadvantages.

– only small number of mortgage providers would lend for this type of setup which means a higher interest rate

– higher accountancy fee due to filing accounts for 3 companies

Hi Michael ?,

From Rob and Rob’s Property Podcast I’ve found some more info on the company to company loan strategy. They touched on it briefly in TPP125, around the 19:00 mark: https://www.thepropertyhub.net/tpp125-should-you-create-a-limited-company-for-your-property-portfolio/

It’s mostly the same information that you put out in your article, but thought I’d share for anyone else reading the comments who is interested in hearing another source on the topic. Myself I’m not in a position to do something like this now but when I do I’ll consult a specialist accountant’s opinion.

Best,

Theodor

Hi Michael et al,

Thanks for the very useful post. Like many here, I’ve been frustrated by the lack of information on the topic. My accountant seems to be able to help only with the basic bookeeping. When I asked him about company investments, he said he couldn’t help. Judging by the comments above, this may be a common problem. Which makes me wonder why accountants stay away from advising on such schemes?

I have also struggled to get any information from asset management firms when I called them to enquire about setting up a company account. You won’t believe but most of the customer service people there couldn’t help me. Surely the pool of surplus cash for all limted companies in the UK is large enough for asset managers to try to exploit it?

Finally, Michael, something I wanted to clarify from reading the original post. With both the trading and investment companies, you’d be hit with a 32.5% tax rate if withdrawing dividends at a high income rate, right? So the advantage is, if you can live off for a couple of years with funds withdrawn under the basic rate, the investment company allows you to get returns on the trading co.’s surplus cash, i.e. eventually your 32.5% tax will be applied, but the after-tax pot will be larger than if it had sat as cash for several years. Did I understand correctly?

Sorry I am not really adding much to the debate, I guess I am just sharing my furstration/experience. Thanks everyone for your input. I’d like to know if there are any updates on the scheme/accountant info.

Alex

Hi Alex,

You got it right, yes. If you decide to withdraw from the second company you will be hit with a 32.5% tax rate assuming you’re at a high-income rate. The advantage if you set up an investment company is that your money simply works harder for you. Also, you can be flexible with withdrawals – take a year off or stop working (financial independence anyone?) so you can defer the tax for those periods that you’re not actively trading.

I’ve sent you and those interested, an e-mail with accountant information now that I’ve found a good one.

Hi Michael,

Will you be updating your blog post to reflect any advice you get? Particularly interested in Entrepreneurs Relief!

J

Hi J, I’m updating the post to keep up with new info but I’m still unclear about ER. I’m all ears if you have any new info.

Many thanks Michael.

I may be completely overlooking something here but with either option of transferring money from company A to company B wouldn’t you have to pay 19% corp tax?

In your spreadsheet/calculations you have only accounted for corp tax investing profits. My understanding is that purchasing assets is done AFTER corp tax is paid so in your example above the cash surplus would actually be £48600 (£60000 – 19% Tax).

Please tell me i’m wrong as Id like to take advantage of this structure.

p.s. I also advocate vanguards lifestrategy 80% equity fund.

Hi,

Forgive me if this is a naive question, but by using a second company an an investment vehicle, aren’t you still left with the issue of a personal tax hit when you eventually want to transfer those profits to yourself?

Hey Michalis, I don’t believe I was just googling how to make use of the spare cash lying in business and your article came on top, that looks amazing man. You have written a very nice article which is like a step-by-step guide/manual that seems very helpful stepping stone. Good work done man and nice blogs on your site. Probably you will finally convince me to put my money to a better use.

Keep it up!! :)

Hi

If company A makes a profit and loans the surplus cash to company b. Wouldn’t company A still be liable for corporation tax on company A profits?

J

Hi there,

You state that “the trading company can still claim Entrepreneur’s Relief as long as the loan is repaid in full” but if you have used that inter-company loan to invest (e.g. in property) and cannot easily sell up, you, therefore, cannot pay that loan back? Surely the Holding Company structure is better as dividends can be passed between companies and do not need to be repaid.

Hi Michael,

Great article and as you, I have found it very hard to find any relevant information on this subject, let alone any reputable adviser.

I am just about to set up an SPV and to start investing some of my business’ retained profits using the process you have described.

However, it seems you have now identified an accountant you could recommend. Would it please be possible for you to email me their contact details?

Many thanks

Glad you liked it, Frederic. I’ve sent their details over e-mail.

Hello Michael,

Vanguard does not allow to open business account for trading on their platform. Do you know which platform allows UK business to open an account under business name not personal name for stock trading.

Thanks

hi Michael,

If you don’t mind, can you please also send details of the accountant.

I tried calling Vanguard and few others like youinvest They do not allow companies to open a trading account.

Any one can suggest brokers who have access to funds, investment trusts etc.

Thanks

-Kalpesh

Hi Kalpesh,

Sent my accountant details over e-mail.

I know Interactive Investors allow company accounts as well as Vanguard (global, not the vanguardinvestor.co.uk ISA one) if you invest at least £100,000. I will update the article to include this info.

Cheers,

Michael

Great article and really interesting reading through the thread

Also infuriating how it seems impossible to get the money we’ve all earner without getting screwed. Annoying to the point were you just have to laugh at how much of a con it all is.

Anyway, my question is. Are you still subject to the additional 32% Tax even if the investment company is considered to be part of a long term pension/share investment for the eventual retirement plan? Essentially acting as your own pension fund instead of using another provider.

This may well have been answered but I skim read the comments.

Thanks

Alex

Thanks Alex for your kind words and sorry for the late reply!

You are subject to normal company taxes when it comes to your investment company and it doesn’t act as your pension would in terms of taxes. If I understand correctly, you ask whether your company can become a SIPP provider, which in my opinion would be a complex thing to do – and also out of my league.

But if you plan to have your company as a retirement plan I think it’s still a tax-efficient investment given you leave the money to grow in there. Basically, only pay the corporation tax on the gains until you start withdrawing.

Hi Michael,

Interesting article.I have been doing something similar and have SPV company which has 5 BTL properties. I am not sure if I can use the same company to invest into stock market as well

My accountant is no better than a book keeper. Would be grateful for an accountant advice.

Hi Ajay,

I believe you would complicate things if you want to buy your next BTL given your SPV will now be doing more than one type of investments. However, I’m not an expert on this and you better ask a decent accountant. I can introduce you to mine if you want.

Is it not possible to do this from your limited company directly, without setting up a new company (i.e. Option 1: A holding company or Option 2: You open a totally separate company and receive the money as a loan from “Tech Guru Ltd”.) ?

Hi Bulent, please read the “Why not invest the money from your trading company directly?” section above.

REALLY INTERESTING READ – thanks for the info. Could you let me know your accountants details too please?

Hi Michael

It will be great if you could publish that list of investment companies that will accept investments in the company’s name, specially if you are like me and have less than £100,000 to invest.

Hey Cliff, I’ve mentioned TD Direct in the article (now Interactive Investors) which is one platform I know offering company accounts.

While we’re at it: I am currently in talks with a company that will offer UK investments for contractors and limited companies, starting in the next few weeks. I’ll add a form here for people to submit their details, but if anyone is interested then send me an e-mail at [email protected] and you will receive updates when they’re ready.

Hi. Interesting article. Thank-you.

However, it seems to me there is a bit of blurring here between the stated objective of “how to invest company profits” and the various pro-cons of different types of investing.

If we focus on investing in equities/funds etc, then I don’t see a strong argument for setting up as second company. The principal benefit you illustrate (of avoiding initial tax hit to take the funds out personally) applies equally to a investing directly.

Also, as director of a second company, you have all the normal responsibilities and obligations of a ltd company or course and I personally think you’ve underplayed this aspect in your article imho. It’s extra work/time and responsibility. You’re doubling up all the interactions, HMRC, accountants, year-end accounting, company returns, and so on.

If the investment funds will be sizeable (i.e majority of profits of the trading company), and will require oversight and executive actions (buying / selling property), then I get the second company route as the actions of buying/selling property for investment will conflict with the stated trading activity of the trading company (as you make clear). But realistically, is that going to be the case? I for one simply don’t have the time to run a property investment firm in addition to my main trading activity.

My point is ultimately that the benefits are very much dependant on what type, and extent, of investments of company profits are proposed. For say less than £50k, investing the funds directly in equities/tracker funds from the company directly is probably a far more appropriate route. I can’t see how this is much different from moving the funds into a business savings account, except of course hopefully the gains will be greater, so don’t see how this conflicts with core trading activity.

Have I missed something???!

Hi Steve,

Like you, I would love to be able to invest the funds directly from my trading company. And you are right, you have to treat it on a case by case basis. A few points:

£50k is an arbitrary amount. It really depends on the size of your business. If your turnover is 50k and you have 50k in investments, then yes that would be too much. I don’t know what the exact ratio needs to be, but you shouldn’t have higher trading taking place in non-core activities than core ones.

Regarding hassle: It is a bit of an extra overhead to run another company, but not as bad as people think. That’s because your second company has no VAT, no payroll, and very few transactions per year (I had 10 in 2017). I don’t even need an accounting software. I only need a decent accountant for the company accounts once a year. Yes, it is extra work, but not as bad I thought it would be.

The other benefit of having a second company and the article doesn’t mention is that you can claim investment-related expenses. Books on investing, property viewings in other cities, maybe seminars etc.

Speaking of property, I have not invested in property directly (only property lending) but in my knowledge, lenders want to see a new SPV before approving a limited company mortgage. That’s because there is an additional risk if an existing company cannot repay the mortgage for reasons unrelated to the property investment. A lot of people do have the time to invest in property, and buying property through your limited company has some tax-benefits too.

Bottom line, if you invest in funds and have a small amount compared to your business size, then, by all means, go for the direct investment (ask your accountant first). In my experience, it is not unusual to see people with £80-200k idle in their bank accounts earning zero interest.

It is a blurry line indeed, which is why I wanted to open a second company and keep things separate.

I’ve tried to invest directly in the company’s name and have been told the company needs to be FCA registered. Not certain what that entails.

This is a great article, thanks. A couple of questions; points.

1) You mention above “dividend income corporation tax though will have to be paid at the year-end” however, I am of the understanding that there is no CT paid by a company on received dividends that company receives.

2) It has been established that a company that does 51% trading and 49% investments would be classed a trading company with BPR available for at least the 51% while a company that does 51% investing and 49% trading would be treated entirely as an investment company. Therefore assuming the investment is less that the trading activity, for simplicity would it make sense to conduct the investment through ONE company rather than creating two?

3) On sale of the investment, is the whole investment liable for CT or just the gain (if there is one)? Eg: If the company buys an investment (property, stock, shares, funds) is that not a company expense off-set against CT? Therefore on the sale of the asset does the WHOLE asset not qualify for CT rather than just the gain?

Hi Anon,

1) There is corporation tax to be paid by the company since dividend payments are just another form of earnings.

2) It would be great if you can provide a link documenting that. I’m all up for having one company making all investments, but in my experience, it’s a blurry line which is why I kept things separate.

3) It’s just the gain we have to pay the corp tax on.

Hi Michael,

Sorry a bit late to this discussion but a point which seems not to be covered in detail is if the investing company is loaned money -surely on top of the monthly loan repayment you can repay back the loan exempt of tax in instalments which in order to claim entrepreneurs relief has to be paid 100%. So for instance by lending 100k to the investing co. the trading company can form a commercial agreement at 6% pa. or £500 pm. But also the trading co can reclaim the 100k loan over over a period of years with no tax or CGT.

Another point, if as in my case, I loan the company from the sale of buy to let’s which becomes a personal loan-can I claim interest on the loan per month and take the loan back over time without tax implications ? There is I think personal tax to pay based on my personal income received.

A further point is there appears to be a situation where shares can be exchanged between companies A and B which can reduce tax-which I noted earlier in this thread. Is there any more information on this subject.

Thanks for your advice so far.

This is an ongoing article Craig, thanks for your insightful comment. You are right, one can repay the loan including capital in the repayments. The trading company will have to pay CT on the interest received and the investing company will show a loss for the interest. So no overall gain or loss, just an accounting balancing act.

Based on my knowledge, lending money to a company means that you can be paid back tax-free anytime. However, if there’s an interest charged, then the interest paid to you from the company has to be taxed at a personal level. That’s on top of whatever other income you may have.

Re your last note, I have not heard of a company shares exchange before, but then I’m not an accounting expert.

In the scenario when “Company B” invest only in stock, ETF etc excluding real state market. Are you sure that “Company B” will be not caught as a close investment company?

CT

I am pretty sure that no CT is paid on dividends received by a company. The profit has already been taxed to CT before distribution (there is no double-taxation). See https://www.gov.uk/hmrc-internal-manuals/company-taxation-manual/ctm02060

Important to make sure the location of the fund, EFT, shares etc is in the UK or one of these locations; https://www.gov.uk/hmrc-internal-manuals/international-manual/intm412090

BPR

https://www.propertysecrets.org/index.php/2017/08/24/inheritance-tax-free-rental-property-business/

Just spoke to my accountant, you are right. Dividends are not subject to CT and this is great! Thanks for the heads up, I’ll update the guide.

It’s a big plus :-). Pleased to have helped.

Sorry. I had a blog posting issue. Feel free to delete some posts to leave only one! They all have the same message.

Great article, this whole field is a complete mind f**k.

I sold a large asset in my business in January for a considerable amount of money, since then the cash has been sat there doing f**k all and earning f**k all as I don’t have a clue what to do with it. I wanted to claim ER, but then I was scared by HMRC and their TAAR system because I would want to launch a new business in the ‘online space’ which is what my current company does, albeit a different market, slightly different model e.t.c.

So, I am still at square one – trying to figure out what to do…nightmare!

How is the company structure / investing going for you?

Great page – I find myself here as I am in a similar position to many other people in the comments. As a single director of a contracting company, I am looking to invest on a monthly basis some spare profit from my main trading company.

I expected to be able to just open a general trading account with a provider to allow me to buy UK based shares or funds. My accountants have advised this is fine as long as the account is in the company name and the investment activity is less than 20% (IIRC) of the main trading company. However, I am struggling to find a company in the UK who will provide a general trading account in a limited company name which is not classed as an investment company.

Does anyone have any suggestions?

Thanks

Hey AC, have you tried contacting Interactive Investors? I’m writing an article on how to open an account with them, but that’s as an investment company.

Cheers,

Michael

Great article Michael, I’m looking to do something similar.

Would it be ok to please supply the details of your accountant? I’m having difficulty finding one who will touch an investment company.

Thanks!

Great article Michael.

One poster commented “I’ve tried to invest directly in the company’s name and have been told the company needs to be FCA registered.”

Is this correct?

Thanks

Tim

Hi Michael

Also, am I right in thinking that the article still needs to be updated with the C/T and the spread sheet needs not deduct the 20% each year?

Thanks

Thanks, Tim, you’re absolutely right. CT needs to be paid only at the end and the graph was deducting it every year. I have now corrected it and it’s now showing a £297,000 difference to personal investments compared to the previous £240,000. And that’s not even accounting for dividends being tax-exempt when calculating the final CT!

Regarding FCA registration: I have called them in the past (08001116768) and they informed me that FCA registration is not required if there are no clients or any other members benefiting from the investment company. They were trying to make sure though that every corner is covered. Your case may be different. We still need a LEI code though.

FCA registration was not needed when investing with Vanguard. Also, I have successfully opened an Interactive Investors as well as a property platform account last month and I will be writing a blog post about both soon.

If there is no tax on dividends for investment by a company, is it worth investigating investments that main return is via dividends? In a way, that could be the ISA of the company investment world

I like your way of thinking, Stev: Company ISA :) Indeed. I’m trying to find ways to invest that pay hefty dividends.

In fact, I’ve just started investing at Property Partner as a limited company. I find it a great way to diversify and get exposure to UK property as a company and the rent is classified as dividends. See new post here: The Property Partner experiment.

Hi Michael,

Thanks for the article, I think it’s very useful.

How do you deal with surplusses after you’ve already made the initial loan to the second company? Would you make a separate loan or is there a way to change the original loan and increase the amount?

Thanks

Enrico

Hi Enrico, good question. I make another loan each time I have a new surplus. However, I know that some people start with an initial loan larger than the initial surplus, and only lend the money in stages.

Cheers,

Michael

Hi Michael,

Thanks for this article, could you please help me to try and clarify the following doubts?

1. How much does the new accountant charges for the investment company? I’m paying £1,500+ for the typical IT contractor company but as you mentioned, if one invest just in shares for example, the fees should be a lot lower?

Could you pls email me the details of the one you’ve found?

2. You mentioned “to pay first into a pension”, however following your example where let’s say the investment company (or the pension) has £1 million or more in a few decades, if the money is in a personal pension, there will be inheritance tax implications which are exhorbitant, whereas if the money is kept in a separate company those charges won’t exist when passing wealthy to another generation. Do you see a fundamental problem about using the investment company instead of a standard SIPP pension (not sure if I’m missing something obvious here)?

3. I read your 3 points about why not to invest directly from your trading company but when I researched a few years ago, the points of legal separation and easier tax (as you’re already paying an accountant to do the tax of the trading IT Ltd company and doing a standard IT job I’ve never read any contractor having any kind of trouble with their company) were not a big concerned for me, point 1 about the tax implications resulted in a little bit more corporation tax a while ago, but I think at the moment it was the same at 19% since April 2017 if I remember correctly.

* Could you please let me know what are your thoughts about the ‘tax implications that would apply if a trading company is caught and classified as a close investment holding company’? I don’t see any issue at present, the last few years, I’ve been investing directly from the IT Ltd company and just paying the standard accountancy fee (although I’m helping them to prepare/review the invesment figures at the end of the year)…

Many thanks in advance!!

Joe

Joe, please see below:

1) Accountant charges: It depends on the complexity of your investments. I’m paying £700-800 once a year for the company accounts. But I have no payroll, no VAT, no (investment company) pension and that’s just a Vanguard index fund, although this year I added property too (via property partner). I’ll e-mail you my investment accountant details.

2) Pension vs company: The ultimate hack of using a pension is that you avoid paying corporation tax on your trading company profits. You invest pre-CT tax, therefore taking advantage of a 20% tax relief already. That’s why I love pensions. However, your money is tied until the pension age.

3) I’m sure you can do invest directly from your trading company. But what if you invest 50% of your turnover? What about 100%? As stated in the article, the tax implications are that you won’t be able to claim entrepreneur’s relief should you want to liquidate the company. Not sure what else, given that you’re more of an investment company rather than an IT company. I’m not an accountant, so I followed their advice of keeping the companies separate. That may or may not be suitable for you.

I’ve set up my investment company, loaned some money from my trading company and am just making my first investments. I think I will stick to investing in Funds in order to avoid needing an LEI number.

I have just found out that Hargreaves & Lansdown allow you to open a Fund and Share Account as a UK Limited Company. They keep it very quiet! I can’t find any details on their web site, and it seems you can only get the application form by emailing them. It’s potentially a good option though as they only charge £11.95 per share trade with no annual fees or minimums, and you can buy and sell Funds for free: https://www.hl.co.uk/investment-services/fund-and-share-account/charges-and-interest-rates

I just wanted to share that as it might be good option for investors like myself who aren’t planning to make frequent trades, so it works out cheaper than Interactive Investors. Thanks again Michael for such a helpful article and everyone for their useful comments!

Hi Jonathan,

HL is a good deal if you invest only in shares, however, if you hold funds you will need to pay percentage fee based on your holdings as follows:

On the first £250,000 0.45%

On the value between £250,000 – £1m 0.25%

On the value between £1m – £2m 0.1%

On the value over £2m No charge

II charges £90 flat fee per year, so the break even holding is £20,000 (£20,000*0.45%=£90). For any portfolio invested in funds with size >£20K II is the better deal.

Hi Michael and all,

thanks for sharing all your knowledge and experience! It’s very valuable!

In terms of a SIPP, can you recommend any good pension plans if one invests say 600 – 700 a month on a regular basis?

Also, could you kindly share the details of an accountant? I’m looking to change my current accountant and would be great to have the same accountant looking after both the main trading as well as the SPV company.

Also, in a case of an SPV for property investing (with buy to let mortgage), are the expenses to do with the property fixes and maintanance tax deductible within that SPV? I’d assume so, but would be good to confirm with anybody who knows.

If anybody is already investing in the buy to let property market, could you share your experience with such investing? What’s the average time horison when you can expect a reasonable return on investment? I would expect the funds would have to be tied in for a good few years period before the SPV can make a profit?

Thanks very much in advance

Oksana

Hi Oksana, some SIPP options are Halifax ShareDealing, Interactive Investors and BestInvest depending on the size of your pension. See the latest Ask me anything pension question: https://www.foxymonkey.com/ama-part-1/

I’d assume the fixes and expenses are tax-deductible yes, but I’m not an expert on SPV taxes. I’m investing in property via Property Partner. The taxes are quite simple there as you have capital appreciation taxed as profit and rent in the form of dividend income which is free of corporation tax.

I’ll send a separate e-mail about accountant info.

Hi

I came across your article and found it interesting.

Using option 2 you wrote ‘There is no obligation to pay back the loan and I’m the sole director of both companies”.

If the loan is not paid back does that mean the loan the trading company made would be written off?

Secondly the investing company would have the loans as liabilities. So when it comes to closing it wouldn’t you have to pay off the loans first?

Hey Miz, both very valid questions. If the loan is not paid back, the trading company would need to write it off. My plan is to keep the investing company open and close the trading company.

I’m thinking of the investing company as another income pot (without the age limitation pensions have). But I’ll have a clearer picture when I cross that bridge. If someone has done it already, please comment.

Hi Michael,

If you plan on Closing the Trading company and not selling it, why did you not just invest through the Trading company in the first place? Entrepreneurs Relief won’t be an issue at point of sale if you are not planning to sell the company.

Thanks for the insightful article, I am still unsure of what to do though! I think I need to speak to an IFA.

Very informative article Michael. In fact I am also on the same boat and had been investing directly through company account for a long time. I am an IT consultant. I also like the fact that there are so many like minded people querying on this blog, it is kinda bringing people together to discuss similar ideas.

I also appreciate your efforts in replying to various questions ppl have raised.

I checked with my accountant and as long as my company Share/MF investments does not change the core trading, it is fine. That said, I yet to find the exact percentage on which the core trading purpose can change on records. Just a thought on that, may be I can add another SIC code to my company when I reach that point where investments are more than the companies actual earning/purpose instead of paying for accountancy fee on a separate investment company. will check with my accountant.

I use HL and in past was using Fidelity (offline paperwork for buy/sell). I am planning to move to Interactive Investor soon due to low cost but their fund offering is limited.

Thanks, Anant for your kind words. Other people have mentioned investing directly from your trading LTD. Not sure what the exact revenue percentage is above which your company is classified as an investment company. So to be on the safe side and to keep things clear I opened a 2nd company. Fixed accountancy costs look pretty low once you start investing larger sums (percentage-wise) plus they’re tax deductible.

You probably loved the switch from offline Fidelity to online HL! I’m investing directly with Vanguard and have to call them up every time I want to trade! #2019

Hello Micheal, As always a fantastic blog.

You quickly mentioned about selling the company and only paying capital gains tax of 10%. My question is, could you take this approach?

Earn 100k in Ltd Company A – Sell the company and only pay 10% capital gains tax

Earn 100k in Ltd Company B – Sell the company and only pay 10% capital gains tax

Repeating the process effectively never paying more than 10% tax to take the money personally?

I wonder if there are companies who purchase companies like this to enable this kind of strategy!