This is a review of the popular Interactive Brokers investment platform. Interactive Brokers allow UK limited companies to open a company account. This is great news as more and more platforms allow LTD companies to invest in stocks & shares, mutual funds, ETFs, Forex, Options etc.

I opened an account with IB after a lot of readers pointed out the platform benefits to me. Interactive Brokers are a well-known American firm that now operate in the UK too. I like the transparency and the fact that they’re listed on the stock exchange (NASDAQ: IBKR).

Companies that trade publicly means higher regulation and better protection to us, the customers. Customer money sits in a segregated account, as expected. Read more about how investors are protected here.

In another article, I showed how to invest your company cash. A lot of people have done so through different brokers. I initially trusted Interactive Investors for my funds, but I have now switched to Interactive Brokers which is a low cost and trustworthy broker, in my opinion. Things I’m looking for in an investment platform are:

- Low cost

- Decent customer service

- Solid coverage of the ETF universe

- Strong reputation

- Support for Limited Company accounts

It’s worth noting that Interactive Brokers only offer a limited selection of mutual funds for non-US investors. Initially, I thought this is a blocker, but then I remembered most of the index funds can be replaced with their ETF counterpart (or similar). They offer a huge selection of ETFs including those domiciled in the UK, US, Luxembourg, Ireland etc.

For example, Vanguard’s World VWRL ETF is a global stock market ETF. Then ETFs are great because they can be traded instantly, have tax advantages and are low cost too. So that’s covered for me.

Interactive Brokers are an advanced platform for professional traders. They offer stocks, ETFs, CFDs, Metals, Options, Futures and Forex among other options.

For example, a major feature that took my attention is margin trading. This means you borrow money to invest. You pay some margin fees and have the option to invest more than you can.

They also offer a nice API if you want to do some algorithmic trading.

However, this does not mean IB cannot serve someone like myself – looking for a simple solution who just wants to invest 5-6 times throughout a year in a few tracker funds. I just like to keep it simple, but there are plenty of options to make it complex if that’s what you want.

Fees – Pricing

I’m not going to explain the whole range of fees as this depends on the country, order value, type of product etc. But I’m going to give you a brief overview of a small business account that places a few trades each year into stocks & ETFs in the UK which is one typical use case.

Interactive Brokers is really cheap compared to other brokers. They have both fixed fees and tiered solutions. You can choose which one you want to use.

ETFs and Stocks (Fixed fee)

Up to £50,000 GBP trade value – £6.00 per order

Then depending on the activity of the account, you pay a small fee if you don’t generate enough commissions.

Monthly Activity Fee = 0 if monthly commissions are equal to or greater than USD 10. (or currency equivalent)

If monthly commissions are less than USD 10,

Standard Activity Fee = USD 10 – commissions.

So for an account that places one ETF trade a month, the annual total charge would be

Trade commissions: £6.00 * 12 months = £72.00

Inactivity fee = (£10.00 – £6.00) * 12 months = £48.00

Total annual fee = £120.00

In my experience, this is a very low commission for a corporate account.

ETFs and Stocks (Tiered fee)

The IB pricing structure pleasantly surprised me. Their tiered trading fee starts from 0.050%, min £1.00 per trade for up to £40 million monthly trading volume.

The tiered fee is a great solution for those that want to place small trades a few times per month. Basically the break-even point is an average of £12,000 per trade above which it’s probably worth paying a fixed fee instead.

So a trade of £10,000 at 0.050% will cost £5.00. Even better, a trade of £1,000 will cost only £1. This is amazingly low. Sure you still have to pay a monthly activity fee but still. Assuming you place 10 x £1,000.00 trades each month, so in 12 months that’s 120 trades.

Total annual cost = £120.00.

I cannot stress how low this is compared to the typical £12.50 per trade of other brokers. Other brokers would charge £1,500 per year in trade expenses alone for a similar scenario.

How to open an Interactive Brokers limited company investment account

Opening a UK limited company account is not the easiest task but it’s all online and certainly doable if you have all the documents. You will need to fill in certain company and personal information and upload some documents to verify your details.

I won’t go into details of each and every screen, because most of them are straightforward. I’ll only explain the bits I found tricky.

There are 3 types of accounts for small businesses:

- Cash account

- Margin account

- Portfolio Margin account

The main difference between Cash and the other two types of accounts are the ability to trade on margin. This means you can trade with borrowed funds. It also means you can lose more than your initial investment so beware.

Margin account requirements are rules-based whereas Portfolio Margin account requirements are risk-based according to the positions in your portfolio.

I opted for a Margin account. I do not plan to trade on margin anytime soon but would like the option to be able to do so in the future. Read this document from IB that explains what the margin benefits are along with their requirements.

Note: You can upgrade your Cash account to a Margin account later.

My company is just a vehicle for me to invest in stocks, shares and property. It does not really trade, but invest for the long term. This may or may not be the case for you.

The trickiest part of the application will probably be the one where you select your FATCA status. Luckily for me, I had to do it again for Vanguard in the past, therefore I was familiar with it. But it can be very confusing for people and brokers are not able to help either.

How to determine your FATCA status

The Foreign Account Tax Compliance Act (FATCA) is a 2010 United States federal law requiring all non-U.S. foreign financial institutions (FFIs) to search their records for customers with indicia of a connection to the U.S., including indications in records of birth or prior residency in the U.S., or the like, and to report the assets and identities of such persons to the U.S. Department of the Treasury.

Source: Wikipedia

If you’re a UK-based LTD company you’re probably either an Active or a Passive Non-Financial Foreign Entity (NFFE), unless you’re a bank, pension trust or a public company. What “Foreign” really means is foreign from a US standpoint, as this is a US legislation.

From the IRS instructions (w8ben-e form), an Active NFFE is one that:

• Less than 50% of such entity’s gross income for the preceding calendar year is passive income; and

• Less than 50% of the assets held by such entity are assets that produce or are held for the production of passive income (calculated as a weighted average of the percentage of passive assets measured quarterly)

I’ve stumbled upon a very helpful FATCA decision tree by OneAccount and here’s its glossary. And here’s the long HMRC guidance notes PDF, if you want to kill some time.

My company is a Passive NFFE but that may not be the case for you. If you invest through the company you also trade with, this may not be the case for example. Or if you use your investment company to buy and sell regularly (trading).

Again, I’m not sure about this and you’ll be better off calling HMRC (0300 200 3500) to double-check your company is a passive or active NFFE. And as always, seek professional advice.

How to complete the W8-BEN-E Form for a UK investment company

This is another step in the process. Interactive Brokers will give you a W8-BEN-E form for you to fill out online. The W8-BEN-E form is the equivalent of the W8-BEN form but for corporations. This tells IRS that they should only withhold 15% tax off your dividends rather than 30% thanks to the USA-UK tax treaty. If you have an ISA and invest in US companies, you’ve probably completed one already.

I’ve ticked Part I (1,2,4, 5 – Passive NFFE, 6, 9b – that’s your corp tax UTR), Part III (yes, 14a, 14b – Company that meets the ownership and base erosion test – see IRS instructions), Part XXVI (ticked 40a, 40b).

I can always electronically submit a new WB-BEN-E form if my circumstances change. On the Classic AM interface, it’s under Manage Account -> Account Information -> Tax Information -> Tax Forms.

Sources:

Documents upload

The most time-consuming step of the onboarding application is the Documents Upload screen. Click on the More Information links to find out what each one means.

It takes time to download, sign and upload lots of forms. But the good thing is that you can download all of them locally, and use Adobe PDF reader to Fill & Sign. You don’t really need to print it and send letters, unlike other brokers.

The documents you will usually need are:

- Business Bank statement

- Certificate of incorporation (you can find this on Companies House)

- Personal ID (passport, driver’s license)

- Proof of address (utility bill)

- A few forms from “More Information” you need to download and sign

I only uploaded a few documents and left it incomplete for the night. The next day I received an e-mail from the New Accounts department asking me for a few more details including the Source of Funds. This was a good sign of customer service. I provided all remaining details and they opened my account the same day.

After signing up, you will be asked to electronically submit your EMIR and MiFir preferences. These are regulations for the derivatives markets. I do not trade derivatives and therefore these don’t apply to me. However, if you do, you may be subject to these regulations.

If you want to ask any questions during onboarding, a useful e-mail is [email protected].

Customer Service

The customer service has been pretty good so far. My account got locked after a few unsuccessful attempts to log in. I called them up and despite the late hours, they resolved it within minutes. I had to wait for less than a minute in the queue before a lady with a nice American accent picked up the phone. She was quite helpful and reset my password very quickly.

The customer service via e-mail was also decent. I had only uploaded a few documents during my onboarding. The next day I received an e-mail confirming that my documents were OK and the remaining documents they need from me to continue processing my application.

They have a live chat, a UK phone number, e-mail and a FAQ page.

Placing Orders on the Interactive Brokers platform

Personally, I like simple investing interfaces because I am a boring buy-and-hold passive investor. If I were a trader, the Interactive Brokers interface would be very appealing to me.

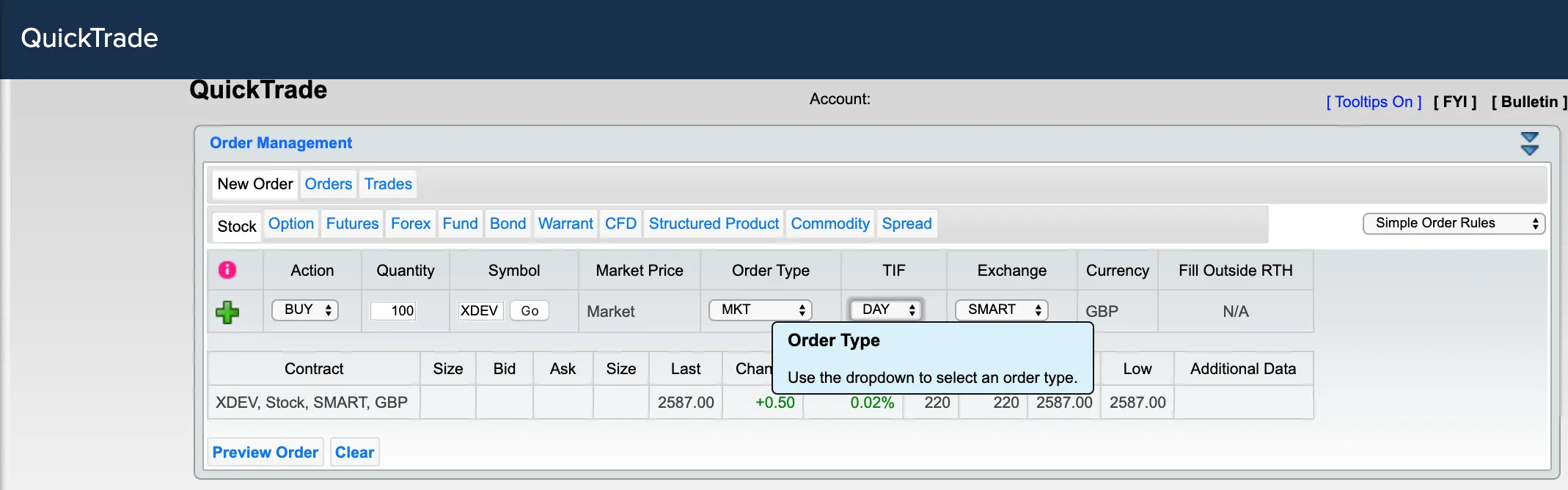

There are different ways to place an order, but I went for the QuickTrade online solution. As the name suggests, you can buy and sell any security at Market or Limit price and get on with life. Here’s how the interface looks like:

If you want more advanced features, then you can download the Trader Workstation which is a desktop application.

The Mutual fund – ETF replicator is another interesting tool this interface provides. Say you have an expensive mutual fund that you want to know what the alternatives are. This tool will show you what the closest options are in ETF flavour and at a lower cost.

Summary: Interactive Brokers Company Account

Interactive Brokers are a great platform for UK Limited companies wanting to invest their funds. It provides a wide selection of ETFs and other securities such as Options and Futures.

The ability to trade on margin should be carefully considered. It can go both ways…

The onboarding process is not the easiest, but it reflects the level of checks they need to perform to make sure they only have legit customers. On the plus side, you can do all of it online.

Interactive brokers are a public company. This comes with both heavy regulation and transparency (both good for us).

I did my best to cover the Interactive Brokers platform for UK companies wanting to invest. But what applies to me may not apply to you. Also, the information in this article may be inaccurate by the time you read this. I did not consider your tax or financial situation.

For a thorough review of investment platforms for UK limited companies have a look at the Company Investing Academy. This includes everything business owners should know to generate an income from their hard-earned company cash.

This article should not be considered tax or financial advice. Always seek professional advice. I am not liable for any damage or losses. Foxy Monkey does not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading this publication. You acknowledge that you use the information we provide at your own risk.

Interactive Brokers have not paid me to write this guide.

85 thoughts on “Interactive Brokers: Limited Company Investment Account”

I’m using Hargreaves & Lansdown since ii starting charging £30 per month! They have been fine so far. When I signed up, they insisted that I need an LEI even if I only want to trade funds, but on the plus side they accepted a digital bank statement.

This seems a better deal though. If H&L give me any reason to switch then I will be checking out Interactive Brokers. Thanks for the heads-up!

Yup some platforms (like ii) insist on obtaining an LEI for regulation purposes. I had to get one before, anyway. Personally, I haven’t used HL but others seem to be happy with it!

Where is the best (cheapest) place to get an LEI?

I’d go with Bloomberg. See this plus comments: How to get a LEI code

H&L have a £1.50 Regular Investment charge. If you used that for investing say once a month and one normal priced trade to sell, it works out just £28.50/yr

I think your mixing you $ and £ with IB. You quote £6 trading fee but $10 inactivity fee, but then take one from the other as if same currency

Inactivity fee is not charged if balance greater than $100k, equivalent to about £70k

Two of the best things about IB is low FX fee $2 (£1.50 ish) and low US share commission fee (about 30p on tiered structure). Combining those makes a very low cost platform and opens up US share trading

Thanks, Cookie for the HL info. This looks very low. Am I right in thinking HL don’t offer US-domiciled ETFs/funds?

On Interactive Brokers, I am not 100% sure how the inactivity fee is charged for accounts that trade in GBP (or another non-USD equivalent). Probably the $10 still holds for balances < $100k. So if we assume £6 is $8, then the monthly offering is even better than what I report. They probably only charge $2 per month in this case. I will correct it when I'm confident this is how non-USD accounts work. Indeed, the FX fee is really great!

H&L don’t offer US-domiciled ETFs, but neither do most brokers open to European citizens. IB doesn’t allow you to invest in US-domiciled ETFs either, unless you have been able too? Most ETFs that are available to Europeans and invest in US stocks are domiciled in Ireland or Luxembourg

The US-domiciled ETFs, as their main market is US, don’t bother with KIIDs/KIDs and so are not available to Europeans. Shame as the fees are much less and more diversity

In IB you can actually trade US-domiciled funds. It’s just a bit of a hassle because you’ll have to manually convert your GBP to USD first. For dividend-paying funds, if you factor in the 15% dividend tax, it makes US funds a more expensive proposition overall, despite the European funds having higher OCFs.

Can you name or give the ticker of the US-domiciled funds you been able to purchase? Other sites have reported this was not possible, so be interesting to look at how this is done.

Withholding tax is only on dividends and dividends are only a small percentage of the return, so would be interesting to see an worked example comparison

The low $0.35 buying cost Vs £6 would need factoring in and $2 FX

Hi Cookie, I haven’t actually bought a US fund yet because if you factor in the dividend tax then it works out more expensive than the European equivalents. For example, the vanguard global small-cap fund (domiciled in Ireland) has a 0.29% OCF. A similar one would be a combination of VB (US only) and VSS (global ex-us).

Ignoring FX fees and the spread:

VSS costs 0.12% and yields 3.25%. 15% on 3.25 is 0.4875%. Total cost after taxes considered = 0.60%

VB costs only 0.05% and yields 1.39%. If you factor in the 15% tax on its 1.39% yield, that’s 0.2085%. Total cost = 0.2585%.

I guess the lower the yield the better if you want to purchase US funds. I will try to buy a few units of a US fund and report back here.

By the way, the £6 buying cost only applies to the fixed pricing. You can go with tiered pricing and pay as little as £1 for each trade.

Hi Micheal,

It’s a great blog. I have opened the account with ii last month and they changed monthly fee as

My Plan : 9.99

Non Standard Account Fee : 29.99 for company accounts

Total : 39.98/month.

It is very costly hence just closed the account.

Also opened IB account and but in the order screen when enter the Stock Symbol and click Go it is not showing any stocks.

I will contact customer service to find out whats the problem with my account.

Its Margin account and requested Options Trading as well.

Yes, thanks for example, for dividends witholding tax is consideration

I have found growth stocks beats dividend factoring in all returns. Haven’t looked at Corporation Tax saving

Tiered commission LSE is % based, so less than £6 on less than £12k trades

You’re right Cookie, one cannot purchase US-funds as a retail investor. That’s because the regulation doesn’t allow funds without KIID to be sold unless you have an institutional account. https://kb.clientam.com/article/3203

Just thought of updating this thread. Not being able to buy US funds is not a blocker but good to know!

Hey Michael,

Valid point wrt retail investor. I believe there are no such restrictions for buying US-domiciled funds/ETFs/Shares via a limited company.

Also, IB also has a Lite option, which is commission-free for US-based stocks (for Cookie’s growth stocks) and ETFs (general S&P 500 and world trackers). The FX risk has to be borne, of course, especially with the current GBP/USD setup.

For Non-US funds/ETFs, the fixed-priced commission is applicable. Sadly, there is no low-fee regular investing option with IB

You can get around the KIID rule by selling a short term ITM put option on the ETF you want to buy, and then wait to be assigned! Then if later you want to sell it, you can, the restriction is only on opening a position.

That’s a great tip, thanks Mark.

So you end up owning the stock/etf after a certain time period? What if you want to hold it for years? Can you give us an example of how it works in practice?

You end up owning the stock immediately after the expiry. You can then hold it for as long as you want, the rules don’t force you to close it, but they allow you to close it.

Example: say you want to buy SPY (S&P500 ETF). You can for example sell the March $500 put, which is deep in-the-money as the ETF trades around $407:

https://finance.yahoo.com/quote/SPY230317P00500000?p=SPY230317P00500000

You receive a premium of about $93 (the intrinsic value of the option). At expiration (unless SPY is above $500) you will end up buying it for $500 (net purchase cost $407 including the option premium you collected upfront, same as if you had purchased the ETF at $407.

If SPY by some miracle is above $500, you simply keep the option premium.

Only issue (maybe) is that you can do that in multiples of 100 shares as one options contract has 100 multiplier (leads to buying/selling 100 shares), but then if you want say only 70 shares you can buy 100 with this method and then sell 30.

Great stuff thanks for explaining it.

Anyone know what the interest charge for margin is for uk corporate IB account?

Quite reasonable. As of Jan 2020, it’s 2.1% for GBP accounts up to £80k. More here: https://www.interactivebrokers.com/en/index.php?f=1595

wow that seems incredibly low

and 1.6% for balances >80k

degiro is 7-8% or something last time i looked. I wonder how IB can offer such low rates

FWIW another alternative is Selftrade. I’ve been using them for my company trading account since 2006, and can recommend them. I used them mainly for trading company shares, preference shares, bonds and some ETFs.

Hi Michael,

I bought stocks thru IB today and the process to buy USA stocks is below.

1. Convert GBP to USD

2. Buy USA Stocks.

Just wondering, is this the case with other platform to buy USA stocks. If that’s the case we are relying on both GBP/USD and Stock performance to make profit.

Regards

Selvan

Hi Michael

Thank you very much for the extremely useful information. I was wondering what your thoughts are about Hargreaves Lansdown account for investing through a limited company.

I was wondering what ETFs and mutual funds you found worth investing on Interactive Brokers.

I spoke with IB and understand that a margin will be applied automatically and there will be an interest charge on the loan. Is it better to have a Cash Account instead of a Margin Account for long-term investments to avoid the interest on the margin?

Is converting currency to USD/EUR to buy ETFs and funds a good idea? Would you rather stick to the investment options available in GBP

I would be grateful for your thoughts and advice

Many Thanks

Surban

Hi Surban,

I’m not sure about Hargreaves Lansdown as I have not used them personally. But I’ve heard other readers use them and they’re happy with the service.

Regarding margins, I believe Interactive Brokers won’t charge you for a loan you haven’t taken. The option to take a margin loan is there. So they’ll show you the buying power, available cash etc. But unless you borrow money you won’t be charged – https://www.interactivebrokers.com/en/index.php?f=1560

If you want to keep it simple, a Cash Account is better in that sense. I stick to GBP ETFs just because it’s simpler to buy, no need to exchange currency. But it doesn’t make a difference to the underlying NAV if they’re offered in other flavours.

They have plenty of ETFs but no mutual funds. I use TrackInsight or Morningstar to search for ETFs. Personally, I stick to well-known ETFs such as VWRL (world equities), XDEV (value), WSML (small-cap), VEU, VAGP (bonds), etc These may or may not be suitable for you.

Many thanks for the company hub and all the info on this website. I have set up a separate limited company to invest in index ETFs and opened up an account via Interactive brokers after using the info on this website. How did i respond to the question ” Make your EMIR election” on IBKR platform?

I do have a LEI number though but if I provide this then it asks about Counterparty information

Financial Counterparties (“FC”)

Non-financial counterparties above the clearing threshold (“NFC+”)

Non-financial counterparties below the clearing threshold (“NFC-“)

Third country Entities outside the EU (“TCE”) in some limited circumstances

Thanks for any info on this.

I’m unsure on this one Nav, which is why I didn’t write about it. I think I picked NFC- but I’m not sure, sorry.

HI Michael,

Amazing article, thanks for this. I’m trying to sign up now with IB, I’ve setup a holdings company which I will transfer money into.

Question: Any recommendations on a bank which operates holding company accounts? I tried signing up with Metro bank but they advised me saying they don’t open accounts for holding companies.

Thanks

Kunal

Hi Kunal, it’s a regular business account I have with Santander. Not sure if they have special rules for holding companies, but it was straightforward to open one for a regular limited company with an investment focus. I went to a business branch in London.

Thank you very much, Michael. Much appreciated.

I was wondering whether Accumulation ETFs are better if you like to reinvest as this takes away the hassle of physically reinvesting the dividends?

Also, I gather VWRL dividend is paid in USD. Does it mean we need to convert it into GBP before we can reinvest the dividend into VWRL again?

I see VWRP does this automatically as this is an accumulation ETF.

Thank you for the list. Very helpful!

Do we need USD to buy WSML?

Many Thanks, Again.

Surban

Hey Surban, Accumulation ETFs take away the hassle of re-investing the dividends but add the hassle of calculating how much they paid you for accounting purposes. Pick your battles :)

Indeed, investing in a USD-based fund means the dividends come in USD. WSML is a USD one. Interactive Brokers won’t automatically convert USD to GBP. This is why sometimes it’s better to stick with the equivalent GBP-based funds. What I’ve found useful, is that Interactive Brokers will give you all the ETF options (in different currencies) once you type the fund ticker, so you can pick the one you want.

Hope that helps!

Am I right in saying that the minimum investment in Vanguard funds on IB is $100k USD? My plan is to invest less than that in Vanguard LifeStrategy, so this is a bit of a deal breaker for me unfortunately.

I’m finding it hard to find a platform for a corporate account at the moment. Hargreaves Lansdown are not currently accepting new company accounts due to Coronavirus, nor are Cavendish, Interactive Investor charge £39.99 a month, Fidelity are an option but have a postal sign up process, Share Centre are absurdly pricey. Vanguard seem to offer direct selling but I cannot find their fees anywhere on their website?

Also, is an LEI an absolute requirement with every provider? I’m just a regular one man band private limited company with a few quid to invest. Not in the financial business.

It’s certainly not as easy finding a corporate account as it is a personal one. I’d be grateful if anyone has any recommendations at this weird time?

Great blog – thanks for all the helpful content.

The minimum investment in IB for Vanguard ETFs is very low, not $100k. I think LEI is a requirement, yes, but IB can do it on your behalf. Hope that helps, Pete.

Thanks Michael. I’ve been in touch with Joyce at IB and they have confirmed that unfortunately there is a minimum 100k USD investment in Vanguard LifeStrategy funds. This table shows the details: https://www.interactivebrokers.com/en/index.php?f=2262&exch=Vanguarduk

I suppose if I want to avoid this, I have to look for ETF equivalents. I will probably go for a Fidelity account instead, although they insist on being paid by cheque! I don’t even have a company cheque book any more since banking with Starling…

Oh sorry, Pete, I thought you were talking about Exchange Traded Funds, not mutual funds :) But yeah, Lifestrategy funds don’t come in an ETF flavour as far as I know.

Fidelity pay by cheque is so American! I hope you find an easy way… A friend started with Starling and they asked him to only deposit 10k at a time. Is it the same for you or has it changed? I’m with Santander and pay 7.50 a month.

Thanks Michael. Starling has been fantastic so far and I’d highly recommend them. There was no minimum deposit and there is no monthly fee. Always easily contacted and everything is done remotely with ease. Bouncing back loan took 24 hrs to get, super easy. I was paying HSBC £6.50 a month for very little and haven’t looked back since switching.

Have spoken to Fidelity and apparently they can accept bank transfers but this involves another postal form. These post based platforms remind me of the 90s. Plan to change the fidelity account to Cavendish when they accepting business applications again, to get lower rates.

Cheers,

Pete

Awesome, thanks for letting us know Peter. Hopefully, Starling remains free for businesses.

Hey Michael,

Did you look at TradeStation Global? They essentially are IB’s low cost option (i.e. they do not have a $10 per month charge), nearly everything else (charges, fund range etc.) is same as IB. Users essentially use IB’s platform but without the maintenance charges. Have you or anybody on this thread looked at TradeStation Global?

Thanks for the recommendation, Satya. I must admit I’ve never heard of TradeStation Global before. I see they charge 0.12% on each GBP and EUR trade, so you’d be paying £120 on a £100k trade. I wonder if they provide a fixed-fee option as IB do.

Fees aside, how do you like TradeStation Global?

Managed to set my IB account up. Was relatively simple, thanks to this article. I’m used to simple Vanguard FTSE Global all cap ACC investments in my ISA/SIPP. Is there a broadly equivalent ETF in IB?

What’s the best SIC code to use when setting up a new ltd company for trading?

It looks like it’ll have to be:

Section K: Financial and insurance activities, or

Section S: Other service activities ?

I want to make sure it’s not misinterpreted as me/ltd company offering financial services e.g. to other people or companies (or am I over-thinking it?).

Also – are there tax implications of selecting one SIC code over another?

Hi Neil, the SIC codes define the nature of your business and there are no fixed rules. Just focus on finding the SIC code(s) that best describes your investment activities.

Because I invest in shares and bonds, and I may invest in property too, I have chosen the following SIC codes:

64991 – Security dealing on own account

68100 – Buying and selling of own real estate

Hope that helps.

I have been waiting for new account application to be processed for almost a month now. Documents were all accepted and approved. I even deposited funds which were requested to speed up application approval. Still no solution nor any reply from IB. I still hope for the best.

Are you able to buy and sell US stocks and shares on the IB platform with a corporate account without having to subscribe for NYSE data feeds?

Some brokers like IG will only enable access to US stocks and Shares if subscribe to NYSE data feeds which costs $54 a month, so you are forced to subscribe to NYSE data feeds in order to buy US stocks via your corporate account, is it the same with IB?

You can buy US-listed equities without having real-time market data for it on Interactive Brokers. You’ll get a popup warning saying you’re trying to submit an order without having market data for this instrument. That’s really frustrating but you can carry on placing the trade regardless.

By default, they provide free delayed market data. You can actually request a data SNAPSHOT for which they charge 0.01 USD per quote request for US-listed equities. As a courtesy, they waive the first USD 1.00 per month, so that’s 100 quotes for free. See here.

It’s really frustrating trading platforms do that. I would expect free real-time market data before I place an order on the platform. Obviously, I’m not really bothered as I’m not day-trading, but still.

Hi Michael

Great article, thanks for your comments.

In your opinion, who would recommend overall between IG Markets and Interactive Brokers for a small business corporate account?

Kind regards

Aman

I know IG are a reputable company, Aman but haven’t tried it myself. Perhaps a reader can comment on this one?

Hi Michael

Thank you for your excellent article. I started trading with Interactive brokers with my company account a few months ago after reading this . Although it is possible to buy individual stocks, IB doesn’t allow you to buy US ETFs (eg ARKG etc) unless you are a professional. Do you know whether there is different option/setting for buying US ETFs? Overall IB is a very good platform for buying shares and for trading. I am a long term investor and don’t do day trading.

Regarding your comment about live share prices, I use a different platform (trading212 or Webull) to check live price before I place an order on IB.

IBKR and European providers won’t allow us to buy any US ETFs which is a shame! Lots of good ETFs out there and cheaper too. However, that’s because of the EU regulation (PRIIPs). The US ETF providers need to provide a Key Investor Information Document (KIID) and list in Europe. I don’t see a way around that, sadly.

Hi Michael,

Just wondering is https://www.vanguardinvestor.co.uk/investments/vanguard-us-equity-index-fund-gbp-acc?intcmpgn=equityusa_usequityindexfund_fund_link

US Equity index fund (whole of market) or S&P 500 available on IG platform.

I meant to say IB (Interactive Broker).

Hi Shaky, the ETF flavour of the S&P 500 is available on IBKR – https://www.vanguardinvestor.co.uk/investments/vanguard-s-and-p-500-ucits-etf-usd-distributing?intcmpgn=equityusa_sp500ucitsetf_fund_link. It has a vast majority of ETFs.

Funds on the other hand are harder to invest in on that platform and have a minimum buy, not sure about the US equity index fund.

I started the process using the promotional link but it is misleading to say that it is possible to do within an hour.

For example, one section asks for

“Notarized extract from the U.K. Office of the Registrar of Companies(i.e. the “Trade Register”) or comparable document from the company’s country of origin (must be less than 6 months old) ”

Another document is sent out to your address and you need to sign then return.

Funnily enough, sending them money is the easiest part!

I have a personal account with HL and Iweb. I also have a SIPP with AJ Bell and have opened an account with HL for an association. These were all childs play compared to the difficulty and time consumption opening up an account with Interactive Brokers.

I still havent got mine open yet (47 hours later) as I am arranging for the notarised document! I will update the total number of hours when the account is finally opened.

Let me know which document you submit that they accept for the notarized extract. I am confused and stuck at this stage.

Hi Tom,

Glad to know you got your account up and running. So which document you used for ‘Proof of Registration’?

Is it okay to download the Incorporation document from UK Company House? Which pages do I need? Do I have to get a notary public to sign it?

Hi, thanks for the useful post. I am trying to open investing account for my UK based limtied company. The documentary requirements seem quite annoying. Can you let me know what is the actual document they need for ‘Proof of Registration’, where they say “Notarized extract from the U.K. Office of the Registrar of Companies(i.e. the “Trade Register”) or comparable document from the company’s country of origin (must be less than 6 months old)”?

I have no clue. I have asked them multiple times and they just reply with that exact copy and paste that you got.

If I ever find out I will let you know.

I tried submitting my most recent confirmation statement but that was not accepted. I provided them a link to Companies House with all of the publicly available documents and asked which one they want – they just needed to tell me which of the documents on that list they want from me. No reply to that but the next day I got the same email asking for the same “proof of registration” document!

Its very Kafkaesque and confusing. I am now literally printing out and signing any document I can find and sending it in HOPING that its the mysterious one they require.

Im now on day 6 of trying and I am stuck on the same part “Proof of Registration”.

Im starting to doubt whether its worth it. Sorry Michael, the post is useful and I would have wanted you to get the referral bonus but for these guys its looking like a case of “computer says no”

Hey Tom and Vinod, the process seems very annoying. Not sure what they mean by ‘notarised extract’ but there was nothing sent to me via post that I had to sign. Everything was done through the online interface. Perhaps provide them with your certificate of incorporation? I’ve used [email protected] for comms and help.

By the way, I earn no affiliate commission from your sign-ups. This used to be the case temporarily but I disabled it a while ago due to the link confusing LTD Company owners that were signing up as individuals instead. Good luck, hope it gets resolved quickly.

Thanks for the reply Michael.

I had emailed them and received replies which contradicted other emails. I used the live chat feature asking which document is needed, even linking to companies house for them to tell me the exact one. I was confusing told “we cannot assist you further”.

It is mental, but I actually just printed all of the documents from Companies House for the past 18 months, signed and sent them all in.

Day 10. Still no account but the application is now being submitted for approval which is a new state. I kinda wished I never bothered but I have spent/wasted so much time and I can only imagine what convulated mess it would be to get my money back from them : /

Hi Tom – what did you upload in the end for the Proof of Registration?

Hey Michael,

Big fan of this blog, you write so many awesome posts that have helped me a lot!

I’m following your advice and was looking into setting up an account with IB but I have one simple question: What’s the benefit of setting up a company account with IB vs a standard retail account? The latter option seems a lot easier, but i’d like to know what the downsides are of doing that if i’m investing through a UK limited company?

Many thanks

Adrian

Hey Adrian, technically you, the director and the LTD company are two different legal entities. So all business accounts, bills etc should be in the company name. With regards to IBKR, one I can think of, for example, is that LTD companies require an LEI code for financial transactions as per the UK regulation. That’s not the case for retail accounts.

Also, another risk is the investable amount being classified as a director’s loan to you with extra tax charges. Personally, I would go for a business account to avoid any such risks.

Update, day 16.

Still no account, still down £1000.

Emailed twice with no solution. Got given a UK direct contact by email. He asked for the shareholder list which I send 2 days ago. No response.

Spent 45minutes on hold phoning the 0207 number before I got hold of someone.

For Vinod and others that are struggling with the “Certification Regarding Trading Control and Ownership of the Account” part; scroll to the bottom of the page and there is a small link saying “Download Agreements & Disclosures”. Click on this and it will download a zip file. In it there is a file “Certification Regarding Trading Control and Ownership of the Account”. Print and sign it. Now, confusingly it is the only file that you cannot upload on the page where you upload all the other files. Why? They must be trying to filter out impatient potential clients. You need to email it to [email protected] with the email title as your account number (found at the top right of the application page).

I will post again when (?if) I get the account opened

I am still waiting after 40 days.

Finally got it open!

The zip file linked to from “Download Agreements & Disclosures” at the bottom of the page was the final (hidden) part for me.

I think it must be an intelligence test which also weeds out impatient people

Thanks a lot for the reply. I should check if I did that.

60+ days. Last check is the only thing pending. Thanks a lot for your info. Was very helpful.

I just got my account opened.

I started my application on 04-May-21. It was opened on 26-Jul-21.

I had to resubmit several times to correct answers regarding estimated net worth of the company.

If you have any questions ask customer support agent to transfer to account configuration team. That helped a lot.

I opened another account for an Estonian company. It took only 4 days. I didn’t even fund before the account creation.

“Certification Regarding Trading Control and Ownership of the Account” Step was crucial.

Enjoy investing!

Thanks for reporting back, David. Yes, it’s also nice that Interactive Brokers fixed the default desktop screen to go to the client portal now. Cheers.

Thanks Micheal for all the helpful tips in the article. I have just been approved! Hurray! So I guess from start to finish that was 10 days.

A few tips – if you have any directors in your company that aren’t shareholders, you will be asked for their ID and proof of address. That was our last hurdle.

Regarding the ‘Certification Regarding Trading Control and Ownership of the Account’ – I printed the form that they provide a link to just below where they want you to upload that piece of information. That seemed to work (once signed etc) rather than having to go to the Disclosure and Agreements section which I did look into as a backup (and almost used as they rejected the first signed copy that I uploaded.)

I did notice that they started working on my account a lot faster once I transferred some money. I was skeptical based on David and Tom’s comments.

I have to agree that it is a somewhat frustrating and time consuming experience but I am now looking forward to using the IB platform and service.

Thanks again all for the tips.

Hi All

I have running Interactive Broker account for a month. But its a pain to use. Its not allowing me use quick trade or web-trade. When I spoke to them they advised me to download TWS desktop client which is for proper traders. Its too complex. I just want to buy ETF and funds and simply hold for 10 years.

The customer service guy was useless. Any ideas? Anyone come across this issue?

Many thanks.

Bala

You can either use the Interactive brokers mobile app which is good or use the client portal which is somewhat hidden for UK investors, not sure why! Just go to interactivebrokers.co.uk/portal once logged in.

Wow! That works! Would be great if you can write down all the tips of IBKR

This is fixed now. It automatically goes to the portal

Hi Michael,

Been a massive fan of your blog for a long time and read the article over and over again haha.

I was wondering if IB is still the ideal platform to use for company investment accounts?

Many thanks

Hey Sor, Interactive Brokers is still what I would recommend for limited company investments. Assuming you want to invest in stocks, bonds, ETFs that is. Glad you liked the blog!

Great Article,

Wondering anyone can help with this, I am trying to open an account provided LEI etc. and selected: Non-financial counterparties below the clearing threshold (“NFC-“)

But system asking me to “List up to three Financial Counterparty Types”, by giving drop-down option for selecting type (ex: Agriculture, IT etc.)

I wonder the same thing. I am going ahead with the last option: “other service activities”

The UK Interactive Brokers fee is 0.03% (no max cap in UK) versus Interactive Investor at £39.99 per month. So if you are investing a lump sum of £200k you are better at Interactive Investor.

It is a shame because in other countries Interactive Broker offers a cap, like 29 Euros in all EU countries.

Hey Andy, are you referring to the Interactive Brokers trading fees? The £39.99 is a platform fee on Interactive Investors, and IBKR don’t charge any for holding investments.

But even for trading fees, I believe Interactive Brokers would work out better than Interactive Investors, assuming a few lump sum investments per year.

So a trade of £200,000 at 0.03%, will cost £60 on Interactive Brokers vs £480 that you pay on Interactive Investor. And the II charges are recurring, the other one is a one-off only when you trade…

Hello, IB recently told me that it is a requirement to have LEI for EMIR for all LTD accounts even if we are just buying index funds. Are you aware of this change?

Hi Andrew, this has always been the case. If your company deals with securities then you need a LEI code. An index fund is a basket of stocks so you’d need one.

Getting a LEI code is quick and easy. See how to get a LEI code for your company here.

Hi Michael,

I joined interactive brokers via my ltd. Any idea how to work out the year end taxes ? Seems the platform does not provide anything useful, but a general statement.

Thanks