If you are looking to invest your company cash, this post explains everything you need to know.

Does your UK limited company have surplus cash in the business?

What if you could invest the company cash and earn an extra income?

Taking more dividend income can be very costly and banks pay zero interest these days.

How much money do you lose to inflation each year?

An average UK inflation of 2.9% means that £100,000 will be worth £75,000 in 10 years time. A £25,000 loss!

Wouldn’t it be nice to invest through your UK limited company?

Also, most companies are trading entities with a clear purpose. What are the risks of investing the company money?

Good news!

In this blog post, we will cover:

Contents

Can I Invest my Company Cash?

Yes, you can invest your company cash.

Limited companies can invest the business cash in several ways such as:

- Stocks and Funds

- Property

- Pension contributions

- Crypto

- Gold

- High-yield savings account

After a certain income point, investing your company cash is better than taking dividends.

This is because you save on income tax until you really need the money.

Let me explain.

As a company owner, you likely pay yourself in the form of a small salary and more in dividends.

Up to a total £50,270 income, it’s usually better to take the money home. You can then invest at a personal level after paying for your living expenses.

But what if your company earns more than £50,270? This leaves surplus cash in the company.

As years go by, this lazy money stays idle losing purchasing power to inflation!

You can take more income (and pay more tax) or you can invest from your limited company.

But if you cross the £50,270 income (salary, dividends, etc) then the dividend tax is 32.5%! And that’s after having paid 19% corporation tax already.

That’s a lot of tax. And yes, there is an alternative!

Investing from a limited company can result in huge savings compared to investing personally.

Otherwise, you might be leaving a lot of money on the table. More on that later.

Where can I invest my company money?

Your limited company can invest in assets like stocks, funds, ETFs, property, crypto, bonds and more.

It can also make pension contributions and buy commercial real estate.

Here is a detailed list of what a limited company can invest in.

1 – Stocks and ETFs

Your limited company can have a corporate trading account. It can own public shares like Apple and Tesla, ETFs and mutual funds.

There are many brokers offering limited company trading accounts.

My favourite one is Interactive Brokers.

IB is well-known, trustworthy and well priced. Read my Interactive Brokers guide for limited companies.

It should save you some time researching and signing up.

If you want to learn more about stocks and shares I recommend Tim Hale’s book Smarter investing.

Index funds are the pillar of my investing strategy and have worked very well so far.

2 – Buy-to-let Property or Commercial Property

Your company can invest in property. Owning real estate is a very profitable way to invest here in the UK.

A company can buy a flat or a house for investment purposes. You will collect rent while the property appreciates in value.

Note there are 2 challenges when investing in property through a limited company:

- Buy-to-let mortgages are more expensive

- Lenders want to see a separate company vehicle for this purpose

A Special Purpose Vehicle (SPV) is exactly that.

What is an SPV?

An SPV is a limited company whose sole purpose is to hold a property unit or a block of units.

Your company can lend money to an SPV which buys the property, as we will see shortly.

It keeps a tidy book which is what lenders want to see before giving you a mortgage.

Property can offer good cash flow if you can find an attractive investment.

Your company can also make property loans to developers and earn interest on the loan. Yields are 8-12% per year depending on the platform.

3 – Pension contributions

If you don’t make pension contributions from your company, you should definitely consider it.

Your company can pay into a director’s pension that grows tax-free. This is called an employer contribution.

The best part is that the money going into the pension is not taxed by corporation tax. It’s a win-win situation for both the company and yourself and a great way to secure your financial future.

A pension is much better than an ISA for limited company directors as the graph below shows:

Pensions are great but they are not accessible until pension age (57 years old from 2027).

Your limited company cannot invest in an ISA. You first need to take an income.

It might be better to split your company cash between pension and company investing.

Company investing is a good way to bridge the gap until the pension age.

In the meantime, you can access the limited company funds at any time without relying on future pension rules.

4 – Crypto such as Bitcoin

Your UK limited company can invest in cryptocurrencies like Bitcoin and Ethereum.

Love it or hate it, cryptos have made some people extremely rich and looks like they are here to stay.

To buy crypto from your limited company you need to sign up for an exchange offering a corporate account.

Some of them do, but the real challenge is finding a bank that allows the transfer to an exchange.

Gemini and Kraken are exchanges offering corporate accounts. Binance is great for trading if you can deposit crypto to it but has stopped accepting GBP transfers.

There are not many crypto-friendly banks, but Revolut, NatWest and Mettle rank higher on that list.

How much crypto should you own? Cathie Wood suggests a crypto allocation range of 2.8% (minimum volatility) to 6% (maximum returns).

5 – Private investments

Not all markets are public. Your company can own a stake in another company.

You might find such deals in your private network if a startup needs funding.

There are also platforms that offer private investments to limited companies such as Crowdcube and Seedrs.

6 – High-yield savings accounts (3-5%)

Thanks to the high-interest rates, cash can pay a high interest these days. Limited companies can hold cash in a high-yield savings account and earn 3-5% interest per year.

This is great. Other options include Money market funds, short-term bonds, or even ultrashort corporate bonds.

Check out the cash article above.

Now you might be wondering.

What are the risks of investing from my limited company?

If my company sells goods or services, can it do something completely different? Let’s find out.

Risks of investing from your limited company

It is definitely legal to invest from your limited company.

Most limited companies have a ‘trade’, selling goods or services.

For example, you might be an IT contractor or a doctor with surplus company funds.

Can your trading company make investments?

Yes, your trading company is allowed to make investments.

Investing directly from your trading company is cheaper, straightforward and simple. But this might not be the best way to do it.

It all depends on your goals and your setup.

These are the three reasons a trading company should not make investments directly:

- Risk of your company classified as a “Close Investment Holding Company”

- Legal separation between trading and investing

- Easier for tax purposes

1 – Risk of your company classified as a “Close Investment Holding Company”

This means 2 things.

i) Your Entrepreneur’s Relief is at risk. Investment companies cannot claim Entrepreneur’s relief. You cannot close down the company and pay only a 10% capital gains tax. You can, yet, close it down and pay 20% tax.

ii) The Corporation tax will go up to 25% in 2023. Read the updated Corporation tax guide for 2023 onwards.

Companies with less than £50,000 in profits will get a ‘small profits relief’ rate. This keeps the corporation tax at 19%.

But investment companies do not get the same treatment regardless of profit size. So your trading/investment company will pay 25% corporation tax.

2 – Legal Separation

If one company is in trouble, this should not spill over to your investments.

A buy-to-let mortgage, for example, should not put your trading company at risk.

3 – Easier for tax purposes

Separating the trading from the investing activities makes it easier for accounting.

The investment company is simpler and does not have any payroll or VAT obligations.

In the next section, we will see the different ways a limited company can structure its investments to overcome those problems.

How to Invest my Company’s Surplus Cash

In this section, we will introduce two ways of investing your limited company’s surplus cash.

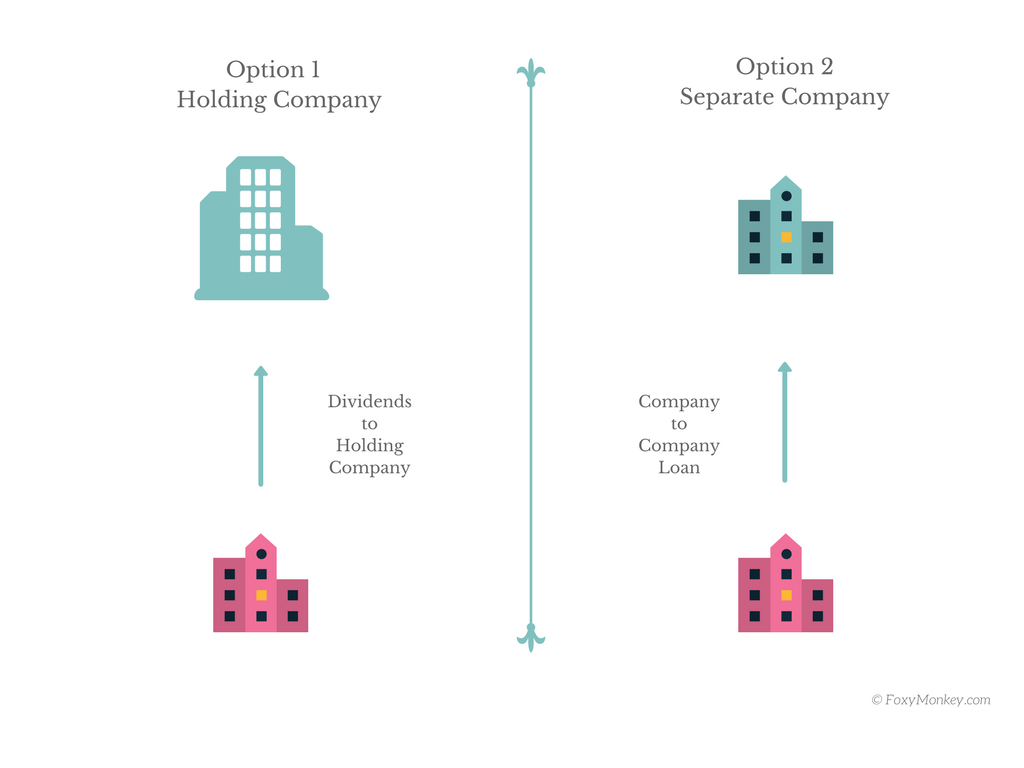

There are 2 tax structures that allow you to invest your company cash:

- Open a parent (holding) company and form a group structure

- Open a separate investment entity and make a loan to it

In both cases, you separate the trading from the investment activities.

The choice depends on your time horizon and your goals.

Option 1: Form a holding company group

In the holding company model, you open up a new company that owns your trading company.

The trading company transfers money up to the parent company in the form of dividends.

These dividends are between companies and in the UK, they are tax-free.

Your holding company can then make investments in several assets or start new subsidiaries.

The benefits of the group structure are:

- Assets ring-fencing (including intellectual property, computer equipment, cash etc)

- Can make the trading company more attractive for a sale

- Synergies between one or more companies within the group

- Better family tax planning and dividends distribution

- Inheritance (estate) planning

Option 2: Loan to an investment company

In the company loan scenario, you need to form a new limited company and make a loan to it from your trading company.

These are 2 separate legal entities and the loan needs to be under commercial terms. This means you need to charge interest on the loan.

The interest payment is not a dealbreaker since the net effect is zero!

This is because the trading company treats it as profit but the investment company treats it as a loss.

Generally speaking, the loan option is a quicker, easier to set up structure. It is suited for more short-term projects.

Choosing a tax structure is not easy. It’s one of the things you need to consider before investing your company cash.

This is why we have built a Company Investing Course and a powerful community.

The course includes tax and investing information as well as a Q&A with a Chartered Accountant.

If you are a business owner, you will find it incredibly valuable. Join us!

Is Company Investing Worth It?

As a company director, you should always take the first £50,270 of income.

This is the basic rate tax threshold. The income tax to pay is only £2,677.

But what if your company makes more? One option is to put some money in a pension.

But we lose access to it and we can only put so much into a pension.

So most people take the easy path of taking more dividends. Although this is convenient, it is also so costly! People pay so much in the name of convenience.

As an example, a £60,000 surplus cash would cost you £250,000 more in dividends tax over a 10 year period!

Don’t believe me?

Let’s compare taking extra dividends (32.5%) versus company investing.

Assume a £60k company surplus each year and 7% returns for both the company and personal investors.

As you can see, avoiding the upfront dividend tax gives us a nice £252,000 advantage. That’s even after paying the corporation tax on the company profits.

Copy my online Excel document (File -> Make a copy) and play with your own numbers.

At the end of the 10-year period, we can take an income from a much bigger pot. We can withdraw as much as we need, pay family members or invest in other business opportunities.

Speaking of family planning and inheritance tax optimisation, Finumus has written a great FAQ post on Monevator about family investment companies.

Overall, we saw why investing your company cash is so much better than taking profits. It’s also the reason most rich people operate through limited companies.

Final thoughts

UK businesses can invest their company cash and build real wealth. Your business can contribute to a pension, buy property, invest in shares etc.

This presents some risks to the trading business.

It is better to separate trading from investing activity for various reasons. We showed two different tax structures to do that.

Lots to consider but there’s real money to be made. It’s time to beat inflation and put the business cash to work.

Do you know a company owner with surplus funds? Share this post with them!

17 thoughts on “Invest Your Company Cash: Everything You Need To Know”

Thank you, Michael as always. This is really helpful. After applying for HMRC clearance on a holding structure, the outcome was unfavourable as the HMRC rejected the proposal. However, setting up an investment company and SPV for property was straightforward. I continue to read your insightful thoughts and interviews with different experts and learn from them. I must have listened to your interview with Andrew Craig so many times now and every-time I listen, I learn something new. Thank you for those.

One question- are there any reputable platforms that a Ltd company contractor can use to lend money to developers?

Thank you for your kind words, Zed. Sorry to hear you got rejected. Did HMRC provide any particular reason why?

There are some platforms offering UK development loans to Limited companies. It’s hard to find one that covers all 3: high yields, great management and long-track record.

People in the community talk about Crowdproperty. Caution is needed and you need to research on a case-by-case basis.

Edit: Removed a link as no longer relevant.

Thank you, Michael. HMRC position was bit illogical as they indicated that the reason they will not give clearance is because I should pay a dividend to individual shareholders under the current structure and then let them invest, which was not what I was looking for as you nicely summarised the negatives for this approach. I could have gone to appeal but for me starting investment was more important given the COVID and HMRC remote working last year. I also decided to speak with few good tax advisors, all of them ex HMRC, the alternative loan structure was preferable and straightforward option.

Thank you for development loan information. I would be hesitant to loan my hard earned income to someone if these platforms don’t have a long track record. I already have properties in SPV and REITS in my diversified low cost portfolio and may not need extra exposure to properties.

Hi Michael, great website.

I was reading the regulations on corporation tax payable on dividends received. It seems to me that in most cases (as long as the dividend paying company has paid tax on its profits and is based in UK or a country with a UK tax treaty) that dividend payments to a Ltd Co are exempt from Corporation Tax. This makes a big difference to my strategy for how to generate income, and would be a significant advantage for investing via my company. Am I correct, or have I missed something?

Thanks

This is indeed the case, Steve. Makes the dividend investing case very attractive for limited companies!

This is super interesting. What are your thoughts on a global stock fund vs global dividend fund? Which one would be better if you have an investment period of say 5-10 years?

After 2008 global trackers performed better than global dividend funds. But if we look at the entire period 1994-2023, the dividend fund came out ahead.

The comparison takes into account the corporation tax for limited companies. I wrote a post on global tracker Vs dividend fund for limited companies here: https://www.foxymonkey.com/dividend-fund-limited-company/

Hi Michael,

Really great and very informative website! I am also been thinking about this issue a lot recently as I am also an IT contractor with a large cash surplus sitting in my LTD!

I’m trying to look ahead and see what I would need to then do to draw down the money from this company. If after the next 10 years I have 120k in the investment company, which includes gains of 20k after CT, then how would you best draw down this cash and be tax efficient? As wouldn’t you end up still paying some tax in some way on this cash in any case?

hope that makes sense!

Simon

Hey Simon, a good position to be in! How you take out the investment gains depends on your future tax position and circumstances.

If you have no other income, for instance, one option is to take a £12,570 annual salary which can be deducted from the corporation tax the company will pay. That’ll also be tax free for you as it falls within the personal allowance.

In general, corporation tax will apply to the company and income tax will apply to you as you draw down more. Hope that helps!

Hi Michael,

Thanks for posting this!

Do you have any advice for info to provide while setting up a bank account for the holding company? Starling declined my application and I want to be careful before reapplying / trying someone else but feel a bit like I’m stabbing in the dark here.

Hi Alan, yeah Starling rejects holding companies, even for existing clients.

Other challenger banks might work.

The business banking question is one of the most frequently discussed ones in the course community. Frankly it’s a pain. Each bank has its own characteristics (SIC codes they serve, speed, what to say, FSCS protection etc). We have built some collective wisdom and you are more than welcome to join us by taking the course. It will launch again soon, including lifetime access to the community.

Hi Michael

Quick question, if we don’t make another investment company and just invest the money in our existing company and the returns are still far lower than our trading revenue (i.e safe low yield investments), would that be okay?

Hi Connor, trading companies can hold investments, yes. Most companies have some form of non-trading activity anyway (bank interest for instance).

But it might cause problems with your trading status if you do it in a big way. Losing Entrepreneur’s relief, business property relief and having more assets at risk of litigation. This might or might not be ok with you.

So yeah, it might be perfectly fine as long as you understand the risks and as long as it works for your company and your partners.

Thanks for the reply Michael.

Yes I suppose there is a lot of grey area for entrepreneurs relief (even if it will stay around). The thing that confuses me is the total assets for non trading operations description (I am an IT contractor so the only assets I have a cash pretty much but I would need to invest 50-70% of the spare cash to get any decent returns). Also the program might disappear in the future, do you have any experience applying for it?

I think for the moment I might just try and look at some fixed term deposits (1-2 year ones) as now it seems like a good time with interest rates going up and volatility in the stock market, but keen to here your thoughts.

It’s true, the rules for Entrepreneur’s relief keep changing. Even the name. It’s now called Business asset disposal relief. Who knows if it will be here a few years from now?

I have not claimed it, but I know people in the community who have done it.

Fixed deposits must be offering higher rates these days compared to last year. Not sure they’ll beat inflation, but at least you know what you’re getting 🙂

Great info thanks

None of my local accountants understand matters this complex

Especially this bit, which is important

Risk of your company classified as a “Close Investment Holding Company”

Legal separation between trading and investing

Easier for tax purposes

Don’t suppose you could recommend an accountant ?

Hi John, in my experience accountants want to do the bare minimum. A few accountants understand more complex concepts such as company investing but you need to find them and they still won’t have all the answers (brokers, bank accounts, professional contacts for buy-to-let etc.).

Happy to recommend one. I’ve sent you an email.