This article will show you how to earn the most on your cash.

Thanks to UK’s higher interest rates, you can make your cash work harder in 2024.

This article explains how Savings accounts work, Money Market Funds, Cash ISAs, Premium bonds, NS&I products, Short-term Gov Bonds, their rewards, risks and their taxes.

Contents

- Banks are not paying you the full interest

- 1. Savings Accounts

- 2. Cash ISAs

- 3. Premium Bonds: Feeling Lucky?

- 4. NS&I Income or Growth ‘Bond’

- 5. Money Market Funds: What are they?

- 6. Short-term Gov Bonds: Another way to play the high-interest rates

- 7. Ultrashort Corporate Bonds: Feeling more adventurous?

- 8. Mortgage interest: Earning Money by NOT paying it

- How much to keep in cash?

- Holding Cash is Exciting Again

Before we dive deeper, here is a summary of the best places to hold cash in 2024:

| Account | How much can I earn | Notes |

|---|---|---|

| Savings Account | 3% easy access, 4.1% fixed | Safe. Limited companies can open one too. Fixing your cash can earn a higher return than easy access but locks your cash away. Interest is taxed. Not great if you are a higher-rate taxpayer (but the first £500 is tax-free). No tax-free option if you earn >£125k gross |

| Cash ISA | 2.91% easy access, 4% Barclays ISA | Pros: Tax-free interest, FSCS protection. Cons: Eats up your Stocks & Shares ISA contribution. Requires locking your cash away to earn higher returns |

| Premium bonds | 2% (median) to 3.30% (average) | A safe, fun and tax-free way to save. Chance to win a million pounds like the lottery. Cons: Can only buy a maximum of £50,000 in premium bonds. Low median returns. |

| NS&I growth or income bond | 3.9% or 4% per year | Like a safe government bond but without price fluctuations. Decent yield but the interest is taxable. You lose access to your cash for the term. Point of no return after 30 days of buying it. |

| Money Market Funds | 4% – 4.5% (close to SONIA rate) | Earn high returns without locking your cash away. Expected returns around the Bank of England rate. Interest is tax-free if held inside a Stocks & Shares ISA. Cons: Not zero risk, but extremely low if you go for short-term money market funds of the highest quality. |

| Short-term government bonds (US) | 4.75% (changes with rates) | Highest returns but with some price fluctuation. 4.75% per year if held until maturity, about 2 years. Cons: Can lose money (or earn more!) if you sell before/after the fund’s average maturity time. |

| Ultra Short-term Corporate Bonds GBP | 4.60% | Highest returns but with credit risk. ERNS is a good defensive holding with a solid track record. But even in this case, companies can default in extreme scenarios (but didn’t during covid). |

| Mortgage interest overpayment | 4 – 6% | Guaranteed tax-free “return” on your cash by not paying interest on your mortgage debt. Can be very rewarding if your mortgage costs >3%. Can unlock better future rates because your LTV drops. Cons: You lose access to your cash until the next remortgage. |

Let’s dive deeper. By stating the obvious:

Banks are not paying you the full interest

Banks being banks…

The Bank of England rate was 5.00%, but my Santander bank account only paid me 1.98% (gross).

What gives??

No, this is not another ‘switch to this bank’ type of article. Neither is a reason to write a complaint to your high street bank.

We all know banks are here to make a profit and that’s exactly what they’re doing with my hard-earned cash.

They take my money, earn a 4% interest on it and then pay me just under 2%. They bank the difference.

That’s right. The Bank of England pays them to hold my money. Then it’s up to the commercial bank to decide what to do with my cash.

They can lend it out to mortgage buyers, issue a business loan or simply sit tight and earn the difference.

They are in the margin business, like my good old bookmakers. Consumers, as usual, are missing out.

Time to change that.

What if I told you you can earn the Bank of England rate at all times?

Or that there’s a much better way of saving cash?

Without having to switch to the latest “best savings account” every three months. Or lock your money for years.

1. Savings Accounts

Savings accounts are probably the first thing that comes to mind.

So they deserve an honourable mention.

Perhaps the easiest thing to do is to shop around for the best savings account to park your cash.

This savings account will pay you 3% per annum. Unlike high-street banks, they are quick to pass on the Bank of England rates.

However, the ‘Saving accounts’ approach has certain limitations:

- It’s time-consuming (opening an account, KYC, switching etc)

- The rates are not great (3% when the Bank of England base rate is 4%)

- Low limits for really high-interest savings accounts (e.g. 5% only up to £250 per month)

- Sometimes these banks are unknown

You could even boost your returns by locking your cash away for a certain time, say 1 year, and get a higher return. Think 4%.

You would lose access to your cash but fix your money and earn a higher interest. Withdrawals are not normally allowed in fixed-term saving accounts.

High Yield Savings Account for Limited Company

Limited companies don’t miss out. Limited companies can also earn between 2 – 2.6% p.a. for easy-access savings accounts or about 4% p.a. for fixed 1-year or 2-year deals.

See bank comparison sites like Moneyfacts to find the best bank accounts.

Not bad, especially since your money is 100% safe, assuming the bank is covered by the FSCS scheme. You are protected up to the first £85,000 per person per bank.

Check out also the Flagstoneim platform if you have £50k as an individual or £1m as an LTD company. They can offer better rates for a fee.

Problem is, of course, you lock your cash away, or earn a subpar interest rate.

The best easy-access account from “The Cumberland” offers 2.6%.

If you go for the fixed-term option, you won’t normally have access to your cash. Withdrawals are not allowed.

A happy medium (but a more limiting choice) is the Notice savings account. They pay slightly higher rates. But the bank asks you to give notice (usually 3-4 months) before you need your cash to avoid losing the interest you earned.

Do I have to pay tax on the savings account interest I earn?

Yes, you would have to pay tax on the interest you earn from savings accounts.

Basic rate taxpayers (up to £50k annual income) have a £1,000 tax-free interest allowance every year. Higher rate taxpayers (£50,000 – £125,000) have a £500 tax-free interest allowance.

The rest is taxed as income.

Limited companies have to pay corporation tax on the interest they make from savings accounts.

2. Cash ISAs

Cash ISAs are a type of tax-free product to park your cash. You can deposit up to £20,000 in a Cash ISA per tax year.

With Cash ISAs, you don’t pay any tax on your interest. But you trade the contribution you would have made into a Stocks and Shares ISA. And why would you?

Right now, Cash ISAs pay 2.9% for an easy access one, or about 4% fixed for one year with Barclays.

If you’re saving for a first home, consider a lifetime ISA. It pays you a bonus of 25% on your savings if you use it towards buying your first home or retirement. You can only open one if you’re between 18 and 39 years old.

Cash ISAs also benefit from the FSCS protection, £85,000 per person per bank.

Overall, even though savings accounts and Cash ISA are the most popular options, they often are a hassle to deal with.

It’s much easier to switch between funds in a stocks & shares ISA or in your LTD company brokerage account. This is why I like money market funds, as we will see later.

3. Premium Bonds: Feeling Lucky?

Premium bonds are another savings vehicle.

If you like a bit of ‘luck’ involved, Premium bonds are meant to give back an ok savings rate, tax-free!

You can invest a maximum of £50,000 in premium bonds. In total, not per year.

There is no tax to pay when you “win” a prize in premium bonds. There are no interest but “prizes”. You can even win up to £1m prize if you’re the lucky one.

The average earnings are 3.30% per year as per the NS&I premium bonds website.

However, most of the earnings are skewed by the few people who earn the big bucks. So the average is not a great metric of what you will earn.

With a £50,000 premium bond pot, you will earn about 2% per year as the median person, Martin Lewis calculator says.

The more you invest the higher the likelihood you will earn something.

Pros:

- Tax-free savings

- You can buy for your children too (up to 16 years old)

- Cash in anytime

- A fun way to save!

Cons:

- Not keeping up with inflation

- You might win nothing

- OKish average savings rate

Are premium bonds safe?

Yes! Premium bonds are issued by the National Savings & Investment (NS&I), a state-owned savings bank backed by HM Treasury.

I’d say they are as safe as the FSCS protection you get in your Barclays account.

4. NS&I Income or Growth ‘Bond’

NS&I offers two great savings products. They call them ‘bonds’ but they are more like a locked savings account:

- Guaranteed Growth Bond at 4% per year, fixed for 1 year

- Guaranteed Income Bond at 3.9% per year, fixed for 1 year

They are both one-year products.

You can think of the income bond as one that pays you monthly until the end of the term.

Whereas the growth bond will only pay you at the end of the term as a lump sum. Your initial money plus the interest.

Even though the NS&I products are called “bonds”, they don’t suffer from the ups and downs of your capital like a traditional government / corporate bond would.

Traditional bonds suffer from interest rate risk. If interest rates go up their price goes down (and vice versa). Unless you hold them until maturity.

But the NS&I ones don’t suffer from any price fluctuation. You are guaranteed to get your annual return at the end of term.

They are more like savings account in a bank.

The downside is that you cannot take your money out until the bond matures.

Pros:

- Good yield on cash

- Low starting minimum of £500 and max of £1m

Cons:

- No access to your cash before the end of term

- Interest is taxable😞

- You cannot buy these in any ISA

You have 30 days to change your mind after investing in these NS&I products. After that, you cannot access your money until the end of the term!

Honourable mention: If you are one of the lucky ones who hold the old NS&I inflation-linked bonds, you get your cake and eat it too! NS&I inflation-linked bonds were savings products where you could earn the inflation rate each year, without any capital volatility.

5. Money Market Funds: What are they?

Money market funds (MMF) are investment vehicles that aim to provide interest on your cash by holding cash and short-term debt.

They are used by pension funds, institutional investors and companies to manage cash balances.

MMFs pay investors the interest minus some fees. Their fees, however, are typically low. 0.15% per year or so.

The greatest thing about money market funds is that you can expect to earn around the Bank of England rate, automatically.

No bank switching hassle, no locking periods, and even no tax if held inside an ISA or a Pension.

Someone else (the fund manager) has the job of putting your cash in different places and paying you the interest minus fees.

MMFs are the safest instrument you can find in the investment assets spectrum, almost like cash.

These vehicles are not a new phenomenon. They have been around since 1971 and are much more popular in the US.

MMF won’t wait for a month or two until they pass on the Bank of England’s higher rates to you. I’m looking at you, Santander.

How much can I earn in a UK Money Market Fund?

A UK buyer of a money market fund will roughly earn the SONIA rate (Sterling Overnight Index Average).

This is very close to the Bank of England rate. SONIA is what the banks pay to borrow GBP overnight from other financial institutions.

It is the ‘risk-free’ rate, issued by the Bank of England.

At the point of writing (February 2024), the SONIA rate is 5.18% whereas the Bank of England base rate is 5.25%.

Money market funds could even beat that, as they make cash deposits longer than ‘overnight’.

For example, you can get 4.70% per year by stashing your money in the Blackrock Cash Fund. The 4% rate hike only happened in February, so as older deposits are redeemed, new ones should pay higher rates.

The Royal London Short Term Money Market Fund shows a 3.30% annual yield in its latest fund reporting document which is from December. It should now be closer to 4% given the interest rate hikes.

These yields fluctuate depending on the environment. But a short-term money market fund should pay rates close to the SONIA or Bank of England rate over time.

How to buy a UK money market fund?

You can buy a UK Money market fund from your investment broker platform. For example, you can buy MMF in a stock and shares ISA like Halifax Sharedealing or a general investment account like Interactive Brokers (click for my full review).

It is as if you are buying any other fund.

Now, let’s get to the real question: Are money market funds safe?

Given this is where I put my cash, are MMFs as safe as cash? How risky are UK money market funds?

Are Money Market Funds safe?

UK Money market funds are very low-risk but not zero.

Blackrock puts it at the lowest risk of the risk spectrum 1/7.

The Fitch Rating gives the Royal London cash fund an AAA rating.

AAA’ ratings denote the lowest expectation of default risk. They are assigned only in cases of exceptionally strong capacity for payment of financial commitments. This capacity is highly unlikely to be adversely affected by foreseeable events.

Fitch ratings

But regardless of what these institutes say, it’s probably better to look under the hood to see how the sausage is made.

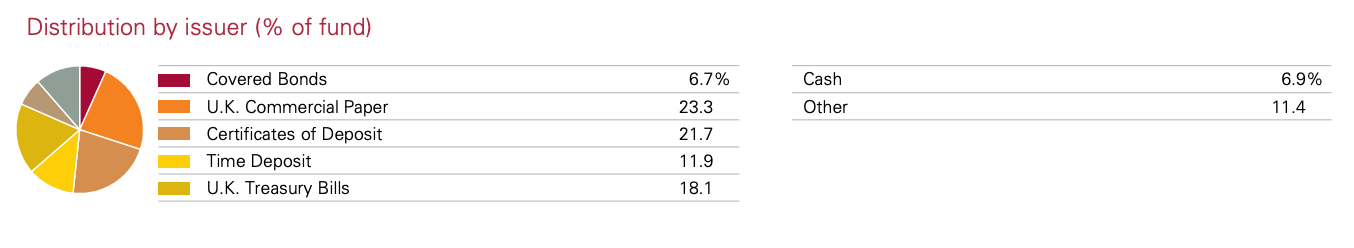

What do they do with our cash?

Here is Vanguard’s Sterling Short-Term Money Market Fund:

And here is what the Blackrock Cash Fund invests in:

Certificate of deposit and time deposits mean fixed-term cash deposits in other banks. These makeup more than 60% of the fund. This cash is held in other banks to help them with short-term needs.

The Financial Company Commercial Paper is a form of unsecured debt issued by corporations, usually banks, like UBS, NatWest and ING bank. So not exactly cash.

Asset-backed commercial paper is very similar but backed by an asset (not unsecured). A floating rate is again debt with variable interest. UK Treasury bills are very short-term government bonds.

So yeah, as you can tell these are not all cash deposits.

Maturity matters too.

Looking at the maturity tab, more than half of the fund’s deposits mature in less than a week. The Weighted Average Maturity is 52 days.

No, your money is not locked. You can get your money by selling the fund without any lock-in periods. But the fund rolls in and out of fixed-time assets as you hold it.

And finally, the credit quality of the issuer is in the ‘extremely strong’ category of A-1. The short-term credit ratings by S&P range from A-D.

Another thing I’m looking at is history and track record.

Have money market funds ever failed?

Since 1978, three US funds failed to return the full pot to investors. And even in these extreme instances, the value lost was negligible.

One money market fund went below its cash value in 1978. It lost 6% of its value. According to Wikipedia, it was not a true money market fund, because the average maturity of securities in its portfolio exceeded two years.

Then in the doom days of 2008, investors rushed for the exits. They stressed money market funds too, probably to cover margin losses elsewhere.

One US Money market fund, called the Reserve Fund faced a bank run scenario and was forced to liquidate. It distributed payments over the years and it eventually paid 99.1% of the money to investors.

In 2008, the US Treasury stepped in to prevent a run-on-the-bank scenario everywhere. It guaranteed the holdings of any public MMF that paid a fee to participate in this ‘insurance’ program.

It was a nice way for the US treasury to make money too.

In the UK, no money market fund has ever failed to return money to investors.

But even if you are happy to accept the low risk of losing any money, perhaps another question is: ‘Can MMFs guarantee I will be able to get my money back at all times‘?

And the answer is no. MMFs cannot guarantee daily redemption under all circumstances. For example, if a “run on the bank” happens to a fund it cannot guarantee same-day liquidity.

The fund might ‘gate’ them.

Part of the reason is that some of its assets are fixed weekly or monthly. Regulation is there to ensure the proper operation of the fund so that investors actually take all their money back. And that’s a good thing.

During Covid, some MMFs faced increased selling from investors. They didn’t, however, lose any money or prevented any selling.

I’m inclined to say holding cash in a money market fund is extremely safe. But not as safe as the 100% guarantee you get from your bank’s savings account.

Having said that, the FSCS protection DOES apply to UK-domiciled Money market funds, if the provider fails (e.g. BlackRock). So you would get £85,000 per person per provider (not per fund).

As always, the devil is in the details.

Money market funds are not all made equal. For the safest option, you should look at Short-Term Money Market Funds. These are regulated to hold only the highest-quality debt and weighted average maturity under 60 days (see FCA guidance 2022).

See also the four MMF categories here. Basically, the Standard Variable MMF is the more relaxed option that I would avoid. That’s because it allows for assets with a maturity of up to a year. None of the ones I mentioned here is SVMMF.

MMFs are regulated and have certain rules to avoid putting too much cash in one institute. For example, an MMF shall not hold more than 10 % of holdings issued by a single body.

For example, the Royal London Short-term Money Market Fund has a duration of approximately 20 days. The Blackrock Cash Fund has a Weighted average duration of 52 days. Both are Short-term Money Market Funds.

If you want to torture yourself as I did, you can read more about the European MMF regulations or the more interesting Resilience of Money Market Funds paper issued by the FCA in 2022.

Best UK Money Market Funds

Here are the best short-term UK Money Market funds for UK investors, sorted by highest yield.

- Blackrock Cash Fund, 4.44% yield, 0.24% fees

- Royal London Short Term Money Market Fund 3.30% yield (December 22)

- Legal & General Cash Trust, 3.10% yield (December 22)

Note that the Royal London and the Legal & General funds have not updated their yields since December. They should be generating higher returns by now, as shown in the below section.

The Blackrock Cash Fund (Class A dropdown) started in March 1990! This gives extra credibility.

It has been through the Dotcom crash of 2000-2002 and the Great Financial Crisis of 2008-2009 without a blip.

Can you guess where the zero-interest-rate policy started? 😉

Here’s how to find the Best UK money market fund yourself:

How to find the Best UK Money Market Fund

- Go to this Morningstar page: Morningstar Financial Research, Analysis, Data and News

- Select Morningstar Category GBP Money Market – Short Term

- Click Short Term Performance Tab

- Sort by highest 1-month return

- Filter from the top, the highest-yielding GBP money market fund

Here’s what it looks like.

For example, the Blackrock Cash fund tops the list with a 0.37% 1-month return. That’s 4.44% per year.

It’s also top in the 3-month return, behind the Blackrock Cash fund.

Because these funds have cash deposits that are claimed in less than 60 days, the 1-month and 3-months are the best indicators of what the fund will pay in the future.

Notice the difference between the 6-month return of 1.39% (annualised: 2.78%). That’s because the rates were much lower back then. With current rates at 4%, a 1-month 0.37% return is a 4.44% annual return.

Going earlier than 3 months will show returns when the interest rates were 1-2% which would distort the current picture.

The good thing is the money market funds compete with each other to give us the best outcome.

How to calculate the Money Market Fund’s actual yield

Finding the annual yield for a money market fund is challenging.

Why can funds not report the yield to maturity at all times?

Part of the reason is the interest is variable. So they cannot estimate what they will get back down to the penny.

In the Morningstar dashboard aboard I extrapolated the annual returns from the past return. This works ok, but it’s not 100% accurate.

Some funds, like the Royal London one, report an annual yield, but that’s the past 12 months one. In a variable interest rate environment, this is not useful.

At least BlackRock gives a daily yield. If you average it out for a week or two, this will give a good estimate of what the fund pays out. Assuming that every day you reinvest the amount, the annual yield is actually slightly higher.

The 12m trailing yield is almost a worthless indication of this year’s expected performance because the rates have moved so much in between.

How are money market fund payments taxed?

UK Money market funds pay interest that is taxable. If you hold money market funds inside an ISA, they are tax-free.

If you buy a money market fund in a general investment account, then you would have to pay income tax on earnings above your personal savings allowance.

Basic-rate taxpayers have a £1,000 tax-free allowance before they pay any interest though. Higher rate taxpayers (40% tax) have a £500 tax-free allowance on the interest.

The Money market fund payments are of interest type, not dividends. Therefore their tax will sting in a general investment account. 20%, 40% or 45% depending on which tax band you fall into.

Sorry, no tax-free interest for additional rate taxpayers (£125,000+ in gross earnings from April 2023 onwards).

Limited companies would have to pay corporation tax on the interest they earn from money market funds.

You can deduct other expenses or investment losses against your corporate profits.

Bottom line – Money Market Funds

Use money market funds to earn a decent yield on your cash, like banks do when they lend each other money using the interbank SONIA rate.

Money market funds are not 100% risk-free. They are still an investment, of very low risk.

I would put the money market funds risk below bonds and equities but above cash.

They are meant to hold, not grow your capital after you consider inflation.

UK MMFs are FSCS protected if their provider fails, up to £85,000.

Use Short-Term UK-domiciled Money Market Funds to eliminate as much risk as possible but also earn a reasonable yield that beats your bank.

Choose reputable providers with a long track record. For example, Blackrock is the top asset manager with $10tn assets under management. The fund’s track record matters too. The fund existed since 1990.

Money Market Funds can be particularly useful as a higher-rate taxpayer or for holding cash funds in an LTD company. Most FTSE 100 companies use them by the way.

In my view, my 3 months emergency fund should always be in a bank account. But I keep some of my cash for short-term goals in UK short-term money market funds.

The yield is worth the (very low) risk to me. Easy access, solid track record, no switching hassle, and tax-free advantages. It is one of my favourite choices.

6. Short-term Gov Bonds: Another way to play the high-interest rates

Short-term government bonds can provide a good balance between getting a decent yield exchange for some price fluctuation.

The UK or US are extremely unlikely to default on their debt. So you will get your money back (zero credit risk). From a credit perspective, it’s as safe as the FSCS protection!

Your future money might not be worth as much as today though, due to inflation. But this article is about Cash, and you know that already.

How much can you earn in short-term gov bonds?

Take the US 1-3 years Treasury Bond IBTG ETF. It yields 4.70% per year and the US gov bonds are hedged back to GBP.

Foreign bonds have currency risk (e.g. you hold dollar bonds). But some bond funds, like the IBTG above, are hedged so you avoid the currency risk.

The Weighted Average YTM is what you care about here. This metric shows how much you will earn if you hold the fund to its maturity, which is 1.90 years as per the Weighted Avg Maturity metric.

The fund bonds were bought at different times and mature at different times (1-3 years). The Weighted Average YTM takes all of them together and shows what the fund yield would be if you were to hold the fund for its average maturity.

-> Sell it earlier and you might make a bigger profit than the yield if US rates have moved down.

-> Hold it for longer and you might make less money if US rates have moved up.

For example, in the zero rate environment pre-2022, bonds got hammered due to the quick spike in interest rates. Now interest rates are already high and these short-term bonds are way safer from rate rises.

So here’s your guaranteed 4.70% per year backed by the US government and no currency risk. Assuming you hold it for about 2 years.

There’s an even shorter duration fund that holds dollar bonds with 0-1 year maturity, unhedged. IBTU pays 4.76% per year and holds US gov bonds with 0-1 year maturity.

However, this one is not available in ISA/SIPPs. I could buy it in my limited company account using Interactive Brokers.

Here is an Invesco Invesco US Treasury Bond 0-1 Y UCITS ETF (LON: TIGB), yielding 4.76% per year, 0.5 years maturity/duration, that you can hold in an ISA, SIPP or a limited company. Thank you, reader George for pointing that out!

If you prefer the UNhedged version of holding short-term dollar bonds, you can go for the equivalent TREI Invesco US Treasury bond 0-1 UCITS or the PR1T Amundi Prime US Treasury bond 0-1Y UCITS ETF DR – USD.

The IGLS iShares 0-5 years UK Gov bond ETF caught my eye too. The difference here is that it invests in UK government bonds only, not in the US. But the average maturity is 2.5 years, so not quite short-term. Nonetheless, it’s an option if you don’t mind the longer maturity profile and only want to trust the UK government.

Other notable mention:

- XSTR Xtrackers II GBP Overnight Rate Swap UCITS ETF. Tracks the SONIA rate and invests in short-term UK bonds.

- CSH2 Lyxor Smart Cash – Tracks the SONIA rate and is actively managed but low fee 0.07%

7. Ultrashort Corporate Bonds: Feeling more adventurous?

If you’re feeling more adventurous and want to take more risks for a higher yield, have a look at ERNS.

ERNS is a corporate bond fund with a very short duration (3 months) in GBP currency.

Its expense ratio is 0.09%, so very low.

It invests in industrial, financial, and utilities bonds as well as government-like ones. Its holdings are defensive.

For example, its top 5 holdings are

- European investment bank bonds,

- International bank for reconstruction and redevelopment,

- Bank of nova scotia,

- KFW and

- Nationwide.

The yield to maturity is 4.60% per annum and the 0.34 duration makes it extremely resilient to interest rate moves. In March 2020 it went down by only -0.4%, temporarily.

However, we are talking about corporate bond funds now, and it’s an entirely different profile from cash. Even if ultrashort, you are taking credit risk and companies like banks can always go bankrupt.

The past 10 years have been smooth sailing despite Covid (-0.4% in March 2020), Brexit, Ukraine etc.

The ultrashort maturity profile combined with its defensive holdings and good track record made me include it in this post.

Even though this is a defensive option, it cannot be compared with cash in the bank. It has a higher risk profile, but it’s worth considering if you want the extra yield.

Choose the UESD if you prefer the ESG option of ERNS.

Another one to check out is JGST by JPM which pays dividends monthly (thanks Neil). So it might be more suitable outside an ISA or when investing as an LTD company.

A slightly riskier option to ERNS is PIMCO QUID ETF.

8. Mortgage interest: Earning Money by NOT paying it

That’s right. Instead of saving your cash in an account, consider putting them into your mortgage account instead.

An extra pound that is NOT going towards your mortgage interest payments, is a tax-free gain of equal measure.

So if you make a £10,000 overpayment and your mortgage interest rate is 4%, that’s £400 savings every year.

Now that mortgages are anywhere between 4-6%, it’s a great way to save. Again, tax-free!

Sometimes, it can be even better to pay down the mortgage than invest or rather than hold bonds.

If your bond is paying 2.5% and your mortgage interest is 3%, you could make an extra mortgage payment in exchange for locking your money away. A bond is more liquid than a mortgage.

The extra mortgage payments are not only helping you ‘earn’ the interest rate, but also unlock better rates when it’s time to remortgage. This is because your future loan-to-value will be lower.

Important: Check for mortgage overpayment extra charges. Many mortgage providers penalise you if you make overpayments above a certain threshold. We are their assets after all, and they want us to continue being so!

That was a much-needed overview of all the best places to hold cash in 2024. But how much cash should we keep?

How much to keep in cash?

We, humans, like cash because it gives us a feeling of safety. So this question can be very different because psychology and emotions play a big role here.

What works for me might not work for you.

However, as long as you have a good emergency fund then there is no reason to keep hoarding cash.

Cash is almost guaranteed to lose out to investment assets like companies and housing over the long term, for the simple reason: inflation.

Personally, I keep 6 months of living expenses in cash. The rest is invested.

Cash, however, is not just for emergencies. For example, you might have a certain life event coming in two years, like buying a house, going on a world trip, or funding a new business.

I’d put these life events in different buckets and keep funds in cash for anything less than 3 years. So instead of keeping it in Barclays at a 0.6% rate, try one of the above products.

For goals longer than 3 years, you can do some liability matching and match certain investments.

Perfect is the enemy of good. Therefore, don’t overthink it because the perfect asset allocation only exists in hindsight. The longer the timeframe the more risk you can afford to take.

One starting rule of thumb for investing is “Place 120 minus your age in aggressive assets and the rest in defensive assets”.

Holding Cash is Exciting Again

This article summarised all the best places to hold cash in the UK in 2024.

UK taxpayers can earn around 4% in various ways. In most cases, risk-free and tax-free too.

We suffered a period of zero interest rates, where governments printed money and assets were inflated. Previously, this rewarded investors and punished savers.

Looks like with higher interest rates come some relief for those who want to see some yield on their cash.

With high inflation, holding cash is not a great situation to be in, but at least you now get something back.

High inflation is the reason I am not changing my investing strategy unless cash returns at least 8%.

What about you? What do you plan to do with your cash?

Thanks for reading.

Are you a business owner? Then check out the Company Investing Academy and find out how to best invest your business funds.

Join 200+ business owners who learned how to build wealth and supercharge their businesses.

16 thoughts on “Best Places to Hold Cash in the UK in 2024”

Great post. I had not considered MMF since I held a 10k position in a company pension fund for much of the 2010s, waiting for the markets to drop. That position ultimately lost a few % over those years, perhaps because the provider fee ate into the tiny returns. I now have a SIPP and ISA with not insignificant cash positions (again waiting for more opportune times – I don’t suggest following my strategy!) that pay zero/negligible interest. MMF at these higher interest rates would appear to be a better bet this time round.

Hi Andrew, shame you sat in cash in the 2010s. It was a great time to be invested.

Indeed, Money market funds have now come back for good. But even some pensions could be paying interest on cash these days. I just received a newsletter from BestInvest. They will start paying 3.10% on cash. Not as good as MMFs but not terrible either!

Very interesting post thank you Michael.

What your thoughts about JGST? It’s an etf that is invested in ultra short duration bonds, debt etc. I think it might be quite similar to the MMFs you describe EXCEPT it pays dividends rather than interest so the tax issues may be lower for higher rate tax payers. Yield to maturity is nearly 4% and duration of holdings is less than 4 months.

https://am.jpmorgan.com/gb/en/asset-management/adv/products/jpm-gbp-ultra-short-income-ucits-etf-gbp-dist-ie00bd9mmg79#/commentary

Thanks, Neil, great stuff. I have included it in the list. Another bonus is it pays dividends monthly, which is attractive.

JGST has about 25% in corporate bonds in banking, so I’d say it sits somewhere between an MMF and an ultra-short-term corporate bond fund.

Very well constructed article that would allow even the least experienced to understand the options discussed.

I am glad you liked the article, Mark. Thank you.

Hi Michael,

Fantastic article!

You really convinced me that MMT is a good option to consider.

Btw, not sure if you are aware but Interactive Brokers offer good interests on Uninvested Cash Balances

https://www.interactivebrokers.co.uk/en/accounts/fees/pricing-interest-rates.php

Currently up to 3.404% for GBP and 4.070% for USD balances.

Not bad for doing nothing.

Oh nice, thanks for sharing that Ila! Interactive Brokers is a really decent option. Typically investment platforms don’t offer anything on uninvested cash.

Do you know how to find BlackRock (or royal london) for LTD on interactivebrokers? I can’t find any with GBP in IKBR.

IBKR does not do mutual funds well, and many money market funds are of this type, sadly. There are some ETFs that you can consider. Two that track the SONIA rate: CSH2 Lyxor Smart Cash and XSTR by DWS/Deutsche Bank. Also, the above short-term government and corporate bond ETFs: IBTU, JGST, ERNS.

The search works well if you use the tickers (e.g. CSH2) on the mobile app.

Or you can just leave cash on IBKR and tearn interest.: 4.33% USD, 3.3% GBP, above $10,000 or so (as of today April 13th 23′). https://www.interactivebrokers.com/en/accounts/fees/pricing-interest-rates.php

XSTR domiciled in Luxembourg and distributes up to 4 times a year. Have you found the dividends to be exempt from Corporation Tax ?

Can anyone advise what is the difference between the Blackrock Cash Fund D ‘Acc’ and ‘Inc’ funds?

Also, how is the best way to monitor performance in terms of making a decision to step back out of MMF’s? Is it best to keep an eye on the SONIA rate, as the fund (using the aforementioned Blackrock Cash Fund D) isn’t itself advertised at a particular % return?

Hey Dan, no real difference between the Inc and Acc funds, other than one pays the income to the investor (Inc) and the other one re-invests it automatically.

SONIA and the Bank of England rate are good benchmarks for MMFs performance. The performance might lag a bit, depending on the duration of the investments they hold.

Thank you Michael, for laypeople such as me, would you mind summarising the pros and cons of paying income to the investor (i.e. Inc) and automatically reinvesting it (i.e. Acc)?

Hey Dan, it really depends what you plan to do with the income the fund pays.

If you plan to re-invest it, then the Acc fund type will do it automatically for you. It will save you time and transaction fees.

If you choose the Income type, your ISA provider will pay you the cash in the account. You’ll have to do the buying yourself in order to re-invest it. I guess it’s a good feeling to receive the payment in cash, but that’s just a behavioural win :)

Does that make sense?

Thank you Michael, that makes complete sense and points me to the ‘Acc’ as the right fund type for me, much appreciated :)