This is the first post of my Property Partner experiment series. I will be investing £10,000 a year via the Property Partner platform over the next 5 years.

I always wanted to own property as part of my investments. But I was always put off by the hassle that comes with it. Have a high deposit, submit lots of documents to get a mortgage, find tenants, a good estate agency, maintain the property, the high fees and taxes that come with buying/selling… And the list goes on.

Especially now (2018) that London properties have appreciated so much, I think there is little room for growth in the next 5 years ahead.

Areas like Manchester, Liverpool, Birmingham, aka The “Northern powerhouse”, are probably better positioned for capital growth and higher yields. Personally, I have

To be honest with you, I have not solved that problem but listening to what others say, you have to do the work and build a network of people. Post on property forums that you’re looking for certain skills. Call local agencies, visit occasionally etc. The final reward is there, but it’s a hassle, which is why I have avoided remote property investing so far.

However, I think technology is changing this. I recently started investing via Property Partner by buying a small share in properties there. They do all the work for a 2% fee – sourcing, letting, ongoing management, and you own shares in the property. They pay rent (dividends) monthly and pay the capital growth part as well if investors want to exit.

I find the concept interesting, and although it has many restrictions (you don’t decide how to furnish it, who the tenants are etc) I see lots of advantages too. For example, the option to invest 20% in 5 cities, instead of 1 property in a single city. Liquidity is another – the option to sell your properties anytime in the secondary market to other investors. And obviously avoiding all the buy/sell hassle which is why I didn’t invest in remote property in the first place.

I fully support the modernisation of investments through technology. The world moves on, so the archaic 2-month buy-to-let buying process should evolve too. Airbnb, RateSetter, Uber are just examples of old systems (hospitality, taxi hailing, loan matchmaking) that needed a disruption.

What is Property Partner and why I’m choosing it

In a nutshell, Property Partner is a platform where you can buy and sell shares of properties around the UK. They do the paperwork, find tenants, collect the rent and pay it out to investors. They also welcome investors from abroad.

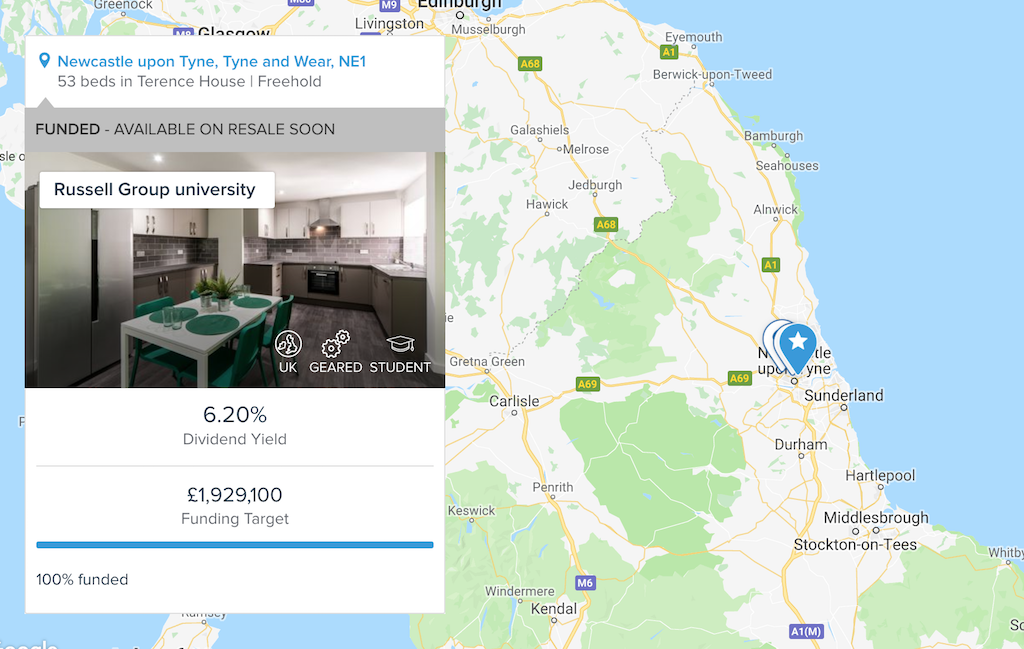

So new deals come up that need funding such as this one:

As you can see this is a student accommodation of 56 units and seeks £1,929,100 in funding (51% LTV). So people can allocate money towards this deal. Once the fund target is met the property is bought.

The 6.2% on the right is the estimated net rent per year. The total return will probably be higher since we haven’t accounted for the (unknown) capital growth from the property appreciation over time. According to PP

For the 12 months ending Sept 2017, CBRE’s PBSA valuation index showed a total return of 11.9%, outperforming the IPD All Property Index of 9.5% over the same period. It also demonstrated strong rental value growth at 4.1%.

But how do I know the property is worth that much? Turns out independent RICS valuations set the property price and Property Partner try to strike a deal below market value. Since they’re buying in bulk they can negotiate harder.

If you don’t want to DIY you can invest in their managed investment plans. At no extra cost, one can buy a certain characteristics portfolio monitored by PP if you invest a minimum of £5,000. But there is no minimum investment otherwise.

I’ll take up the challenge and try to beat the managed plans by investing solo. I’ll probably lose to the machines… and I won’t blame you if you decide to go for one of those plans. You’ll probably do better.

Do we really own the property?

A new special purpose vehicle (SPV) is formed for every deal that owns the property. According to how much each person invests, they own the equivalent shares in this company.

Therefore, we collectively own the property itself. But that doesn’t mean that we have to collectively make decisions for when to sell (coming up…).

The rent is paid in the form of dividends by the SPV which is why you see “dividend yield” instead of “rent”. If you, like me, are investing via a limited company, dividend payments are music to our ears. They’re tax-free :)

What I love about each deal, is that you can see a clear breakdown of the purchase price, rent, costs (mortgage, sourcing, management) including void periods and taxes. It’s quite transparent.

The first question that comes to mind is this: What if they don’t pay the rent? So I asked this question to the PP guys and here’s the response:

We’re experienced professional landlords, working with carefully chosen third party professional management firms and utilising economies of scale to further improve efficiency. To date we have not underpaid a dividend. If investors ask us for an individual property we can provide an answer as to how many units are let.

Faraj Jabbour, Property Partner

Obviously, you cannot know what will happen in the future but a solid track record is always a good sign.

I confirmed this by looking at the property stats which they openly share in their “Open House” publications. Looking at the one from June 2018, I can download the historic valuation and dividend yield BY PROPERTY!

This is a huge Excel file that for spreadsheet nerds like me is gold. You can plot trends, draw graphs but actually, most of this info can be found in every property online anyway. I highly appreciate the transparency though. If I am to invest serious money here, I’d like to have this sort of detail if need be.

My Property Partner Portfolio

Each person is different. What looks like a bargain to me may look like “bag holding” to someone else.

Before I invested there I asked myself: What do I invest for? High-income? Capital growth or a blend of the two? In such an ultra low interest-rate environment, high yield is amazing. Especially when knowing that Property Partner hasn’t missed out on any rent collection.

But most of the returns in property, historically, come from capital growth. In other words, rent is good, but property appreciation is what makes us the big money. If mortgaged, the gains (or losses!) are boosted.

However, because I chose to invest as a limited company (as opposed to an individual) the rent in the form of dividends is tax-free! Therefore it makes sense for my strategy to lean towards tax-free income while leaving some room for taxable capital growth as well. Let’s cut to the chase.

Whoah! What a Landlord eh? Better not tell the government!!

As you can see, I’ve split my investments between Manchester city centre, Greater Manchester, Sheffield, Warrington and Newcastle. I’m also bidding the rest £2,000 in Liverpool City Centre and Birmingham. And why not! London prices are dropping while midlands rise 6% in a year.

I believe with projects such as the HS2 and the regeneration that’s going on in the north, these are the areas that will greatly benefit. The government is making efforts to advance those cities.

Also, because of the fact that London has appreciated so much recently, these cities have lagged behind and have room to grow. This seems to be the opinion of property experts (hi Robs): Episode 240, Episode 164.

If I had to invest in property using a traditional mortgage, I’d probably need a lot more money to start with. I’d also lack the diversification of investing in 5 different cities.

I bought the Manchester property at an 8% discount to the latest valuation. In the Resale market. Oh yeah… I forgot to mention the most important thing. The Resale market!

Buying and selling property in the Resale market

One of the reasons I decided to go with Property Partner is because I have the option to buy and sell already funded deals. This amazing feature allows me to bid on properties lower than their estimated value and immediately benefit from a below-market-value deal if other investors want to sell

Additionally, I don’t have to wait until a Primary market deal comes up. I can sign-up and start investing immediately. I can also sell my investments to other investors early without having to wait the full 5-year period.

However, when trying this feature I found that the bid-ask spread is sometimes high. So existing sellers want to sell high and potential buyers to buy low which makes for a stagnant market. However, you can sort properties by the bid-ask spread and by discount in the Data View and then go for the ones that are selling at lower values AND have liquidity. That’s what I did!

Here’s how the Resale market looks like. Pretty much like any trading exchange.

So you know what the latest RICS valuation is, and you can bid well below that. There are properties that trade at a premium, and others that trade at discounts.

An awesome feature I “discovered” is that your money is not tied up when bidding for properties. That way, I can bid £1,000 for all 10 properties I want to buy at lower prices, without having to have £10,000 in cash. All I need is £1,000.

There’s an additional 0.5% stamp duty tax for buying shares in the Resale market. I don’t really care much about that because the discount rate will compensate me for buying in the Resale market.

Risks

What if Property Partner goes bust?

This is one of my worries. Similar to other platforms, I found they have a contingency plan. Of course, I wouldn’t want to see that take place.

But in the worst case, an alternative property manager is scheduled to take over. SPVs will be unaffected and investors will continue to own the properties as before. That’s because each property is ring-fenced from the assets and liabilities of Property Partner. See further info here.

What if people don’t pay the rent?

You simply don’t get paid. It’s, however, comforting to know that 5 years in the market they have never underpaid on dividends. I guess there is a lower risk in those multi-unit buildings.

The risk of voids diminishes as the number of units increases. This makes sense, as percentage-wise even a single void would be catastrophic in a 3-unit development but not so much in a 50-unit one.

Brexit drives house prices down & interest rates go up

With the Brexit madness at its peak, I’m surprised housing has proven so resilient as an asset class. But there’s always the risk that Brexit will drive prices down. If interest rates go up then mortgages will get more expensive which will eat up our returns.

Risk of buying mortgaged properties

This goes without saying, but if you leverage using a mortgage your gains

Final words

I must admit that I learned all these by reading the vast knowledge base and exchanging emails with the Property Partner team. They were quite responsive and I was impressed they were answering all my questions in detail before I invested a single penny.

To me, that’s a good sign of a platform that respects customers. Another good sign is the excellent rating on TrustPilot. They’re also authorised and regulated by the FCA.

I told them I’m considering investing serious money and they invited me to one of their events. So I went and met part of the 20-people team along with other investors. Property Partner also support ISA investments for their development loans part. Faraj from the team was very helpful and knowledgeable. I mentioned Foxy Monkey and he gave me his contact details to pass on to those interested

So overall first impression is very positive. Time will tell.

Initially, my passive investor instinct was shouting at me. 0.7% to 1.2% annual fee? Are you serious?

But then I thought that’s a bargain considering I benefit from their expertise, getting below market value deals by buying in bulk and diversifying in multiple cities. In fact, I’m quite happy with the pricing model for investors that want to put in more than £10,000. Plus there is no minimum investment amount.

Read my review on the Property Partner fee structure

My strategy going forward will be to buy good deals in the primary market. I saw that good primary deals can sell for 10% or higher in the resale market just after being re-listed. Of course, one can get good deals in the resale market, so I’m exploring low bidding there as well.

My plan is to write an update every 3-6 months and occasionally monitor my Property Partner portfolio. There are deals that come up such as new development loans (10%+) they recently started. So stay tuned!

By the way, Property Partner is currently offering a 2% bonus if you invest £10,000 or more. So a nice little £200 extra for me to invest :)

Disclaimer: This is not investment advice. There is risk involved in investing. As always, do your own research. Property Partner did not pay me to write this experiment. If you, however, become a client through my links then I will receive a reward at no extra cost to you (and thanks!). You can also do the same; they operate a “Refer a friend” scheme.

32 thoughts on “The Property Partner Experiment – Q4 2018”

Hey Michael

This is a very interesting read, thanks for the thorough review. Like you, I am too very against investing property because of the amount of capital outlay and involvement required.

Whilst it looks like investing with Property Partner would alleviate many of these issues, what is the benefit of investing with them as opposed to a globally diversified REIT?

Very good question. I actually had a REIT section which I removed in the end as the post is getting too big!

I think the main difference lies in the size of assets under management. REITs focus on bigger developments like leisure parks, shopping malls and commercial deals. Property partner deals, on the other hand, are between £1m to £3m with a higher focus on residential properties and PBSA.

Then on PP you get to choose the deals. You have a more active role. I particularly like the fact I make my own choices so I have a bigger say on the final outcome.

Of course, I’d expect a globally diversified REIT to be more diversified than a UK Property Partner portfolio. But imho UK property offers some great qualities to investors.

Cheers,

Michael

Hey Michael

Thanks for another informative article !!

This is interesting as I am looking for regular returns with easy exit, if need be and it meets both the criteria.

Can I make this type of investment via my limited company which primarily trades in IT related business? Or will I have to create another SPV specific to property or investment? If so, it may not be very lucrative, specially if I am starting it with small investment like £10k and incurring additional accounting expenses.

PS – I am new to this and still in exploration mode, so please pardon me if my queries are too naive :)

Hi Kavita, some people say you can invest directly from your IT company but it has to be a small amount compared to your annual turnover and assets (<20%). Now, this is a grey area and I'm not an accountant.

Probably you've already seen the “How to invest your company profits” article. The comments may help.

Hello Micheal,

I’ve been using “bricklane” for around a year and the returns have been poor. This company looks a lot more promising. I would be interested in a comparison between a few of the best companies offering this type of property investment.

Cheers,

Llyr

Thanks for commenting, Llyr. I’ve not heard of bricklane before. Interesting… there are many companies out there doing property crowdfunding. Property moose is another one.

Why were you disappointed though? Are the expected returns low or you didn’t get what you were promised?

Personally, the reason I picked Property Partner is because of the quality deals they offer. There are not many but quality beats quantity. Another reason is the secondary market. Only time will tell!

Doing the math, after six months investing the return on my £1000 (testing the water) has been £1,009.62 – 0.96% to date or Annualized 1.93%. There’s a 2% platform fee which took my initial starting investment down to £990.

Bricklane advertises with “Choose from two portfolios with 7.5%+ annualized performance since launch.”

I may have stumbled on a very bad six month period. If things don’t improve I’ll have to give Property Partner a try.

Even in a bad period, I’d like to see the rent come in. So far, so good with PP. I’ll provide another update in the next 3 or so months!

Hi Michael,

Nice article, thanks. However, I don’t agree with one point you make: “Areas like Manchester, Liverpool, Birmingham, aka The “Northern powerhouse”, are probably better positioned for capital growth and higher yields” – Saviills recently published in their blog (https://www.savills.co.uk/blog/article/224467/residential-property/interactive-map-uncertainty-and-mortgage-constraints-to-slow-five-year-house-price-growth.aspx) that prime central London would outperform so called “The northern powerhouse”. I understand that one should spread the risk and have different properties (in different locations) across the portfolio – so perhaps, 30% in Central London and 70% in the north would be a good compromise?

Thanks, Vladikis! London is really one of the best places to invest. The fundamentals are there: demand, transport links, big businesses, etc. In my humble opinion, although growth will continue to occur, it will underperform the north.

That’s only because the price for a house for investment purposes is really high. Very low rental yield and prices being 14x the average wages. historically that’s at an all time high. In Liverpool and Newcastle the ratio is below the city historical average. Another perspective to look at it: London growth has “borrowed” future returns.

Is city centre an exception? Maybe. I’m happy to be proven wrong since I’ll own a bit of London. But my money will be mostly in the north for the next 5-10 years. Noone knows for sure. As you said, 30% central London, 70% elsewhere is a good way to go.

Is it possible to automatically reinvest the dividends/rent? I am looking for growth rather than income and therefore would like some compounding action if it is possible on the PP platform. I am also lazy.

Hey AA, I’m lazy too so I have chosen to reinvest the rental income automatically! Property partner supports that.

What sort of return rate is the dividends/rent and what is the return rate due to the capital gain?

It all depends on your portfolio, Stevio. The average return was 7.2% so far, 4.3% from rent and 2.8% from capital growth. Personally, I’ve managed to achieve a slightly higher return by investing in individual properties. Which is also what PP advertise for their Balanced Plan (~8%).

So S&S

maybe 10% average

8% after corp tax

With PP

maybe 60% of the return being dividends, tax free for a company

Remaining 40% corp tax paid

4.3%+(80% of 2.8%) = 6.54%

Diversifies from S&S, but there is platform risk and non-FSCS investment considerations

Not sure if you have seen, but in the P2P industry there has been the Collateral administration and several others are not in good shape, with some heavy losses on loans up to 0% capital return on asset backed loans. This is not P2P directly, but similar principle of asset backed loans. It is not highly regulated, fraud is a real consideration in a small company and there is virtually nothing you can do if there is a dispute or decision you dont like. A contingency plan is often banded about, but I do not know an example where this has actually worked successfully. Collateral, different reasons for administration, is a real mess.

For me the risk is too high, whilst there are highly regulated, FSCS, huge brokerages for S&S, with similar return even after tax.

S&S there is the potential to time when you take your return or even convert to Family Investment Company (FIC) and pass on to heirs

You could look at high dividend shares, but I think the highest is still only around 3% dividend?

REIT?

Any other purely dividend return investments, comparable to taxed S&S?

Very valid concerns about platform risk but the comparison with P2P lending not so accurate. The way I see it, Property Partner has nothing to do with P2P lending. Sure, there are some development loans for sophisticated investors but the main model of the platform is equity buy-to-let. In other words, owning houses and getting rent and capital appreciation.

Now would I want my investments to be managed by their contingency plans? Obviously not! Which is why I’m doing my best to follow the company, meet the team etc. Next week I’m meeting the head of property, Robert Weaver to address the risk of investing with Property Partner. If it was a digital startup providing just the technology for property investing I’d be very worried. But PP also do the sourcing, the exit deals and overseeing the tenants management. They’re also FCA regulated although not so sure how much value this adds…

So I see it as a traditional property management company but with a technology twist to make it scale, which I like. I guess it’s a trade-off between bearing the platform risk and managing it myself – whatever that involves (not being diversified across UK cities, hassle dealing with tenants, negotiating buying/selling price, and maintaining the BTLs).

I know I wouldn’t be investing in Property if not for them, and REITs are great but highly correlated with stocks. I already own some property via S&S because my global index funds include property companies. So I’ll stick with Property partner for now on the property side but without neglecting my S&S portfolio which is my main return driver too!

You mention the new Property Partner development loans but isn’t a 10% return the sign of a risky loan?

Hi Robert, development loans are riskier than equity (owning and collecting rent) which is why they also pay a higher return. If you look at the market, I think these loans return somewhere between 8-11% mainly because they are short-term.

The advantage though is that they’re not highly affected by house price movements compared to buy to lets. So development loans will return a fixed amount but will miss a say, 5% price appreciation if the house prices go up, and will also avoid a -5% decline if the house prices drop. So they’re a different beast altogether.

Hello Michael

Great writ-up, really interesting and good to hear your thoughts and experiences.

What I dont fully understand is where the debt sits? I assume that each SPV will have its own debt related to the investment property that is purchased?

I also want to understand more on whats in it for PP. Obviously they get a 2% fee (or 1% now) from each investor on initial investment but is that there only form of return? Do they have shares in each of the individual SPV as well? I would almost be surprised if they didn’t because a 2% fee is not a huge amount of income. If that was there only source of funds then they would always be reliant on new investors coming on board.

Or am I misunderstanding things?

Would love to hear your thoughts.

Cheers

Great points, Ben. You are right – each SPV has its own mortgage (debt), its own investors and it’s like a mini business on its own. Property Partner does not hold any shares in the SPVs, at least not that I know of.

I think it makes sense. They’re running an active business which *should* have more potential than buy-to-let investments. Otherwise, why take the risk of running a business at all. Therefore, I would expect PP to spend their money on increasing their revenue by getting more investors and more properties on the platform rather than investing it.

A 2% fee is not a lot. But they also generate money by operating the secondary market plus they seem to have a good chunk of investment backing up the platform.

I guess the other intangible value which is not captured in numbers is the value of the business itself. Having £135m assets under management, that is. Therefore as this amount grows, the value of the company should grow as well. This metric, however, is not cashflow-related and doesn’t contribute to the day-to-day operations required for it to run! But overall, I see much more positives than negatives in this platform.

Maybe we’ll get someone from Property Partner to answer the financials question as well.

Cheers,

Michael

Thanks for the reply Michael. Good to hear your thoughts!

Hi Michael

A great blog and a great article, thanks for taking the time to so clearly document your investing journey. I too am on the path to FI and always hunting for anything that will accelerate it!

I haven’t seen an update to your initial post for Q4 – how has your PP portfolio been performing?

PP looks like a worthwhile alternative to physical BTLs with greater liquidity and opportunity for diversification so it has my interest but I’m going through a terrible time with Lendy at the moment so am cautious of anything that smells similar. I am keen to grow my property investments (I own a handful of BTLs already) so it would be great to get an update from you.

Thanks

Vig

To add to my previous comment, a quick look on TrustPilot suggests their recent AUM fee change has not gone down well. Applying it retrospectively and without much consultation seems to have scared off many.

Have you been impacted by this? Has this changed your view of them? It seems very similar behaviour to the team at Lendy and they are not under Administration, tying up investor money.

Thanks

Vig

Hi Vig,

Thanks for taking the time to comment. Property partner is indeed a great diversifier to my other investments. I quite like the option to invest in multiple properties in a hassle-free way.

Having said that, Property partner fees are now much higher, making it a decent investment only for those willing to invest a large sum. Feel free to read my article, but in short, the large sum threshold is at least £25,000 the way I calculated it, even better if one can invest over £50k in British property. That way the fees are not that bad for the risk/reward proposition.

I have been investing for about a year with them and have made regular contributions over time. Therefore my annualised return is not so easy to calculate (and PP does not provide one). Roughly I estimate it to be 7-8% and I believe after the new fees it’ll be around 6% for me.

I’m not aware of the team behaviour at Lendy but I have met the PP team and I found them decent people trying to run an honest business. Also, I would not compare it to any other peer-to-peer lending platform really when it comes to returns or asset classes. Those are totally different asset classes (consumer lending vs property equity) and the legal structure is also very different.

Let me know your views when/if you end up using them!

Cheers,

Michael

This reminds me of OwnBrix, i invested 10k with them about 10 years ago, since they paid well eventually earning up to 10%-15% yields on some properties, values dramatically increased, almost like investing in the North of England and also gaining value at the same time. 3 years ago, i decided i should add another 10k in there, but before i do. Let’s see if I can pull my funds out first, then i will re-add them with peace of mind that it is possible. However, each request i would make would get ignored, as well as some of my emails and eventually they stopped replying, my funds tho are still sitting in the account that I can still log in to. They have stopped replying and i gave up.

That’s a really bad experience, Bill. It goes to show that a very careful due diligence is needed before investing a penny. You’re trusting the platform too, not just the property market to go up. Have you taken things up with the Financial ombudsman? You should be able to.

Similar to how Lendy failed and Ratesetter succeeded, there are different kind of platforms out there. Having met the team behind Property Partner I like their honesty and transparency. Even in hard times, where they decided to increase the fees, they justified it although they lost some trust. Also, it helps that they’re FCA regulated.

Hi Michael. Firstly, thank you for your site as it’s a wealth of information and I share your yearning for developing other ways to generate income. I am a little late to this so was wondering if you have done an update since you started investing with Property Partner?

Thanks

You know what they say, Charlie: The best time to invest was yesterday, the next one is today :) Here is the latest update on Property partner during Coronavirus and one on my Property Partner returns a few months back.

Hi Michael,

Thanks for an update on your investment. I am planning to invest surplus company cash in property but got confusion about choose Property Partner or actual property.

Ex: If I put down £30K in property partner, I can expect around 4-5% return after all fees. (assuming we are in for yield). So, lets say around £1500/year.

If the same cash use to put down as 25% (25K deposit + 5K other expenses) deposit against 100K home. And roughly similar return expected isn’t this will generate around £4 to £5k/year. We are using the mortgage amount we borrowed in our favor. Or I am missing something.

Property Partner is slowly picking up steam again. I’m expecting a price rebound once they announce the dividends restarting in more properties end of March.

Property partner vs Buy-to-let: It’s a personal choice, Shaky. Property Partner offers a more hands-off approach to property investing but with less transparency compared to a traditional buy-to-let. But it’s more liquid and if you’re doing it through an LTD company the dividends are exempt from corporation tax which is an added bonus.

The mortgage you mentioned makes no difference assuming the same mortgage exists in PP. That’s because house price growth is reflected in the property partner share price too.

Hi Michael

Firstly congratulations on such a great blog! I’ve only recently stumbled onto your blog and find all the material you have very interesting indeed. It has inspired me to open a second limited company alongside my trading company to invest the excess funds I have.

I have been looking at property partner since I found it here and I wonder how you have been doing on it since 2018 ? Just wondering whether property partner have delivered on their promise of uninterrupted yield payments and how difficult you have found it to ‘sell’ your shares in individual propertied ?

You did mention that you would post updates but I could not find a link to it. Do you think with the increasing base rates that are occurring/looming that it would have a detrimental effect on property investing in this way ?

Thanks for your time!

Hi Kenny, glad you have taken action with your LTD company! Most people struggle to just start.

Property Partner started well but then increased the fees. This led to a combination of lower returns and additional discounts in the secondary market as investors rushed for the exits. It wasn’t hard to sell your investments, but selling them at the right price was challenging ;) Then COVID happened and rents were interrupted. They are coming back now and prices have started appreciating.

Since then they also sold a few properties that reached their 5-year exit plan for a 5% per annum return.

The portfolio update just came out (March 2022).

So far, personally, I have not sold the investments and viewed the 1% fee as a must-have for the platform to survive. Now they have stronger resources after being acquired.

To your other question, I don’t think the interest rates will have a devastating effect on property crowdfunding. Interest rates work like gravity so sure, it’ll affect all risk assets including property. But at the same time inflation is rampant. The alternative, staying in cash or bonds is also painful. Real estate / hard assets should keep up, theoretically.

Good luck and thanks for reading!

You can find all my PP follow-up posts here.