Is a pension better than an ISA for limited company directors? And if so, by how much?

Company directors can have their LTD companies pay straight into their pension. This is called an employer contribution. If you are a company owner, this is an amazing tool, because you can pay yourself in a very tax-efficient way.

Take a low salary tax-free (typically £8-12k per year) and then the rest as dividends taxed at 7.5% up to £50k annual income. Above £50,270, taking more dividends stings you with 32.5% tax, and that’s AFTER having paid a 19% corporation tax on it! Not great.

That’s why limited companies pay straight into the pension of company directors. This means zero corporation tax on the pension contribution and zero income tax until later in life.

It’s no surprise that most of the rich company owners I know have already maxed out their pensions.

Pensions work for 3 main reasons:

- Your future self won’t be earning as much, so will be paying lower taxes

- Pension money grows tax-free

- You cannot touch the pot until later in life so you cannot spend it

The fact you don’t pay inheritance tax on pensions is also an added bonus.

But how much should you pay into your pension? Should you pay the maximum into your pension? That’s £40,000 in 2021/22 tax year, as long as you’ve got the profits!

We know that pensions are great tools. But I want to look at the numbers and see how much of a tax benefit the pension actually gives me.

Are pensions really worth it if I am locking my savings away for decades?

How much am I “losing” if I take an extra income and pay into my ISA instead?

I will answer this question for the LTD company director.

Note: Full time employees should definitely take the company matching contribution hands down. So if your employer pays 5% if you pay 5% into your pension, then do it. That's 100% return and free money. I'd always take that. Whether you should contribute more is a discussion for another day.

Back to limited company owners.

Are pensions worth it for a Limited company director on a £50k income?

I want to find out whether pensions are actually worth considering AFTER having paid ourselves a £50k income.

Taking a £50k income from the business is a very common scenario. That’s what most company owners do because staying within the basic rate tax threshold is very tax-efficient.

Typically the director gets paid a small salary, £8,840, and takes the rest £41,430 as dividends. Total £50,270 costs only £2,677 in income tax. That’s a 5.3% effective tax!

Of course, the company pays corporation tax (£7,871 to be exact). But overall, it’s a tax-efficient strategy for a director who wants an income from their business.

Now let’s assume the limited company makes more than £50k a year. If you or your business don’t really need the extra money, there are 3 options:

- Invest through your LTD Company

- Contribute to your pension

- Take extra income and invest in an ISA (or buy-to-let or any other personal investing).

You know I have a soft spot for LTD company investing because it strikes a nice balance between having access to your money and tax efficiency. I even created an entire course about it 😉

But I want to focus on the other 2 options. Should you take an extra income and an extra tax hit to invest through an ISA or put this money in your pension instead?

Pension vs ISA Example

There are 2 friends, David and John. They both take the same income from their LTD companies, £50,270. A small salary and dividends.

They both have a £20,000 surplus in their LTD companies. David decides to contribute the amount to his pension. John doesn’t like pensions and prefers to take the 20k in dividends and invest through an ISA.

Every year:

| Income | Pension | |

| David | £50,270 | £20,000 |

| John | £70,270 | 0 |

How much money does John “sacrifice” to keep it accessible?

Assuming a modest 5% annual return for both:

As you can see, there’s a MASSIVE difference in favour of pensions.

The pension pot is almost double the ISA pot after 20 years of contributing £20k a year. The figures are quoted at the end of the year, which is why you see £21k instead of £20k (5% annual return).

You might wonder how can we have such a big difference. It’s thanks to tax savings. See below how taxes work for pensions versus taking the income and ISA.

Here’s the tax on contributions above £50,270.

| Pension | Before ISA | |

| Corporation tax | Zero | 19% |

| Income tax | Zero for now. Deferred tax (between 20% – 45%) | 32.5% (dividend tax) |

Without using a pension, an ISA is very costly: From the initial £20k, the company needs to pay £3,800 in corp tax (19%) and then John pays 32.5% in dividend tax! Only £10,935 makes it to the ISA every year.

Now obviously, that’s half the picture. Because if you put the money in a pension instead, you need to pay tax before touching it. David saved the corporation tax but deferred the income tax.

Now both David and John decide to stop working and want an income from their Pension and ISA respectively.

Does a Pension last more than an ISA?

David and John are both ready to take a break from work and an income from their hard-earned investments.

David is in a privileged position with double the money. But in this phase, David will have to pay some of the income tax he deferred. John will pay nothing because he paid all the tax upfront.

Assuming a £40,000 cost of living for both, and a 5% annual return as before, here’s how the pension compares to an ISA when taking an income:

Even though a £40k cost of living will require the pension to withdraw £50,016 each time to account for income taxes, the pension ends up outperforming the ISA by quite a margin!!!

After 5 years, for example, the pension is close to 600k vs 250k from ISA. After 12 years, the ISA runs out of money whereas the pension still has £400k in the tank.

It takes 23 years for the pension to run out of money!!

If this doesn’t make you open a SIPP Account right away, I don’t know what will!

You might think… Nice trick, Michael. I noticed how you made the pension withdrawals match exactly the basic tax rate income (£50k). Sneaky!

What if I want to take a much higher income from my pension every year? This will definitely cost the pension more!

Or what if I want to take a much bigger income in some years. What if I take EVERYTHING out of the pension at once?

FAT FIRE: Pension vs ISA when spending big

Assuming the same figures for the accumulation phase, let’s double the spending in de-accumulation.

Let’s spend £6,880 per month which is £82,568 a year.

Those cruise ship cocktails are not going to drink themselves!

Higher spending will come at a higher cost for the pension because it will push us to a higher-rate tax band.

Every year John will take £82k from the ISA whereas David will have to take £100k from the pension to arrive at the same after-tax number.

What? Only £18k tax when withdrawing £100k? How’s that possible?

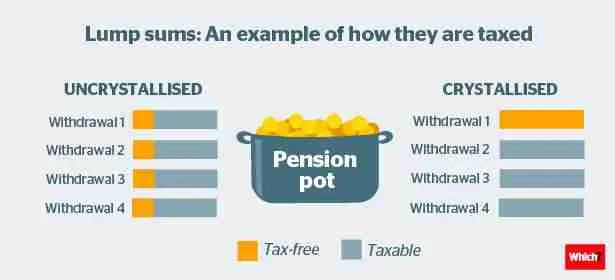

Here’s another interesting fact about pensions: The first 25% of your withdrawal is tax-free! You can choose to take it as a lump sum in the beginning or as you go.

So a £1,000,000 pension can give you £250,000 tax-free the first year. The rest of the years are taxed as normal income (in fact, even better, because pension income is not subject to National Insurance tax!). But you can also choose to take your 25% tax-free every year instead of a big lump sum at the beginning.

Here’s a nice diagram from Which showing you can take 25% tax-free lump sums each year instead of taking 25% tax-free on the entire pot and then ‘crystallising’ your pension.

On top of the 25% tax-free, we’ve got the £12,500 personal allowance, so £37,500 tax-free already!! This is how a 100k pension withdrawal attracts only 18k tax!

Now back to the same question: “How does a pension compare to an ISA when withdrawing big lump sums”?

Once again, what a massive difference. Pensions last almost twice as long compared to an ISA!

You’d think the £100k pension withdrawal would hurt the pot but not really! In fact, there’s another reason at play here, somewhat less obvious.

The same investment return (5%) helps the pension much more than the ISA. It’s simple. 5% on £600k returns a much bigger amount than 5% on £300k. This stays within the pension wrapper and generates even bigger numbers next year.

This compounding magic is another reason why the pension beats the ISA even on higher withdrawals.

Obviously, it can go both ways. So in case of a terrible market downturn, the actual loss for the pension is bigger. But I believe we will see positive returns going forward which is why we invest in the first place.

So what on earth needs to happen for the pension to actually lose to an ISA?

What if we withdraw the entire pot in one go!?!? Maximum tax for pensions!

The Impatient: How much will it cost to take the ENTIRE PENSION POT in one go

Assuming the same figures, £20k pension contributions for 20 years and 5% returns:

Pension: £694,385

ISA: £379,655

Now once we reach pension age, let’s take everything out as income in one year.

Taking the entire ISA to our personal bank account will cost nothing in income tax. Zero.

The pension though will have to take a big tax hit. The first 25% will be tax-free but then:

Total amount: £694,385

Tax paid at 20%: £7,540

40%: £44,920

45%: £166,854

Total Tax: 219,314

Take-Home Pension: £475,070

Take-Home ISA: £379,655

Wow!! Even when trying to pay the maximum tax possible in a pension, it still beats the ISA pot by 25%!

This actually surprised me.

This is why pensions are the GREATEST tool out there for business owners.

ISA or Pension Which is Better?

Pensions are great thanks to a combination of the following benefits:

- Zero income tax, zero NI tax on the way in

- Zero corporation tax for the company

- Money growing tax-free inside the pension

- 25% tax-free on the way out

- No inheritance tax in most cases

I used data and numbers to justify making pension contributions. Not making any pension contributions is leaving (a lot of) money on the table. The data tells us pensions are one of the greatest tools for business owners.

So not only you’ve got more money for you to spend, but your kids can benefit too. A pension is a great tool to pass wealth on. This is because, unlike other investments, your pension isn’t part of your taxable estate.

The not-so-great things about pensions

Now you might say, not everything is great about pensions and you’d be right.

Once you lock your money you cannot touch it until 55 years old (57 years old from 2028). Who knows what the future legislation will look like in 20 or even 30 years. The pension age might increase or income tax might increase or both.

You’re at the mercy of a future government. The tax benefits are lower for the basic rate taxpayer, say the self-employed who pay themselves £30k and put £20k in the pension. That’s another scenario I need to run the numbers on.

You might need the money for a business opportunity or a health issue in the near future.

Not all investments fit inside a SIPP or an SSAS pension. You cannot invest in residential buy-to-let for instance.

Also, there’s the lifetime allowance to consider. Once your pension pot exceeds £1,073,100 it becomes less tax-efficient so the benefits are limited if you’re a high earner.

To be honest, the pension age increase is my biggest fear. I think it’s likely we will see it increasing again to some extent.

Despite the limitations, there’s definitely a place for pensions in a business owner’s investment plan.

I don’t blame you if you don’t want to lock ALL your money away in a pension. But I often tell people to put some money into a pension and also invest through their Limited company and ISAs.

Until then, happy investing 🙂

If you are a limited company owner with surplus cash in the business, check out the latest course on LTD Company investing. It’s time to put your business cash to work.

No, a business cannot have an ISA account. ISAs are only for individuals, not for companies. Businesses can still invest in tax-efficient ways, but they would have to pay corporation tax on taxable profits.

With ISAs, you pay the income tax upfront and then your investments can grow tax-free inside the ISA wrapper. ISAs can only be funded from your post-tax income, so a limited company cannot just invest in your ISA and benefit from tax savings.

From a tax perspective, a pension is a much better option compared to an ISA for limited company directors. However, there has to be a balance. That’s because pensions are not accessible until pension age, have a lifetime allowance cap and also attract income tax when money comes out.

There are many good SIPP providers out there, like BestInvest, Interactive Investors and Vanguard investor. FreeTrade would be my go-to platform but it does not allow Limited company (employer) contributions just yet. Interactive Investors offer a nice balance between fees and user interface.

The Vanguard SIPP is very good. Their 0.15% platform fee is reasonable if you can live with the Vanguard-only fund selection.

Related articles:

5 thoughts on “Is Pension better than ISA for Limited Company Directors?”

Perfectly illustrated Michael. I have both SIPP and ISAs for me and Junior ISAs for the children. Compounding interest and diversification are the game changers and the earlier you invest (no matter how small) the better.

Glad you liked it, Rav, seems you have your finances sorted very well already!

Thats a great article as always, very enlightening and very well researched.

One trick to access your pension money earlier, say at 45 or 50, is to borrow (or borrow more) on your primary residence. The interest rate is very low (can be even under 1% depending on your LTV and term). You can lock in your rate for up to 10 years. Then you can live off that money until you get to 55. At that age you can take the pension lump sum, use it to pay back the loan and start living off the pension money.

That’s a good one for unlocking the cash thanks for bringing it up Giorgo!

Would love to see this same study done but while in the basic tax band. Seems pretty clear that if you plan to pay yourself over £50k it’s worth getting that extra in the pension instead of the 19% Cotax + 32% div.

But what about while in the basic rate (19% cotax + 8.75% div)?

We currently pay ourselves (2 directors) all salary + div and have never contributed to Pension. But I’m starting to consider, and I at least want to see the actual numbers to see if I should split it (like minimising div just to cover life expenses and adding max to pension), or if it’s not worth doing while under £50k pp.