January is the time of the year when people set goals and then quickly forget about them.

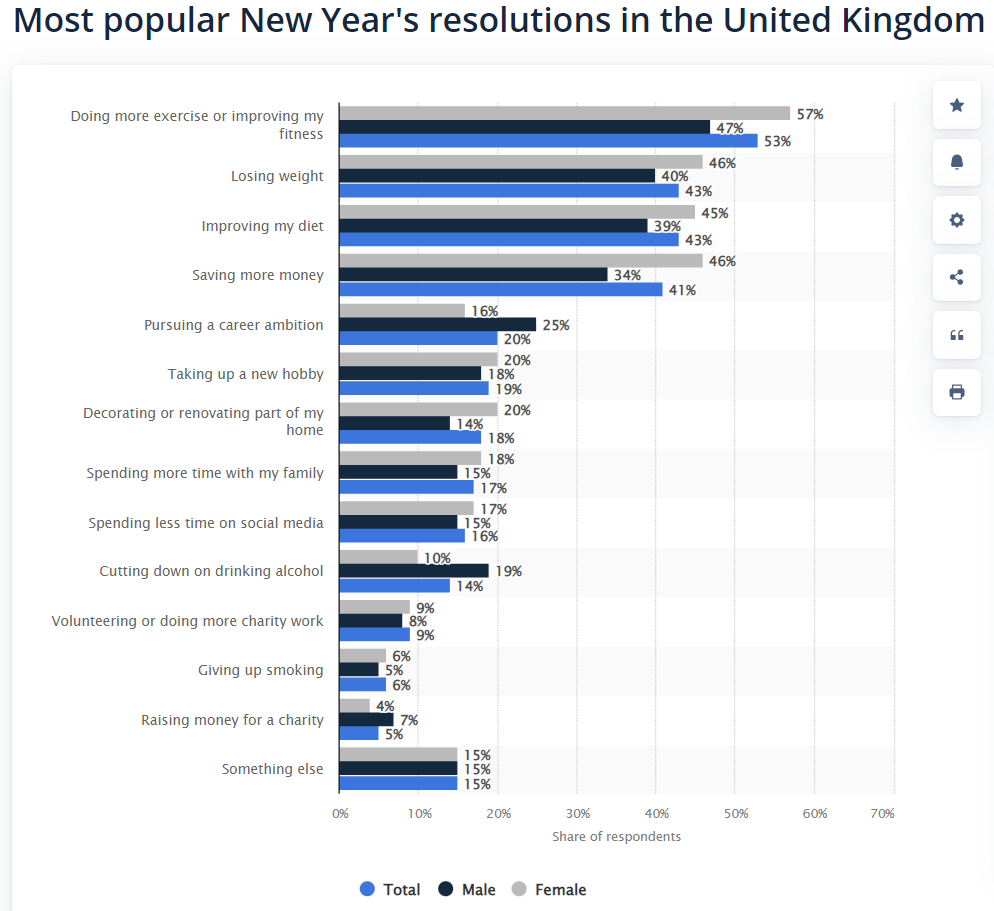

The most common new year resolution is to exercise more, followed by ‘lose weight’ and ‘improve my diet’.

Sorry ‘save more money’ and ‘career ambition’, you only come 4th and 5th!

But even though goals are better than nothing, they are not very useful.

Every January, I keep going back to what James Clear (Atomic Habits) says:

Forget about goals, build systems instead

Build systems, and the score will take care of itself.

This applies to everything: weight loss, investing, career promotion etc.

For example, say your goal is to lose 20kg.

How do you go about it? The goal might seem daunting at first and can quickly end up in the ‘too hard’ pile.

You have a rough idea – cut down on snacks and junk and eat more salads and fruits instead. Try combining it with exercise to make it happen faster.

Easy in theory, hard in practice.

A system consists of simple routine tasks you can do without much effort.

For example, cooking at home might help you lose weight if you plan meals ahead. As long as you stick to it, that is!

Your system might include what recipes you make, how you’ll source the ingredients and how often you cook.

Every Friday lunchtime, for instance, you’ll order next week’s ingredients online. You’ll cook in batch mode every Monday and Thursday for the rest of the days.

On Friday or Saturday, you can reward yourself with a takeaway dinner.

Goals help set the vision.

But a system will make or break the progress towards your goal.

You can apply systems to all areas of your life. Entrepreneurship, getting a promotion at work, being a good parent, and investing and saving.

Different goals can have synergies between them. For example, cooking at home will help you lose weight and save money.

The benefits of having a working system go beyond achieving the goal. Because they make sure you stick to it and stay caught up.

When having a system, you take advantage of this continuous improvement that compounds over time.

My goal: Strengthen the body

After spending some time with a pro-CrossFit athlete, I got enough motivation to start working on my body again (Thanks V! )

I need to stick to the system of hitting the gym every second day, with no exceptions.

I can do it most days, but some other days are hard! Like really hard, no motivation etc. I focus on making the bad days count. If I can make the bad days count, I can keep going.

I also feel much happier after a workout, which gives me another reason to do it.

FTSE 100 All-Time high – Not in the news, is it

It took two decades, but the FTSE 100 is at an all-time high!

There’s always a bull market somewhere !😉

That’s right; our UK home index has hit an all-time high (in British pounds).

You won’t see this in the news, maybe in some #Fintwit circles I lurk in, but that’s about it.

I am not ignoring the cost of living squeeze and the high prices. Households are struggling.

But at the same time, I will highlight a positive when I see one. Optimists live longer, they say.

If you are in a position to have savings, you are at a great place already. Consider putting those savings to work to beat inflation, which is (slowly) dropping.

Oh, those mortgage rates are following too.

Company Investing makes an impact!

More than 200 business owners have taken the company investing course so far.

I am very grateful, and it’s nice to see this makes a difference in people’s finances.

In January, we had two live Q&As where I met some very clever business owners. We had good fun talking about tax, investing and business.

The live Q&As are part of the course and go hand in hand with the recorded videos, notes and spreadsheets.

Are you interested in joining us? If you are running your own business, check if the course/community is for you!

Don’t forget to use your NEWYEAR coupon to get a £100.00 discount 🙂 Promo expires end of January.

Property partner rebrands to London House Exchange and adds liquidity

In other investing news, I noticed that Property Partner rebranded to London House Exchange just now.

I’m still down -7% since my original investment in property partner in 2018. That’s partly due to my decision to invest a good chunk of it into student accommodation and partly due to big discounts on the platform. Investors want out.

As I described in 2021, Covid hit student accommodation hard. It goes to show how much some of these PBSA properties have dropped.

London House Exchange have now added another metric, the Vacant Property Value.

From their definition:

Vacant Possession Value (VPV): assumes each unit within a residential block is sold individually, with vacant possession (i.e. no tenant in place)

For example, if you own a block of flats valued at £1m, you can get better outcomes by selling units one by one. Which can result in a higher return.

The vacant possession value should better reflect the portfolio value, in theory. That’s because selling individual units in a block is the strategy Property Partner follows when ‘exiting’ an investment.

And in practice, if we look at the actual selling record, the Sales price matches the Vacant Possession Value.

According to that metric, I’m not down -7% but up 1.5%. These include dividends and are after fees.

VPV won’t apply to my student accommodation though, so I’m not fully benefitting from that.

Speaking of which, my property portfolio looks much nicer without the student accommodation… but that’s wishful thinking.

Time will tell which metric better reflects the money I’ll get. For now, I hold.

Liquidity in the secondary market

Even good Property Partner properties can trade at a discount to what they sell in the open market. Which sucks because imagine you have picked fantastic properties and are up 30%, but you cannot sell them.

So if you have a healthy portfolio and are sitting on gains, you cannot easily exit because there are not enough people willing to buy – or at least at the estimated price.

There are some positive signs on the horizon. Since the Property Partner acquisition by Better, the parent company will now fix the liquidity issues in the secondary market. Or at least try to.

They will buy 1% of all properties on the secondary market each month for three months. Retail investors can jump on the wagon, too, investing at a -25% average discount to the property values.

To do so, they offer a new investment plan somewhat close to what I would describe as a “property index fund”.

The all-Share Investment plan will target clients who can invest in a highly diversified portfolio with a focus on shares trading at a discount to property valuation.

You can view it here. Always do your own research.

Last but not least, they grew the PP team, which is a good sign for the platform.

To my surprise, Better also bought Trussle, the online mortgage comparison. You may have used one of those. I will try Trussle and Habito on my next remortgage.

Another area where software is eating the world.

Life Sciences and BioTech

Next week I will interview Andy Craig of How to Own the World book fame.

Andy is a repeating guest with whom I could talk for hours.

I know his background is in biotech businesses, and we briefly covered some of it last time (23:50).

This time I want to focus on this emerging trend and how life sciences will change the world around us.

Yes, of course, you can expect a discussion from an investor’s point of view since Andy is launching a new fund on the subject.

Are there any questions you’d like me to cover? Please give me some inspiration!

Other resources

I recently read the Price of Money book by Rob Dix.

Rob did an excellent job explaining how complex economics work, like quantitative easing, inflation and currency depreciation. The focus is to help the reader understand and potentially take advantage of the situation.

For such a dry subject, Rob’s writing, knowledge and humour delivered! It’s written from a UK investor’s point of view, which is always helpful and a bit rare.

A relevant book across the pond, a bit more advanced but dry, is the Pragmatic Capitalist by Cullen Roche.

I also finished watching the 4-episode Madoff documentary, “The Monster of Wall Street”, on Netflix.

A huge Ponzi scheme. Enough said!

Netflix did a good job describing the situation, interviewing real victims and showing what happened.

But I’m pretty sure that’s not even half the story. What they don’t say is what happened behind the scenes.

There are so many open questions:

- What was going on with so much money?

- Why were fund managers committing suicide or being killed?

- Was the SEC truly so blind?

I guess we’ll never find out.

Films like that make you question who you give your money to…

As always, thank you for reading and happy investing …carefully!

PS What do you think of my email approach to include the entire blog post in the newsletter? That’s different to my previous ones, where you only get a preview and a link.