We are almost 2 months into the Ukraine invasion. Yet stocks are higher than they were on the 24th of Feb when the war started.

Predicting any short term movements is very hard. This is why I try to focus on history and data.

We live in a period of high inflation and rising interest rates. Everything becomes more expensive, and let’s not talk about energy and household bills.

- How do different assets perform in such periods?

- What are the risks we face?

- What can consumers/investors do to build and protect their wealth?

Once a year, I read the Global Investment Returns Yearbook by Credit Suisse.

Although the full version is quite long (300 pages or so), they publish a summary edition which is just 50 pages. You can read it here.

It focuses on history rather than trying to predict the future.

Another reason I like it is that it analyses data from all countries, not just the US.

Most research out there focuses on US returns. But during the 20th century, the US enjoyed being that growing superpower, taking a bigger share of the pie, expanding GDP and becoming the world’s reserve currency.

Just look at this graph. Can you spot the outlier?

Drawing conclusions from the US returns is just survivorship bias.

US investors enjoyed 2.1% higher returns per year than the world markets. This might not sound like a lot, but it’s enough to make a US investor 10 times wealthier than their ex-USA counterparts if invested since 1900.

Credit Suisse now analyse 90 countries with over 120 years of data on stocks, bonds, inflation, rates etc.

So here is a summary of the 2022 edition!

Asset returns across countries

The United States has enjoyed an amazing 20th century. It became the strongest economic and military power. The dollar is the global reserve currency.

As expected, their markets have done very well.

Between 1900-2021, US stock returns came at 6.7% per year after inflation. Bonds returned 2% real.

We shouldn’t really forecast returns based on US alone. That’s just too optimistic!

The world excluding USA returned 4.5% per year after inflation for stocks, and 1.7% for bonds.

The UK has lagged behind in the past 20 years. 3.8% real return for stocks, same for bonds. Since 1900, numbers look much better, 5.4% for stocks, and 1.8% real return for bonds.

Current environment: High Inflation

Throughout the 2010s we investors are spoiled by low interest rates, low inflation and money printing. Governments followed their “Quantitative easing” programme. Also, markets started from cheap valuations due to the 2007-2009 crisis.

The environment has changed now. People eat out and travel, demand is back. But supply chains were disrupted due to Covid, and commodity prices have gone through the roof partly due to Putin’s war.

As a result, UK inflation is much higher (7% CPI, April 2022).

And here is the inflation over time from ONS.

The story is similar in other places, like the US. Inflation is back and running wild. 8.5% as I’m typing this in April 2022.

How have stocks and bonds performed historically during high inflation?

Let’s start with bonds:

As an asset class, bonds suffer in periods of high inflation. They provide a hedge against deflation.

This makes sense because bonds have fixed returns without taking into account a rising (or falling) cost of living.

For example, if you lend me £100.00 and I promise to pay you £110.00 next year, you will not be better off if inflation is 10%. In real terms, your money next year can buy exactly what it could today.

If on the other hand, inflation is -5% (basically, deflation) you will be better off by 15% which is great.

Bonds shine in deflation! During such an environment, bonds returned 19.2% per year after adjusting for deflation. This included data from 21 countries and a 122-year history.

During high inflation, bonds are destroyed. -24.7% in inflation of 18%. Cash won’t protect you either.

Stock and Bond returns versus Inflation

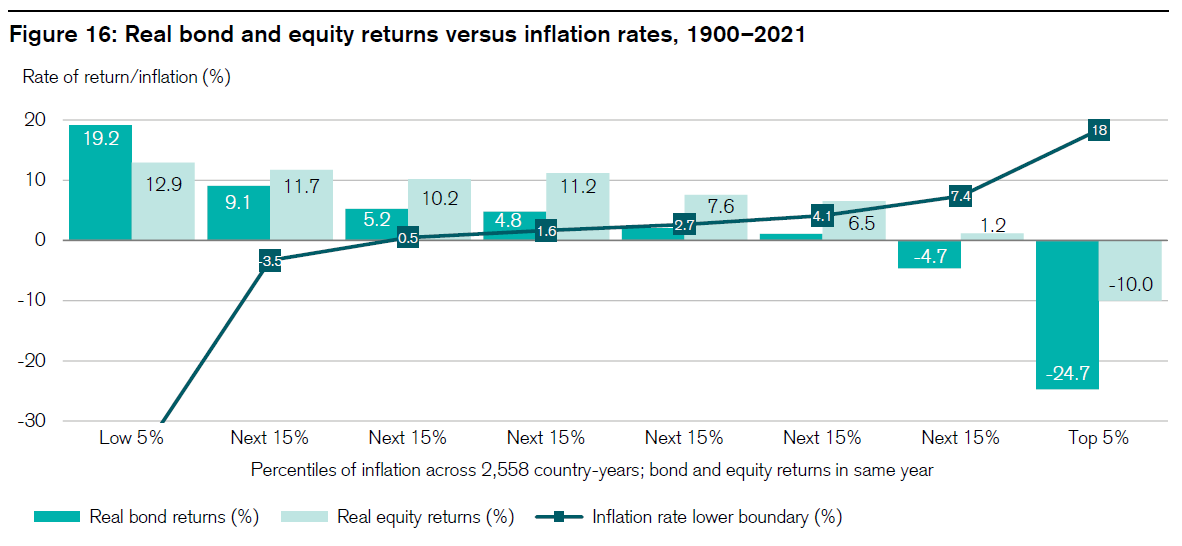

Here is a picture showing the after-inflation return of stocks and bonds. I explain how to read this graph below the picture.

Here is how you can read this graph: Inflation is the line ranging from -30% to +18% on the right.

Inflation starts from very low, -30% in the “Low 5%” bucket where bonds returned 19.2% and stocks 12.9% per year. The next bucket is “Next 15%” where inflation reads at -3.5%. Bonds at -3.5% inflation returned 9.1% with stocks returning 11.7%.

The last bucket is 18% inflation. We don’t live in an 18% inflation environment. But if we did, shares (-10%) would perform better than bonds (-24.7%). Worth noting that in an 18% inflation world, the -10% real return from shares is actually a positive 8% nominal return before inflation.

So your money is at least growing, but not fast enough to catch up to 18% inflation, hence the negative real return.

That’s all according to history. Of course, no one knows how the next high inflation will play out for stocks!

Looking at the data, we can also see that the sweet spot for equities is when inflation is low, up to 4%.

As Credit Suisse suggests, contrary to the common belief, equities are inflation-beaters, not inflation hedges!

During the period of high inflation, they might not catch up. But thanks to the inflation-beating returns in other periods, equities are one of the best ways to beat inflation.

Here in the UK, Covid changed everything. In 2020 we had basically zero inflation, but now (April 2022) inflation is >6%!

So to avoid a negative real return, our UK assets need to return at least 6%!

What about Property?

It’s a shame Credit Suisse don’t mention property at all.

In the last post, we also saw how property / REITs offered good inflation protection during the 1970s.

How do assets perform when interest rates go up?

Governments target inflation of around 2%. Not too high to cause panic and rioting, not too low to risk deflation.

To keep inflation in this 2% sweet spot, when inflation goes higher they fight it. They do what they can by raising interest rates. These days they also stopped printing money (quantitative easing).

You might wonder, why do higher rates cause a drop in inflation though?

Interest rates are the “price of money”.

So higher interest rates mean more expensive loans, higher mortgage payments and higher credit card debt. Consumers, businesses and investors slow down.

The economy slows down as a whole too.

Here is how assets perform during an interest rate rising and falling environment

In periods of rising rates, equities returned just 3.0% after inflation, compared with 9.7% during rate falls.

US bonds gave an annualized real return of just 0.2% in the same environment, compared with 3.7% while rates fell.

So as we can see there’s a big difference in returns between periods of “rate-hiking” like the one we experience now.

Stock and bond returns have been lower during periods of rising interest rates. But these happen to be periods of higher inflation too. And as we saw already, higher inflation (4+%) is also bad for assets.

To sum up, we don’t know if lower returns come from high inflation or from the higher rates that follow in order to fight it. But one thing is clear:

In hiking cycles like the one we live through now, returns from equities and bonds are lower.

Diversification, once again

Here is a nice quote I hadn’t heard before:

Diversification should be the default, so perhaps we should instead think of a failure to diversify as a self-imposed tax.

Credit Suisse yearbook, 2022

Diversification is the reason I am invested in global passive index funds like VWRL. It’s easy to get carried away by amazing stock returns. They exist. It’s just that it is very hard to find them and keep them.

The idea behind index funds is that they capture the entire haystack. So you won’t have to look for the needle, it’s already there.

If you don’t have the skill to invest in individual stocks or fund managers, then investing in a low-cost index fund remains the best way to succeed.

Credit Suisse say that the current environment of higher volatility and sector/factor rotation is potentially more promising for active investors. But they also highlight that generating alpha requires genuine skill and higher risk exposure.

They also reminded me of the paper from Bessembinder (2018). It showed that the majority of US stocks (57.4%) have had lifetime buy-and-hold returns below 3-month US bonds.

Since 1926, the best-performing 4% of companies explain the net gain for the entire US stock market!

Stock markets can make you richer. But even considering the amazing decade of the 2010s, they won’t make you rich quickly.

You always hear about diversification in the stock market.

But diversification is how you stay rich. Concentration is how you get rich.

Owning private businesses is a form of concentration. Those of you who run businesses know that you’re taking a more concentrated risk. But in return, you get a potentially much higher reward which gives you autonomy and money to spend and invest.

Stocks and real estate will grow and multiply your wealth as you build it.

In the Moonshots article I wrote:

You look at businessmen, like Felix Dennis of How to get rich book and they have one thing in common: They put most (if not all) of their assets into very few bets. They put all their eggs in there and then some!

Sometimes more than they have, either in a form of a loan or using other people’s money.

Note just their working capital, but their human capital too (i.e. their working hours).

Concentration pays if you are sitting on a big winner. Diversification pays if you are wrong.

For my Greek friends out there, it’s really expensive to be wrong!!!

Stay humble, stay hungry!

Are you a business owner with surplus cash in your LTD company? Learn how to put the business cash to work.

Get £200 off if you register before the SUPER Early Bird offer expires! The Company Investing Course live sessions start on the 23rd of May.