This article explores whether you can transfer property you own to a limited company.

With the recent changes in buy-to-let taxation, many people consider buying property through a limited company.

But what if you own a buy-to-let already? Is it too late to do that?

It’s not always clear whether you should own property through an LTD company. If you are a higher rate taxpayer, a LTD company is much more attractive from a tax point of view. That’s because:

- The rent is taxed at a 19% to 25% corporation tax, much lower than your 40% or 45% income tax.

- The mortgage interest is 100% tax-deductible for LTD companies. This stopped being the case for personal BTL investors. They only get a 20% ‘tax credit’.

So if you rent out a property (personally) for £1000 and half of that goes to the mortgage, HMRC will tax you on the entire rent. As if you received it, even though some of it went to pay the mortgage.

That’s not to say we should always use a LTD company. Generally, mortgages are more expensive for corporations. There’s also the extra hassle and accountancy cost for LTD companies.

As a general rule of thumb:

Buy new properties through a LTD Company but retain existing property under personal ownership.

But, I digress! This is a post about whether it’s possible to transfer your property to a limited company.

If I own a BTL property can I move it to a limited company?

When you transfer property ownership to a LTD company there are many issues to consider, such as tax, early redemption fees, administrative and legal fees. But let’s focus on the most important one: tax.

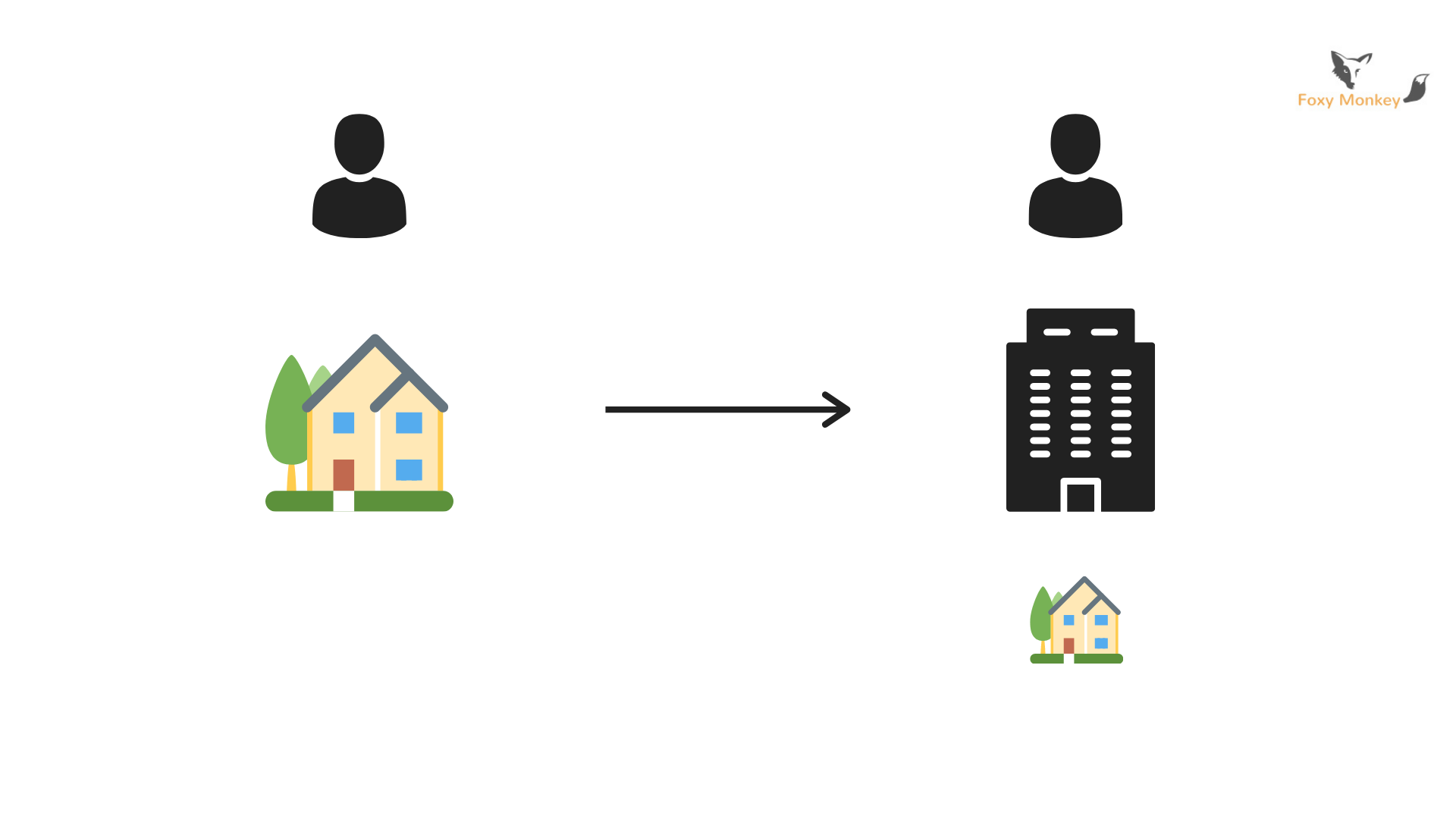

Despite you owning the LTD company, you have to sell your property to your company. In the eyes of HMRC, you and your limited company are two different entities.

This has certain implications:

a) The LTD company has to buy the property at the open market value

b) Stamp duty tax the company needs to pay

c) Capital gains tax (CGT) you need to pay

d) For residential properties priced more than £500,000, the company would need to pay Annual Tax on Enveloped Dwellings

The a) is straightforward but affects the amount of tax we might pay in b) and c)

Regarding stamp duty tax, the company would still need to pay it at the additional rate. There are no exceptions.

But can I defer the capital gains tax when transferring property to a LTD company?

When it comes to capital gains tax, you need to pay it as per the standard CGT rules. So if you bought the property for £300k and you now sell it to your company for £500k (open market value) you will pay capital gains tax on the £200k gain. Most of it will attract 20% tax. Ouch.

However, you might benefit from an old legislation, the “incorporation tax relief” (section 162, TCGA 1992). HMRC defines it as:

If you, either as an individual or in partnership, incorporate a business by transferring the business, together with all the assets of the business, in exchange wholly or partly for shares, you can defer some or all of the gain arising from the disposal of the ‘old assets’ (the business and the assets of the business) until such time as you dispose of the ‘new assets’ (the shares).

In plain terms, when transferring property to a limited company, the capital gain from the sale can be deferred in exchange for a reduction in the base cost of company shares. However, to do that, the buy-to-let has to be run as a business.

What does ‘run property as a business’ mean?

Running it as a business, as opposed to a passive income vehicle is a bit tricky to define. There is no statutory definition for a business.

There was a case back in 2013 (Elisabeth Moyne Ramsay) where the coupled transferred a block of flats to their LTD company. The capital gain was not paid but it was deferred (in exchange for company shares) for when the property is sold. This is what incorporation tax relief is about. HMRC demanded capital gains tax payment and the couple appealed to the first-tier tribunal. FTT made a decision in line with HMRC and asked them to pay the capital gains tax. The couple then appealed to the Upper tax tribunal which decided in favour of the couple.

This couple which eventually won the case was working 20 hours a week on the block of flats and that was their main occupation. They had no letting agency and this was their main business. UTT indicated that the degree of activity should outweigh what might normally be expected to be carried out by a mere passive investor.

In the absence of clear-cut HMRC rules of what running property as a business mean, I would be extremely careful taking this approach.

HMRC’s own interpretation of the judgment at CG65715, however, does impose a minimum threshold of 20 hours per week, as per the particulars of the Ramsey case:

‘You should accept that incorporation relief will be available where an individual spends 20 hours or more a week personally undertaking the sort of activities that are indicative of a business. Other cases should be considered carefully.’

Some questions to ask yourself before you transfer property to a limited company:

- Is this your main source of income and occupation?

- How many hours do you spend per week on the (property) business? More than 20?

- Do you use a letting agency?

- Do you undertake maintenance work yourself?

Before going down this route you may want to seek clearance from HMRC. You can get non-statutory clearance from HMRC on specific transactions.

The decision to incorporate a property rental business is not one to be taken lightly – legal, commercial, taxation, administrative and refinancing issues need to be carefully considered.

This article appeared first in the company investing academy wiki. If you run a limited company consider signing up for the Company Investing Course. Put your business cash to work!

6 thoughts on “Can I transfer my buy-to-let property to a Limited Company?”

Does company have to charge VAT on the rent, though?

Nope, income from residential property except furnished holiday lettings is exempt from VAT.

How about you own the property outright and transfer to Ltd, and all rent come as Director’s loan? what else do I need to consider?

Director’s loan is not a viable long term strategy, as you’ll need to return it and/or pay tax on it.

Great I’m about to invest in a property and this is really helpful as a high rate tax payer in my main Job!

Good luck with your property investing Georgie. Glad you liked it.